OBJ 2 PE 122A Dividing partnership net income Han Lee and Mo

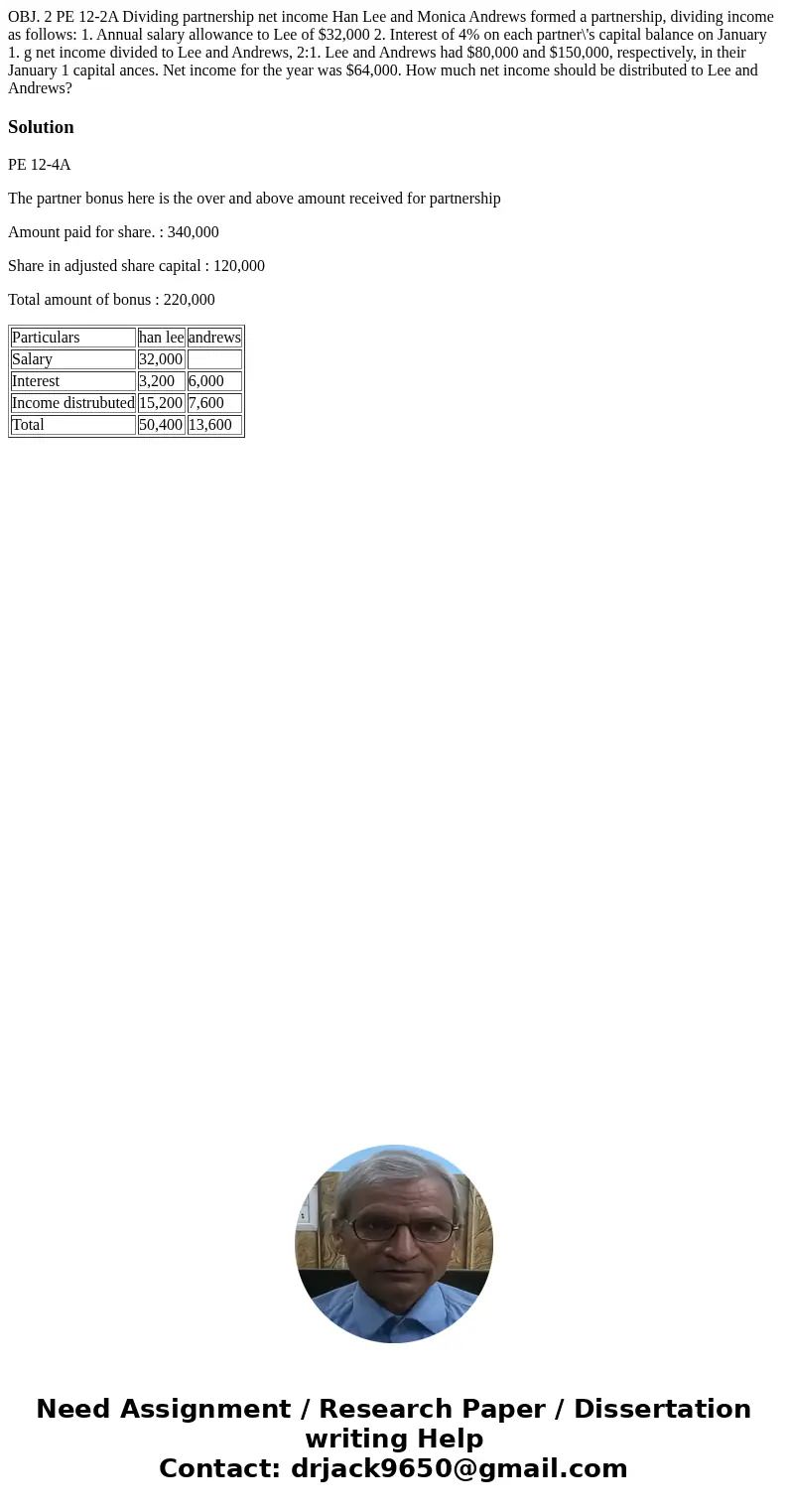

OBJ. 2 PE 12-2A Dividing partnership net income Han Lee and Monica Andrews formed a partnership, dividing income as follows: 1. Annual salary allowance to Lee of $32,000 2. Interest of 4% on each partner\'s capital balance on January 1. g net income divided to Lee and Andrews, 2:1. Lee and Andrews had $80,000 and $150,000, respectively, in their January 1 capital ances. Net income for the year was $64,000. How much net income should be distributed to Lee and Andrews?

Solution

PE 12-4A

The partner bonus here is the over and above amount received for partnership

Amount paid for share. : 340,000

Share in adjusted share capital : 120,000

Total amount of bonus : 220,000

| Particulars | han lee | andrews |

| Salary | 32,000 | |

| Interest | 3,200 | 6,000 |

| Income distrubuted | 15,200 | 7,600 |

| Total | 50,400 | 13,600 |

Homework Sourse

Homework Sourse