Choi is expanding and expects operating cash flows of 26000

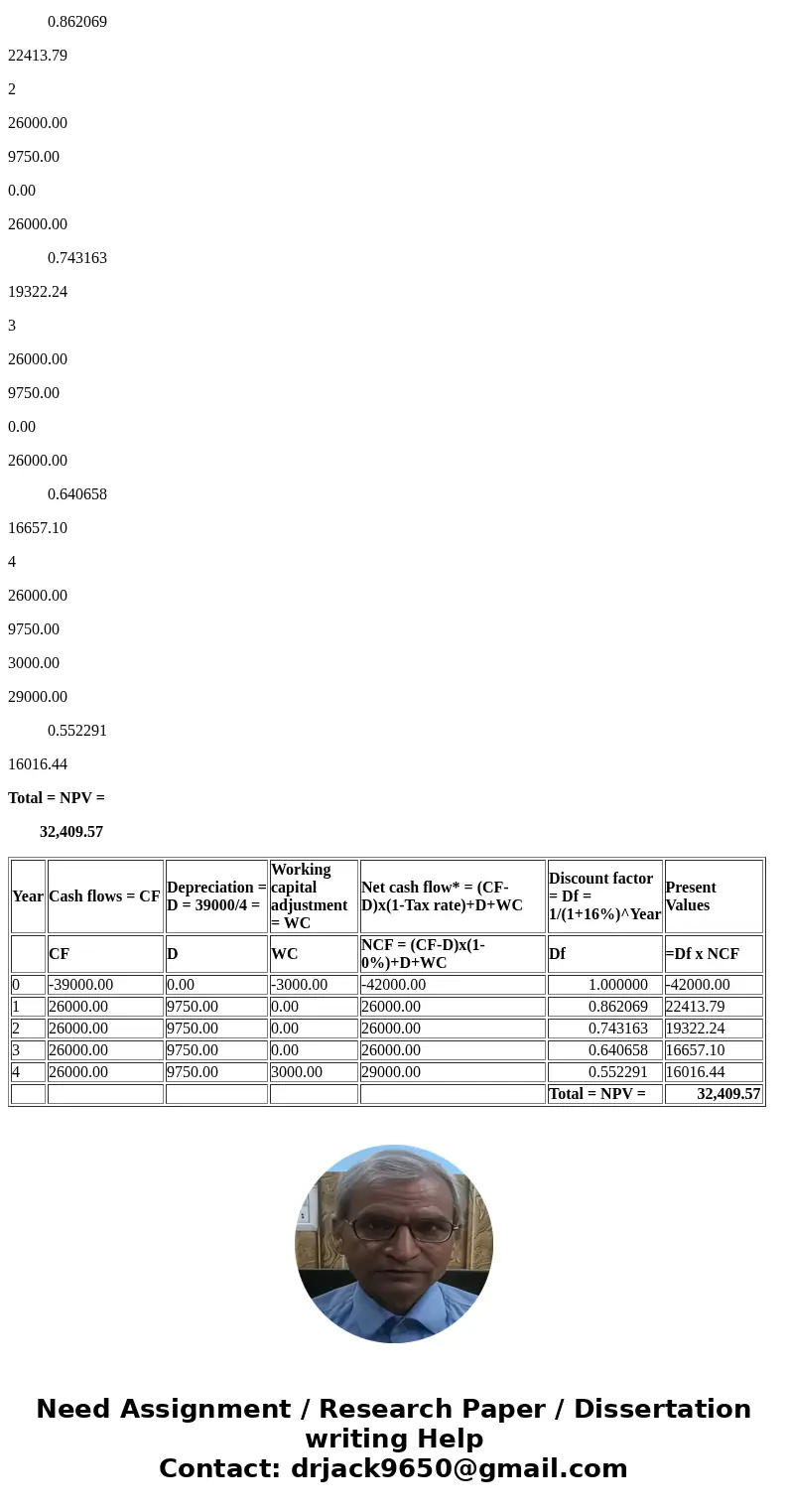

Choi is expanding and expects operating cash flows of $26,000 a year for 4 years as a result. The expansion requires $39,000 in new fixed assets. These assets will be worthless at the end of the project. In addition, the project requires $3,000 of net working capital throughout the life of the project. What is the net present value of this expansion project at a required of return of 16 percent? Show your work please.

Solution

Year

Cash flows = CF

Depreciation = D = 39000/4 =

Working capital adjustment = WC

Net cash flow* = (CF-D)x(1-Tax rate)+D+WC

Discount factor = Df = 1/(1+16%)^Year

Present Values

CF

D

WC

NCF = (CF-D)x(1-0%)+D+WC

Df

=Df x NCF

0

-39000.00

0.00

-3000.00

-42000.00

1.000000

-42000.00

1

26000.00

9750.00

0.00

26000.00

0.862069

22413.79

2

26000.00

9750.00

0.00

26000.00

0.743163

19322.24

3

26000.00

9750.00

0.00

26000.00

0.640658

16657.10

4

26000.00

9750.00

3000.00

29000.00

0.552291

16016.44

Total = NPV =

32,409.57

| Year | Cash flows = CF | Depreciation = D = 39000/4 = | Working capital adjustment = WC | Net cash flow* = (CF-D)x(1-Tax rate)+D+WC | Discount factor = Df = 1/(1+16%)^Year | Present Values |

| CF | D | WC | NCF = (CF-D)x(1-0%)+D+WC | Df | =Df x NCF | |

| 0 | -39000.00 | 0.00 | -3000.00 | -42000.00 | 1.000000 | -42000.00 |

| 1 | 26000.00 | 9750.00 | 0.00 | 26000.00 | 0.862069 | 22413.79 |

| 2 | 26000.00 | 9750.00 | 0.00 | 26000.00 | 0.743163 | 19322.24 |

| 3 | 26000.00 | 9750.00 | 0.00 | 26000.00 | 0.640658 | 16657.10 |

| 4 | 26000.00 | 9750.00 | 3000.00 | 29000.00 | 0.552291 | 16016.44 |

| Total = NPV = | 32,409.57 |

Homework Sourse

Homework Sourse