A project has annual cash flows of 8000 for the next 10 year

A project has annual cash flows of $8,000 for the next 10 years and then $8,500 each year for the following 10 years. The IRR of this 20-year project is 8.39%. If the firm\'s WACC is 8%, what is the project\'s NPV? Round your answer to the nearest cent. Do not round your intermediate calculations.

Solution

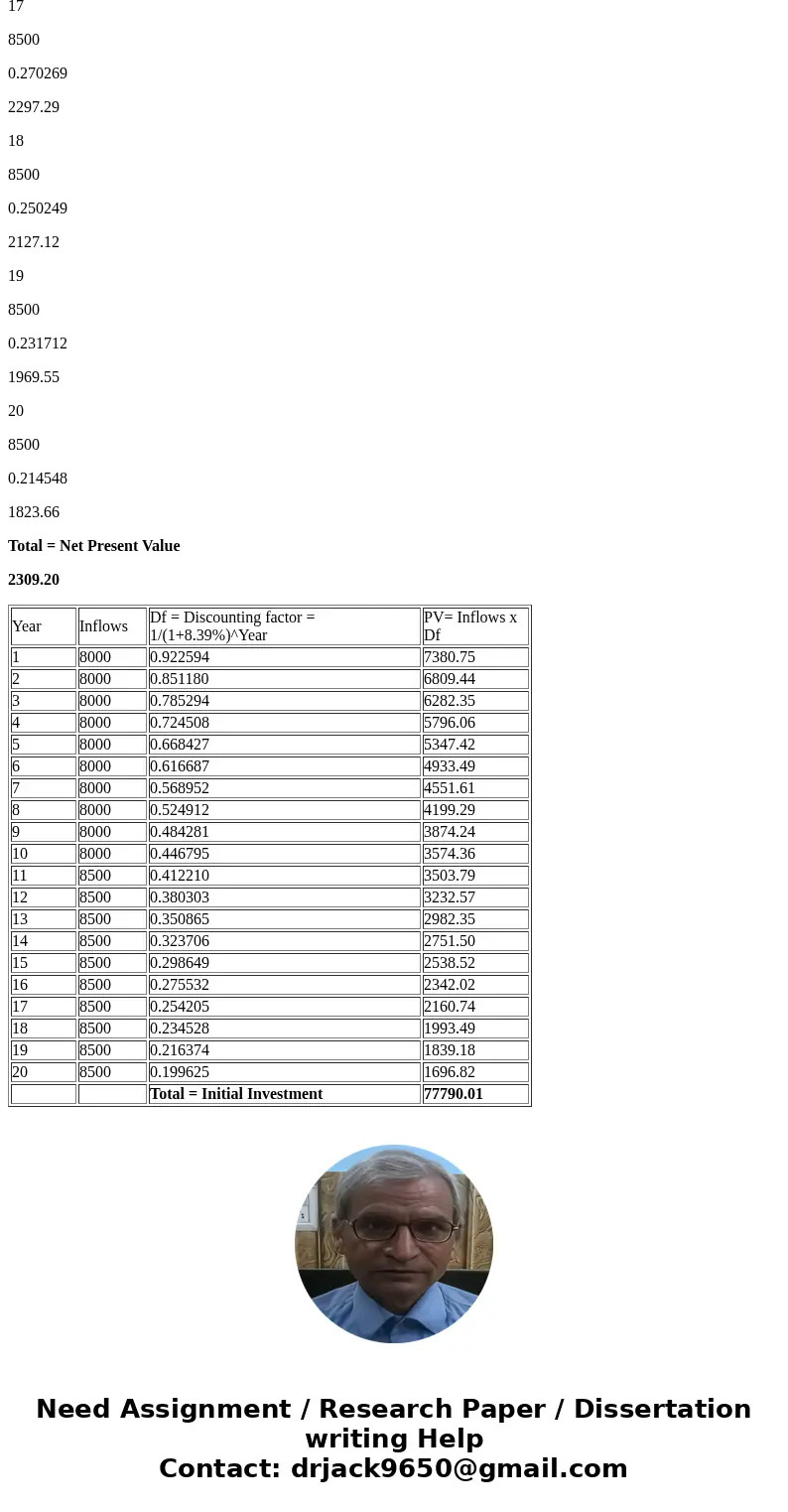

At IRR, Sum of (All present value of cash flows) = Investment or Initial cash outflow

Let’s calculate investment value by discounting cash inflows at IRR = 8.39%:

Year

Inflows

Df = Discounting factor = 1/(1+8.39%)^Year

PV= Inflows x Df

1

8000

0.922594

7380.75

2

8000

0.851180

6809.44

3

8000

0.785294

6282.35

4

8000

0.724508

5796.06

5

8000

0.668427

5347.42

6

8000

0.616687

4933.49

7

8000

0.568952

4551.61

8

8000

0.524912

4199.29

9

8000

0.484281

3874.24

10

8000

0.446795

3574.36

11

8500

0.412210

3503.79

12

8500

0.380303

3232.57

13

8500

0.350865

2982.35

14

8500

0.323706

2751.50

15

8500

0.298649

2538.52

16

8500

0.275532

2342.02

17

8500

0.254205

2160.74

18

8500

0.234528

1993.49

19

8500

0.216374

1839.18

20

8500

0.199625

1696.82

Total = Initial Investment

77790.01

Now, we can calculate NPV with by plotting investment and by discounting cash flows @8%:

Year

Inflows

Df = Discounting factor = 1/(1+8%)^Year

PV= Inflows x Df

0

-77790.01

1.000000

-77790.01

1

8000

0.925926

7407.41

2

8000

0.857339

6858.71

3

8000

0.793832

6350.66

4

8000

0.735030

5880.24

5

8000

0.680583

5444.67

6

8000

0.630170

5041.36

7

8000

0.583490

4667.92

8

8000

0.540269

4322.15

9

8000

0.500249

4001.99

10

8000

0.463193

3705.55

11

8500

0.428883

3645.50

12

8500

0.397114

3375.47

13

8500

0.367698

3125.43

14

8500

0.340461

2893.92

15

8500

0.315242

2679.55

16

8500

0.291890

2481.07

17

8500

0.270269

2297.29

18

8500

0.250249

2127.12

19

8500

0.231712

1969.55

20

8500

0.214548

1823.66

Total = Net Present Value

2309.20

| Year | Inflows | Df = Discounting factor = 1/(1+8.39%)^Year | PV= Inflows x Df |

| 1 | 8000 | 0.922594 | 7380.75 |

| 2 | 8000 | 0.851180 | 6809.44 |

| 3 | 8000 | 0.785294 | 6282.35 |

| 4 | 8000 | 0.724508 | 5796.06 |

| 5 | 8000 | 0.668427 | 5347.42 |

| 6 | 8000 | 0.616687 | 4933.49 |

| 7 | 8000 | 0.568952 | 4551.61 |

| 8 | 8000 | 0.524912 | 4199.29 |

| 9 | 8000 | 0.484281 | 3874.24 |

| 10 | 8000 | 0.446795 | 3574.36 |

| 11 | 8500 | 0.412210 | 3503.79 |

| 12 | 8500 | 0.380303 | 3232.57 |

| 13 | 8500 | 0.350865 | 2982.35 |

| 14 | 8500 | 0.323706 | 2751.50 |

| 15 | 8500 | 0.298649 | 2538.52 |

| 16 | 8500 | 0.275532 | 2342.02 |

| 17 | 8500 | 0.254205 | 2160.74 |

| 18 | 8500 | 0.234528 | 1993.49 |

| 19 | 8500 | 0.216374 | 1839.18 |

| 20 | 8500 | 0.199625 | 1696.82 |

| Total = Initial Investment | 77790.01 |

Homework Sourse

Homework Sourse