A 750 percent coupon bond with 13 years left to maturity is

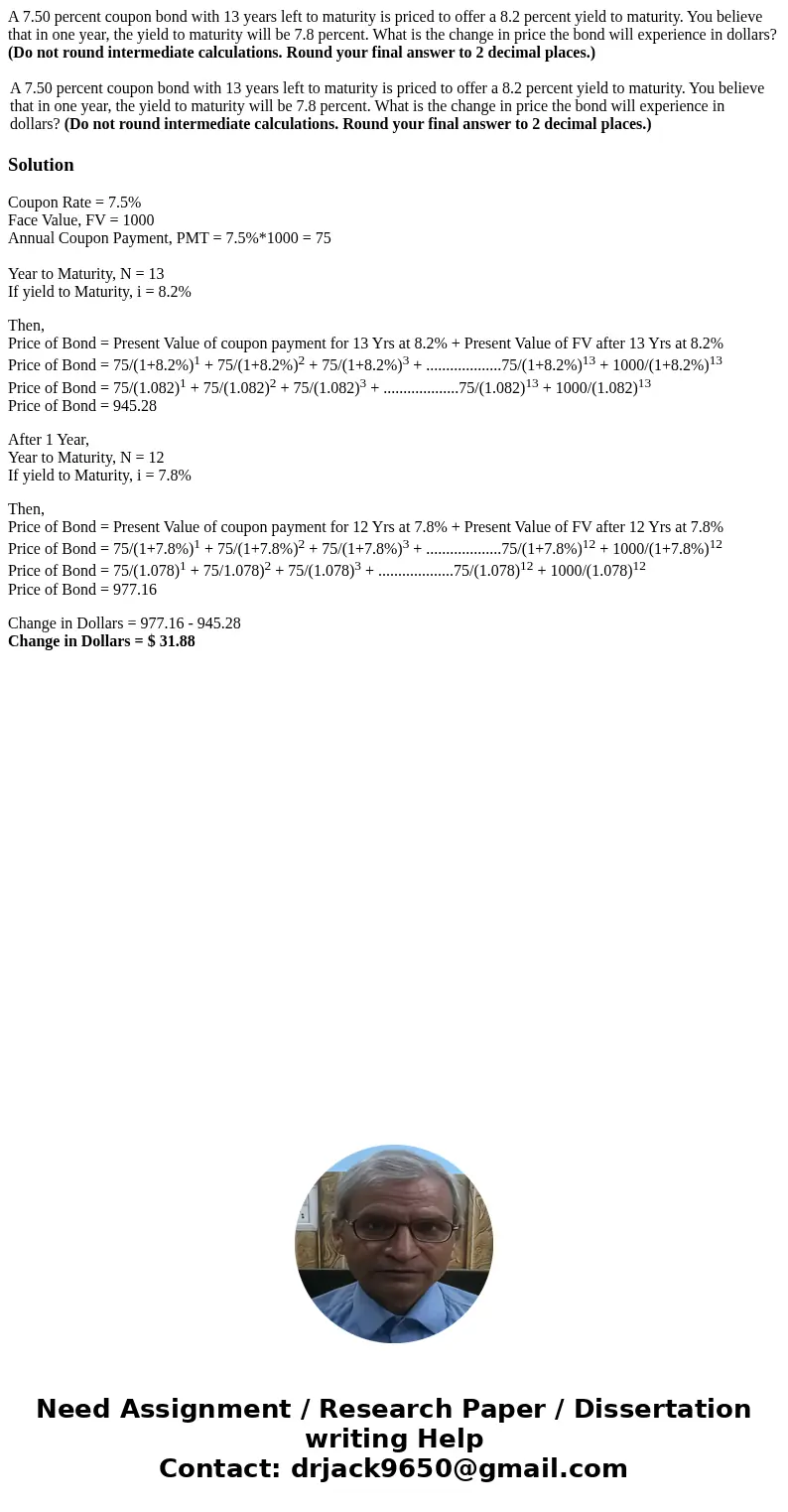

A 7.50 percent coupon bond with 13 years left to maturity is priced to offer a 8.2 percent yield to maturity. You believe that in one year, the yield to maturity will be 7.8 percent. What is the change in price the bond will experience in dollars? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

| A 7.50 percent coupon bond with 13 years left to maturity is priced to offer a 8.2 percent yield to maturity. You believe that in one year, the yield to maturity will be 7.8 percent. What is the change in price the bond will experience in dollars? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

Solution

Coupon Rate = 7.5%

Face Value, FV = 1000

Annual Coupon Payment, PMT = 7.5%*1000 = 75

Year to Maturity, N = 13

If yield to Maturity, i = 8.2%

Then,

Price of Bond = Present Value of coupon payment for 13 Yrs at 8.2% + Present Value of FV after 13 Yrs at 8.2%

Price of Bond = 75/(1+8.2%)1 + 75/(1+8.2%)2 + 75/(1+8.2%)3 + ...................75/(1+8.2%)13 + 1000/(1+8.2%)13

Price of Bond = 75/(1.082)1 + 75/(1.082)2 + 75/(1.082)3 + ...................75/(1.082)13 + 1000/(1.082)13

Price of Bond = 945.28

After 1 Year,

Year to Maturity, N = 12

If yield to Maturity, i = 7.8%

Then,

Price of Bond = Present Value of coupon payment for 12 Yrs at 7.8% + Present Value of FV after 12 Yrs at 7.8%

Price of Bond = 75/(1+7.8%)1 + 75/(1+7.8%)2 + 75/(1+7.8%)3 + ...................75/(1+7.8%)12 + 1000/(1+7.8%)12

Price of Bond = 75/(1.078)1 + 75/1.078)2 + 75/(1.078)3 + ...................75/(1.078)12 + 1000/(1.078)12

Price of Bond = 977.16

Change in Dollars = 977.16 - 945.28

Change in Dollars = $ 31.88

Homework Sourse

Homework Sourse