The table below shows the bidask quotes by UBS for CDS sprea

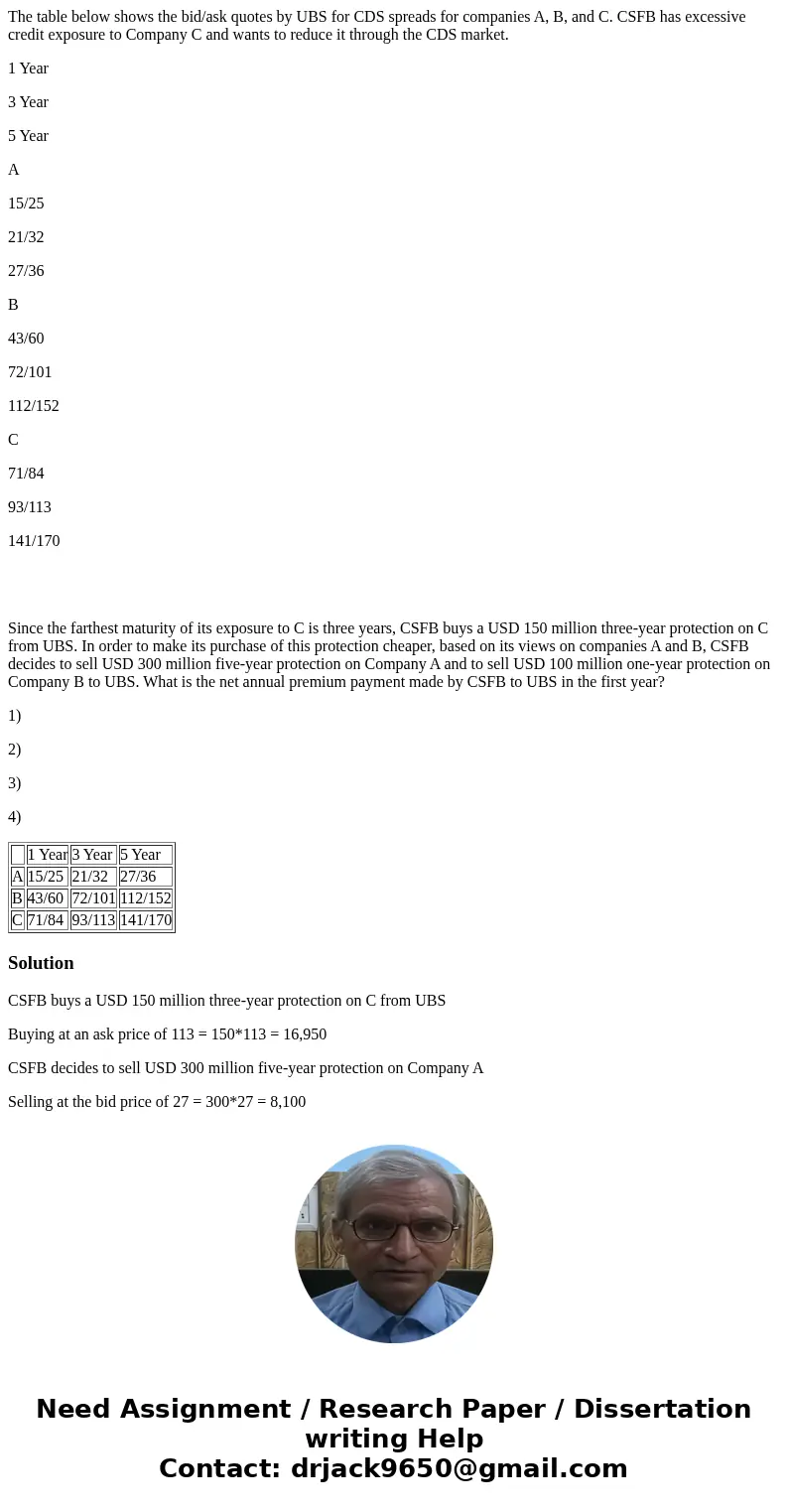

The table below shows the bid/ask quotes by UBS for CDS spreads for companies A, B, and C. CSFB has excessive credit exposure to Company C and wants to reduce it through the CDS market.

1 Year

3 Year

5 Year

A

15/25

21/32

27/36

B

43/60

72/101

112/152

C

71/84

93/113

141/170

Since the farthest maturity of its exposure to C is three years, CSFB buys a USD 150 million three-year protection on C from UBS. In order to make its purchase of this protection cheaper, based on its views on companies A and B, CSFB decides to sell USD 300 million five-year protection on Company A and to sell USD 100 million one-year protection on Company B to UBS. What is the net annual premium payment made by CSFB to UBS in the first year?

1)

2)

3)

4)

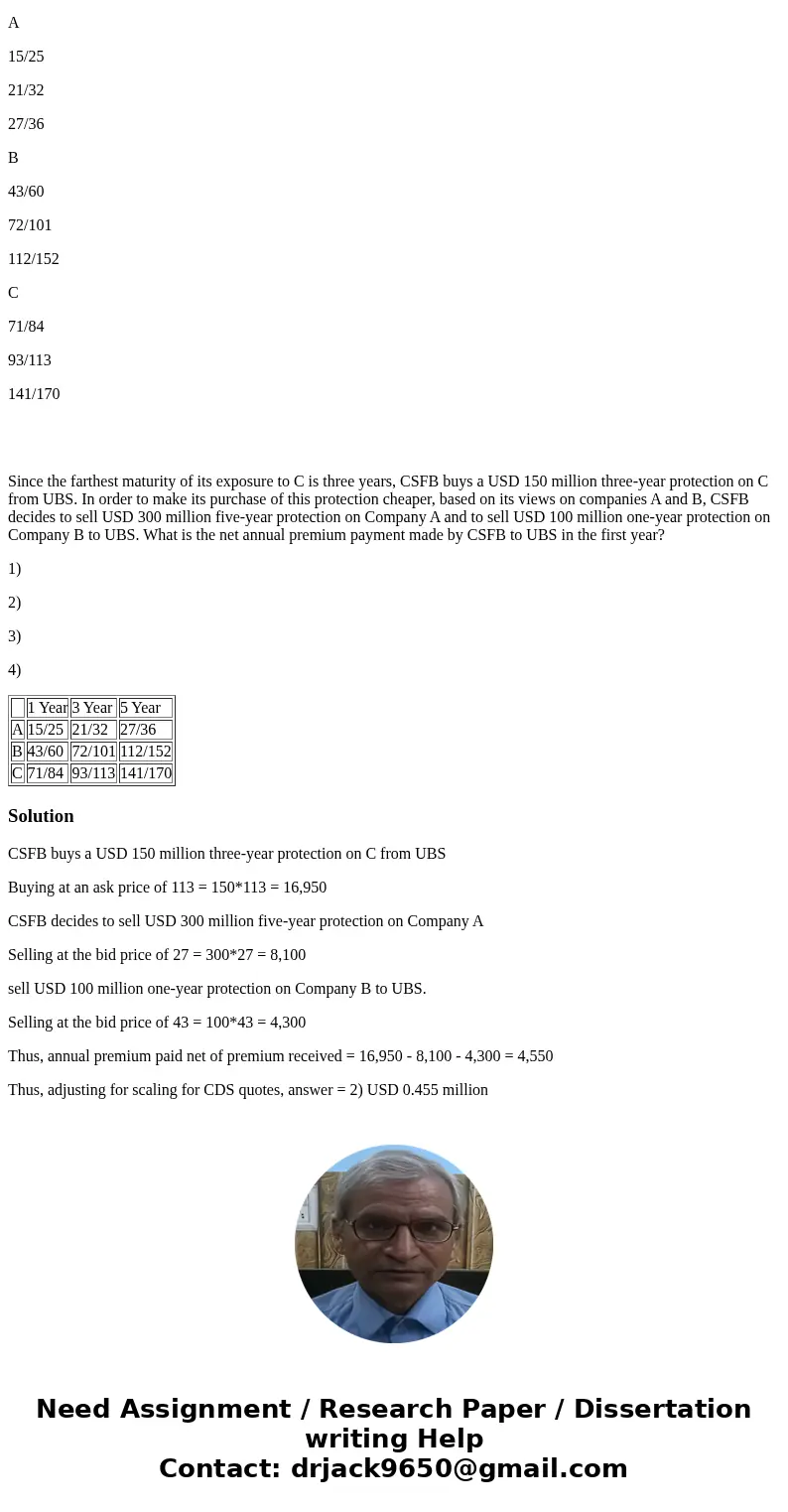

| 1 Year | 3 Year | 5 Year | |

| A | 15/25 | 21/32 | 27/36 |

| B | 43/60 | 72/101 | 112/152 |

| C | 71/84 | 93/113 | 141/170 |

Solution

CSFB buys a USD 150 million three-year protection on C from UBS

Buying at an ask price of 113 = 150*113 = 16,950

CSFB decides to sell USD 300 million five-year protection on Company A

Selling at the bid price of 27 = 300*27 = 8,100

sell USD 100 million one-year protection on Company B to UBS.

Selling at the bid price of 43 = 100*43 = 4,300

Thus, annual premium paid net of premium received = 16,950 - 8,100 - 4,300 = 4,550

Thus, adjusting for scaling for CDS quotes, answer = 2) USD 0.455 million

Homework Sourse

Homework Sourse