9 Problem 126 LO 11 13 14 On December 31 2016 Akron Inc purc

9 Problem 1-26 (LO 1-1, 1-3, 1-4) On December 31, 2016, Akron, Inc: purchased 5 Percent of Zip\'s Company\'s common shares on the open market in exchange for $16,000. On December 31, 2012, Akron, Inc., acquires an additional 25 percent of Zip Companý\'s outstanding common stock for $95,000. During the next two years, the following information is available for Zip Company Common S Stock Dividends Fair Value (12/31) $329,880 388,888 483,880 Print 2016 2017 $75,8 $7,80e 2418 88,88815,8 At December 31, 2017, Zip reports a net book value of $290,000. Akron attributed ány excess of its 30 percent share of Zip\'s fair over book value to its share of Zip\'s franchise agreements. The franchise agreements hadi a remaining life of 10 years at December 31, 2017 a. Assume Akron applies the equity method to its Investment in Zip account 1. What amount of equity income should Akron report for 2018 2 On Akron\'s December 31.2018, balance sheet, whät amount is reported for the Investment in Zip account?

Solution

Akrons total interest in Zip Company = 25%+ 5% = 30%

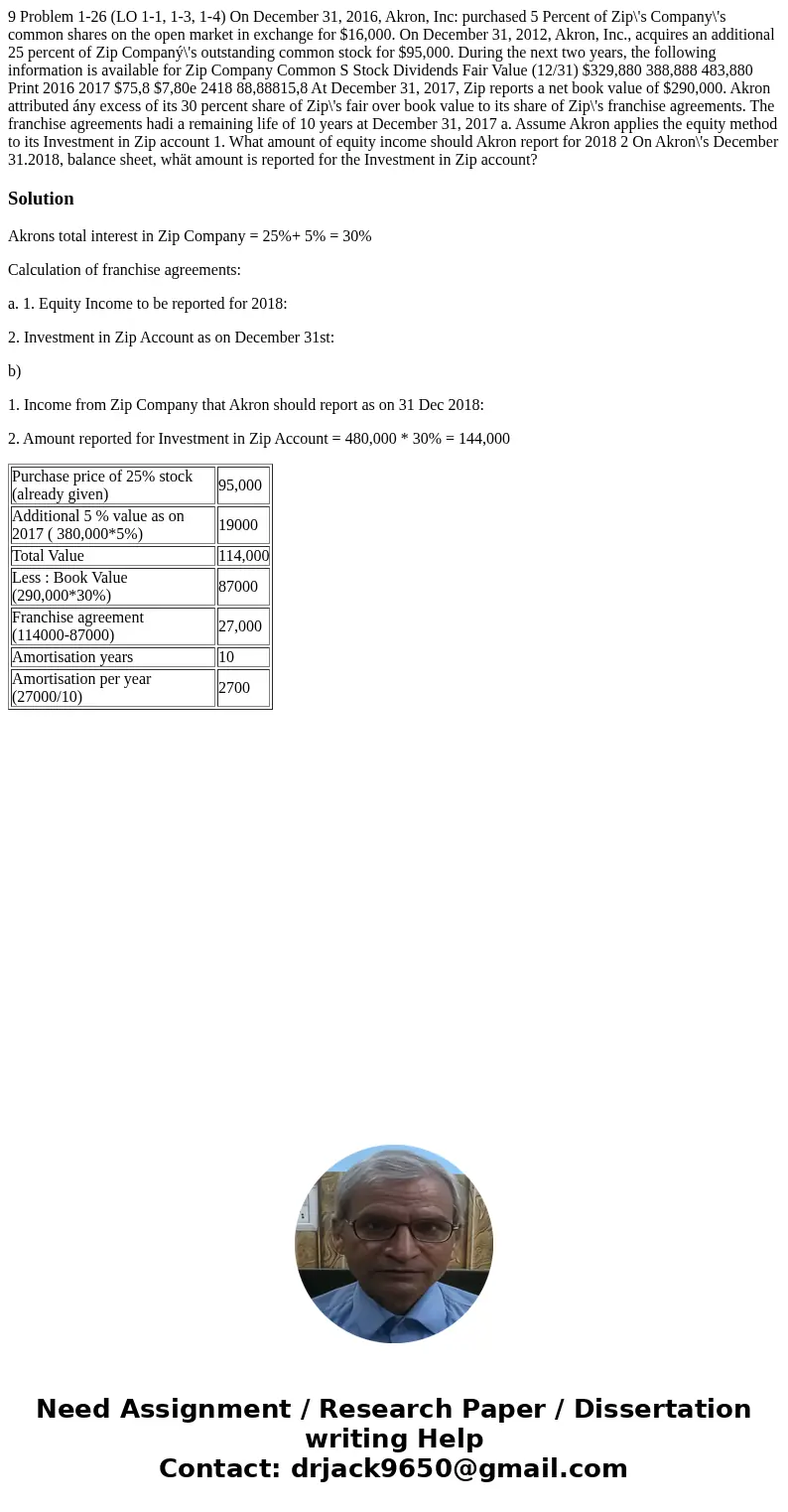

Calculation of franchise agreements:

a. 1. Equity Income to be reported for 2018:

2. Investment in Zip Account as on December 31st:

b)

1. Income from Zip Company that Akron should report as on 31 Dec 2018:

2. Amount reported for Investment in Zip Account = 480,000 * 30% = 144,000

| Purchase price of 25% stock (already given) | 95,000 |

| Additional 5 % value as on 2017 ( 380,000*5%) | 19000 |

| Total Value | 114,000 |

| Less : Book Value (290,000*30%) | 87000 |

| Franchise agreement (114000-87000) | 27,000 |

| Amortisation years | 10 |

| Amortisation per year (27000/10) | 2700 |

Homework Sourse

Homework Sourse