edugenwileypluscom Return to Blackboard WileyPLUS andt Accou

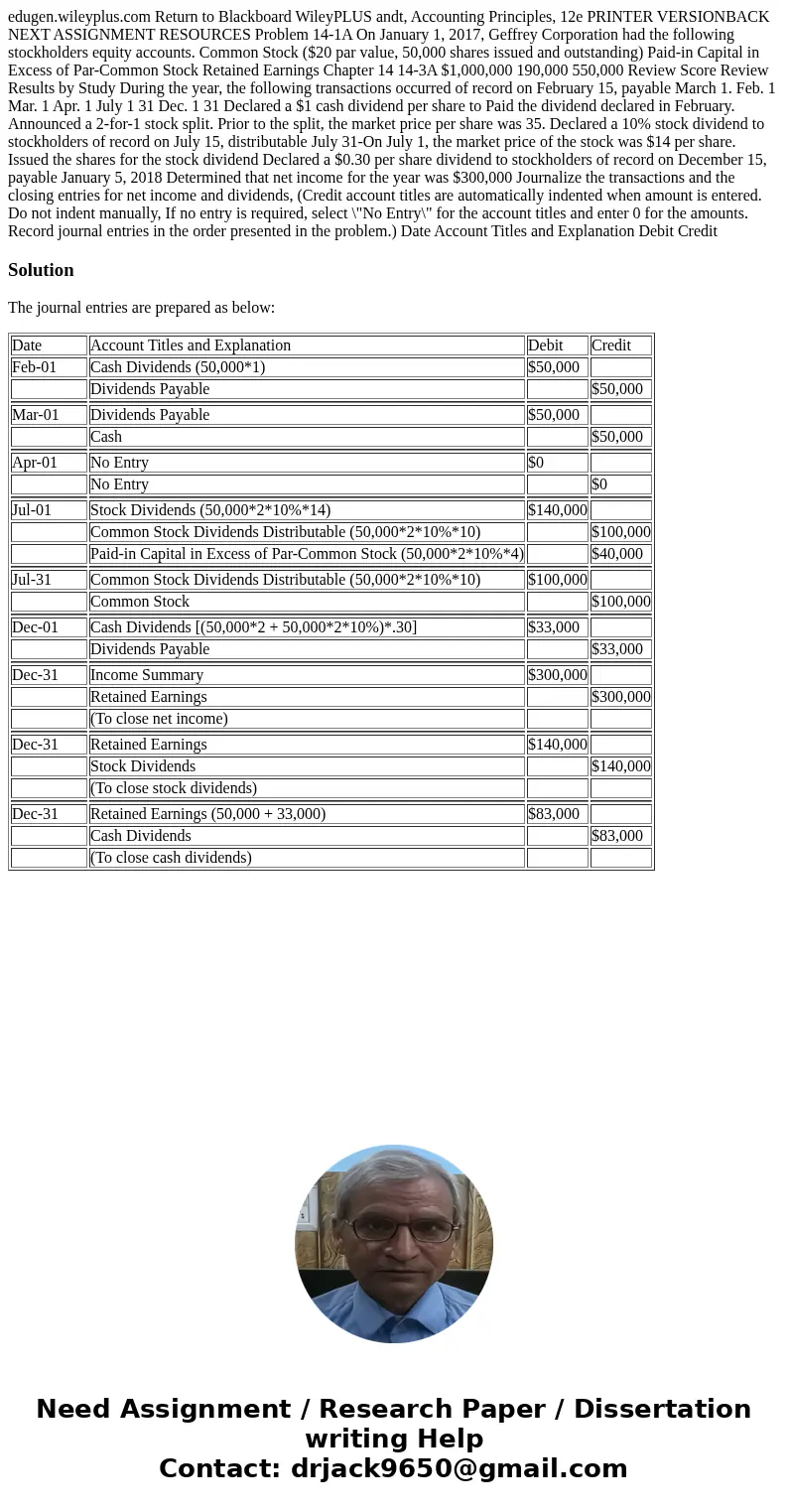

edugen.wileyplus.com Return to Blackboard WileyPLUS andt, Accounting Principles, 12e PRINTER VERSIONBACK NEXT ASSIGNMENT RESOURCES Problem 14-1A On January 1, 2017, Geffrey Corporation had the following stockholders equity accounts. Common Stock ($20 par value, 50,000 shares issued and outstanding) Paid-in Capital in Excess of Par-Common Stock Retained Earnings Chapter 14 14-3A $1,000,000 190,000 550,000 Review Score Review Results by Study During the year, the following transactions occurred of record on February 15, payable March 1. Feb. 1 Mar. 1 Apr. 1 July 1 31 Dec. 1 31 Declared a $1 cash dividend per share to Paid the dividend declared in February. Announced a 2-for-1 stock split. Prior to the split, the market price per share was 35. Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31-On July 1, the market price of the stock was $14 per share. Issued the shares for the stock dividend Declared a $0.30 per share dividend to stockholders of record on December 15, payable January 5, 2018 Determined that net income for the year was $300,000 Journalize the transactions and the closing entries for net income and dividends, (Credit account titles are automatically indented when amount is entered. Do not indent manually, If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit

Solution

The journal entries are prepared as below:

| Date | Account Titles and Explanation | Debit | Credit |

| Feb-01 | Cash Dividends (50,000*1) | $50,000 | |

| Dividends Payable | $50,000 | ||

| Mar-01 | Dividends Payable | $50,000 | |

| Cash | $50,000 | ||

| Apr-01 | No Entry | $0 | |

| No Entry | $0 | ||

| Jul-01 | Stock Dividends (50,000*2*10%*14) | $140,000 | |

| Common Stock Dividends Distributable (50,000*2*10%*10) | $100,000 | ||

| Paid-in Capital in Excess of Par-Common Stock (50,000*2*10%*4) | $40,000 | ||

| Jul-31 | Common Stock Dividends Distributable (50,000*2*10%*10) | $100,000 | |

| Common Stock | $100,000 | ||

| Dec-01 | Cash Dividends [(50,000*2 + 50,000*2*10%)*.30] | $33,000 | |

| Dividends Payable | $33,000 | ||

| Dec-31 | Income Summary | $300,000 | |

| Retained Earnings | $300,000 | ||

| (To close net income) | |||

| Dec-31 | Retained Earnings | $140,000 | |

| Stock Dividends | $140,000 | ||

| (To close stock dividends) | |||

| Dec-31 | Retained Earnings (50,000 + 33,000) | $83,000 | |

| Cash Dividends | $83,000 | ||

| (To close cash dividends) |

Homework Sourse

Homework Sourse