An insurance company is analyzing the following three bonds

An insurance company is analyzing the following three bonds, each with five years to maturity, annual coupon payments, and duration as the measure of interest rate risk.

What is the duration of each of the three bonds? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

| An insurance company is analyzing the following three bonds, each with five years to maturity, annual coupon payments, and duration as the measure of interest rate risk. |

| What is the duration of each of the three bonds? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) |

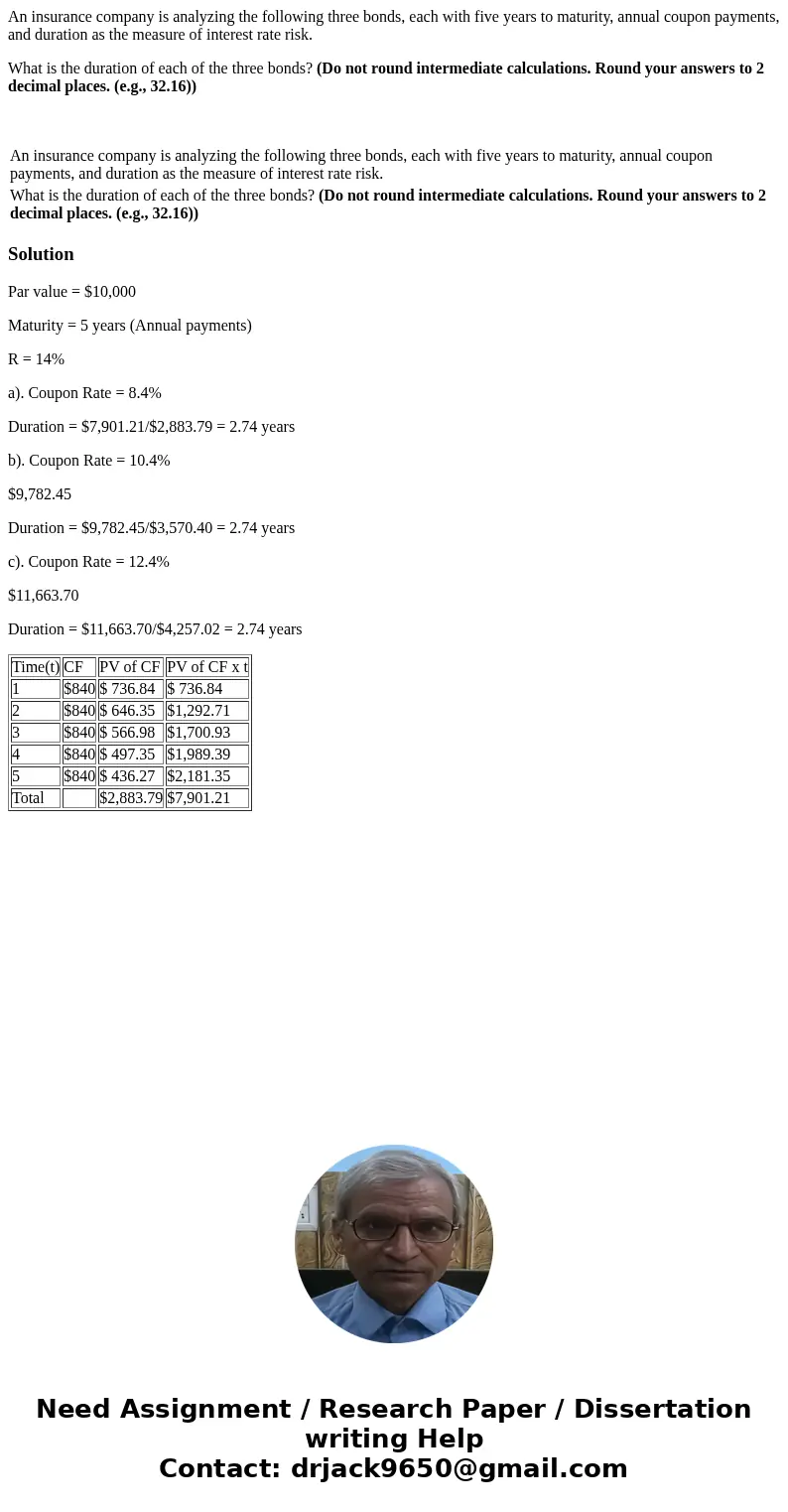

Solution

Par value = $10,000

Maturity = 5 years (Annual payments)

R = 14%

a). Coupon Rate = 8.4%

Duration = $7,901.21/$2,883.79 = 2.74 years

b). Coupon Rate = 10.4%

$9,782.45

Duration = $9,782.45/$3,570.40 = 2.74 years

c). Coupon Rate = 12.4%

$11,663.70

Duration = $11,663.70/$4,257.02 = 2.74 years

| Time(t) | CF | PV of CF | PV of CF x t |

| 1 | $840 | $ 736.84 | $ 736.84 |

| 2 | $840 | $ 646.35 | $1,292.71 |

| 3 | $840 | $ 566.98 | $1,700.93 |

| 4 | $840 | $ 497.35 | $1,989.39 |

| 5 | $840 | $ 436.27 | $2,181.35 |

| Total | $2,883.79 | $7,901.21 |

Homework Sourse

Homework Sourse