You are trying to decide whether to accept or reject a proje

You are trying to decide whether to accept or reject a project. The project will generate a cash flow of $15,000 in year one; $25,000 in year two; $20,000 in year three; and $4,000 in year four. The project costs $40,000 initially. The firm has a weighted average cost of capital of 8%. Your firm generally accepts projects that payback in three years or less. What is the discounted payback of the project? Should you accept or reject the project?

Solution

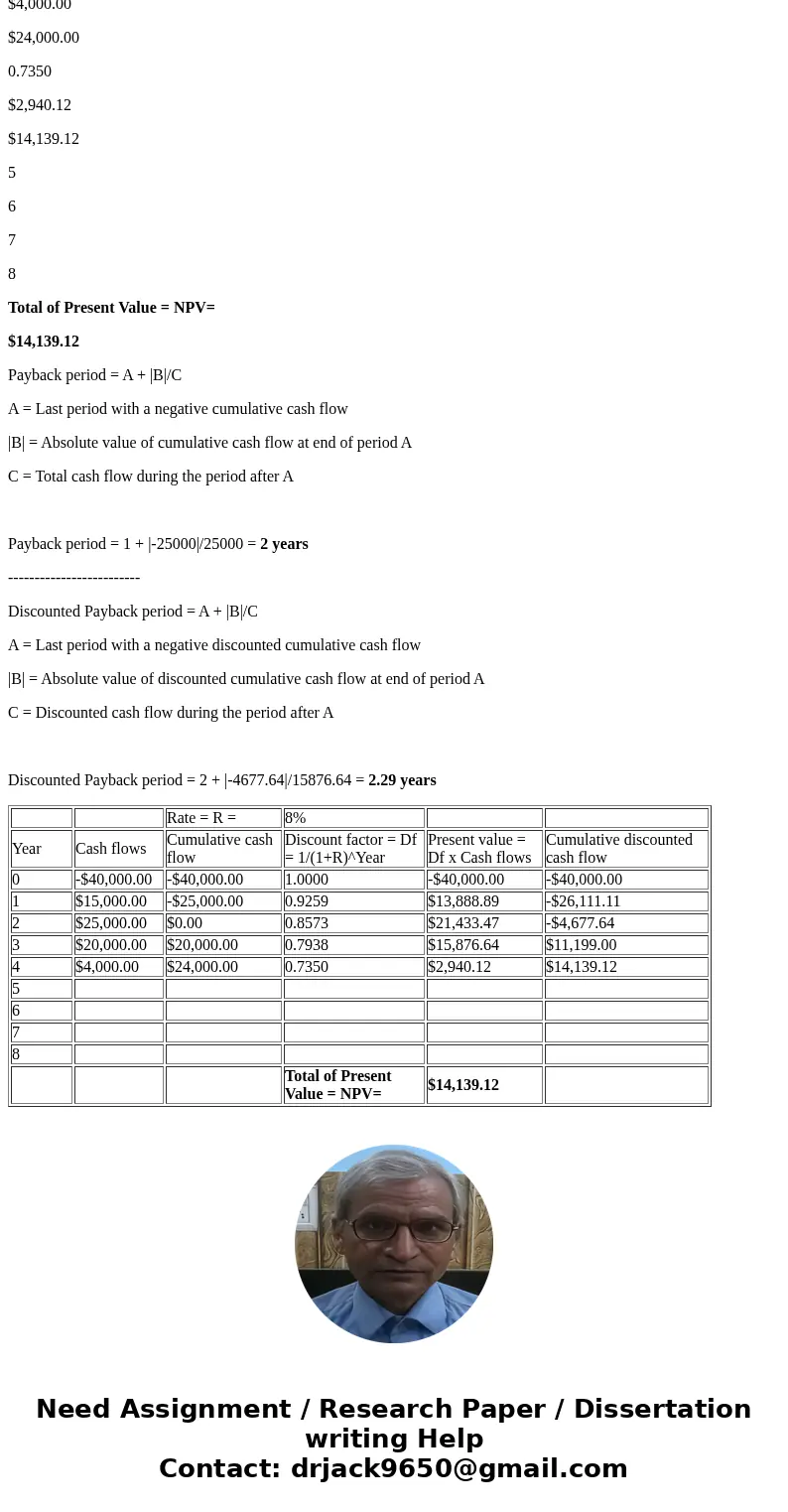

As cash flow payback is falling before 3 years, Payback period is 2 years we can accept the project.

In case of discounted payback period we are getting 2.29 years. It is falling before 3 years again. We can accept the project based on discounted payback also.

Rate = R =

8%

Year

Cash flows

Cumulative cash flow

Discount factor = Df = 1/(1+R)^Year

Present value = Df x Cash flows

Cumulative discounted cash flow

0

-$40,000.00

-$40,000.00

1.0000

-$40,000.00

-$40,000.00

1

$15,000.00

-$25,000.00

0.9259

$13,888.89

-$26,111.11

2

$25,000.00

$0.00

0.8573

$21,433.47

-$4,677.64

3

$20,000.00

$20,000.00

0.7938

$15,876.64

$11,199.00

4

$4,000.00

$24,000.00

0.7350

$2,940.12

$14,139.12

5

6

7

8

Total of Present Value = NPV=

$14,139.12

Payback period = A + |B|/C

A = Last period with a negative cumulative cash flow

|B| = Absolute value of cumulative cash flow at end of period A

C = Total cash flow during the period after A

Payback period = 1 + |-25000|/25000 = 2 years

-------------------------

Discounted Payback period = A + |B|/C

A = Last period with a negative discounted cumulative cash flow

|B| = Absolute value of discounted cumulative cash flow at end of period A

C = Discounted cash flow during the period after A

Discounted Payback period = 2 + |-4677.64|/15876.64 = 2.29 years

| Rate = R = | 8% | ||||

| Year | Cash flows | Cumulative cash flow | Discount factor = Df = 1/(1+R)^Year | Present value = Df x Cash flows | Cumulative discounted cash flow |

| 0 | -$40,000.00 | -$40,000.00 | 1.0000 | -$40,000.00 | -$40,000.00 |

| 1 | $15,000.00 | -$25,000.00 | 0.9259 | $13,888.89 | -$26,111.11 |

| 2 | $25,000.00 | $0.00 | 0.8573 | $21,433.47 | -$4,677.64 |

| 3 | $20,000.00 | $20,000.00 | 0.7938 | $15,876.64 | $11,199.00 |

| 4 | $4,000.00 | $24,000.00 | 0.7350 | $2,940.12 | $14,139.12 |

| 5 | |||||

| 6 | |||||

| 7 | |||||

| 8 | |||||

| Total of Present Value = NPV= | $14,139.12 |

Homework Sourse

Homework Sourse