Click here to read the eBook Amortized Loans AMORTIZATION SC

Click here to read the eBook: Amortized Loans AMORTIZATION SCHEDULE a. Complete an amortization schedule for a $16,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 7% compound annually. Round all answers to the nearest cent Beginning Repayment Ending YearBalance Payment Interest of Principal Balance 2 b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % Interest 96 Principal Year 1: Year 2: Year 3: c. Why do these nercentages change over time?

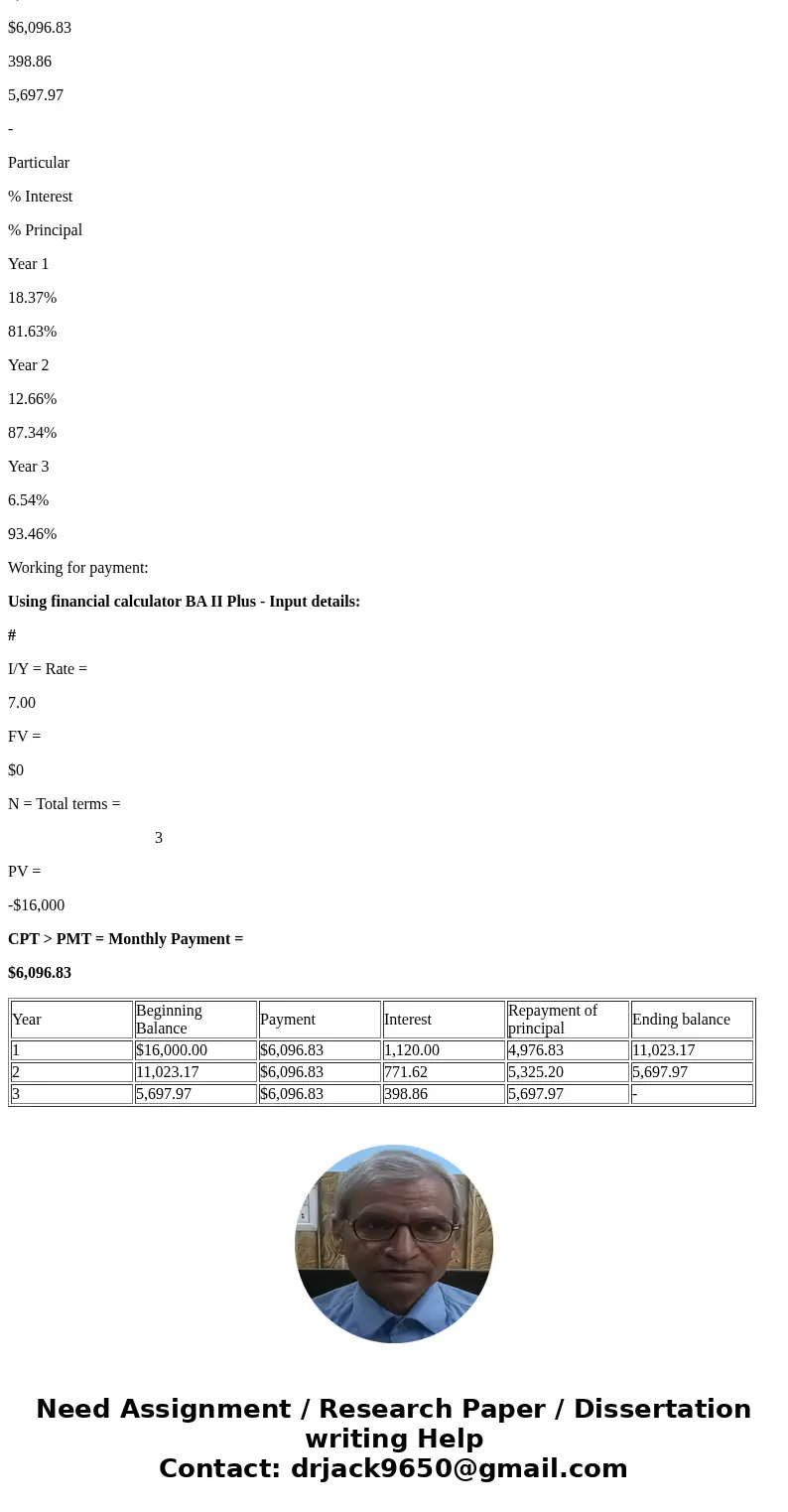

Solution

Year

Beginning Balance

Payment

Interest

Repayment of principal

Ending balance

1

$16,000.00

$6,096.83

1,120.00

4,976.83

11,023.17

2

11,023.17

$6,096.83

771.62

5,325.20

5,697.97

3

5,697.97

$6,096.83

398.86

5,697.97

-

Particular

% Interest

% Principal

Year 1

18.37%

81.63%

Year 2

12.66%

87.34%

Year 3

6.54%

93.46%

Working for payment:

Using financial calculator BA II Plus - Input details:

#

I/Y = Rate =

7.00

FV =

$0

N = Total terms =

3

PV =

-$16,000

CPT > PMT = Monthly Payment =

$6,096.83

| Year | Beginning Balance | Payment | Interest | Repayment of principal | Ending balance |

| 1 | $16,000.00 | $6,096.83 | 1,120.00 | 4,976.83 | 11,023.17 |

| 2 | 11,023.17 | $6,096.83 | 771.62 | 5,325.20 | 5,697.97 |

| 3 | 5,697.97 | $6,096.83 | 398.86 | 5,697.97 | - |

Homework Sourse

Homework Sourse