1 Using the following WACC675 Cash Outlay 675850 Period 10yr

1. Using the following: WACC-6.75% Cash Outlay $675,850 Period 10yrs .P1-P4 $350,000 respectively, remaining years decrease by $50,000 each year Calculate the following project\'s IRR Calculate the project\'s NPV. Should this project be accepted or rejected? Why a. b. XYZ Inc. is currently evaluating two mutually exclusive projects that have the following net cash flows: 2. Project A Project B Both projects have a cost of capital of 12 65000-150000 percent. Equipment must be procured 125000 25000 in 7 years. Which project should Carlyle 22500 25000 select and why? Use any of the 3 Capital 15000 25000 Budgeting Technique to justify your Year 30000 25000 25000 25000 25000 answer. 5

Solution

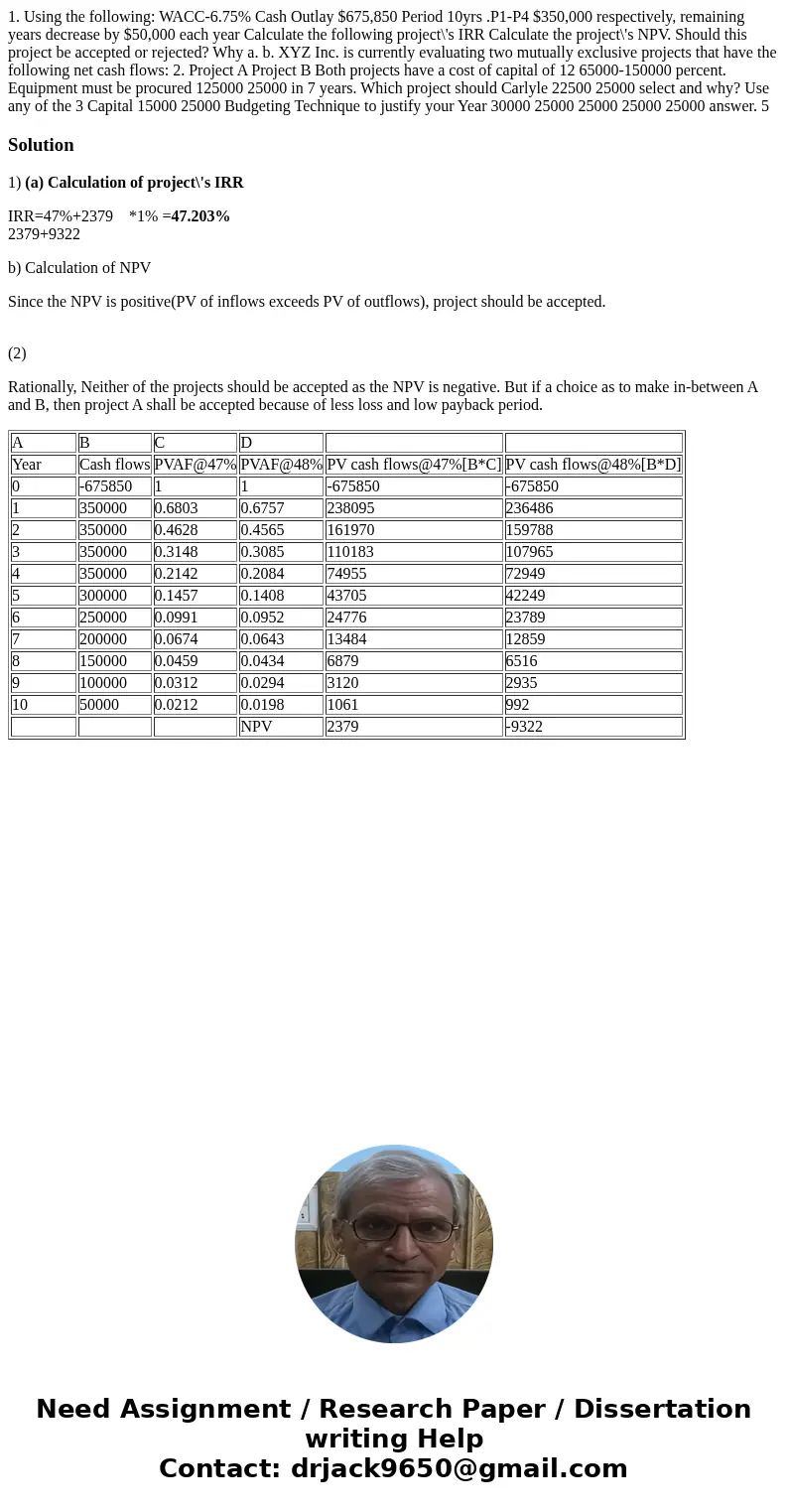

1) (a) Calculation of project\'s IRR

IRR=47%+2379 *1% =47.203%

2379+9322

b) Calculation of NPV

Since the NPV is positive(PV of inflows exceeds PV of outflows), project should be accepted.

(2)

Rationally, Neither of the projects should be accepted as the NPV is negative. But if a choice as to make in-between A and B, then project A shall be accepted because of less loss and low payback period.

| A | B | C | D | ||

| Year | Cash flows | PVAF@47% | PVAF@48% | PV cash flows@47%[B*C] | PV cash flows@48%[B*D] |

| 0 | -675850 | 1 | 1 | -675850 | -675850 |

| 1 | 350000 | 0.6803 | 0.6757 | 238095 | 236486 |

| 2 | 350000 | 0.4628 | 0.4565 | 161970 | 159788 |

| 3 | 350000 | 0.3148 | 0.3085 | 110183 | 107965 |

| 4 | 350000 | 0.2142 | 0.2084 | 74955 | 72949 |

| 5 | 300000 | 0.1457 | 0.1408 | 43705 | 42249 |

| 6 | 250000 | 0.0991 | 0.0952 | 24776 | 23789 |

| 7 | 200000 | 0.0674 | 0.0643 | 13484 | 12859 |

| 8 | 150000 | 0.0459 | 0.0434 | 6879 | 6516 |

| 9 | 100000 | 0.0312 | 0.0294 | 3120 | 2935 |

| 10 | 50000 | 0.0212 | 0.0198 | 1061 | 992 |

| NPV | 2379 | -9322 |

Homework Sourse

Homework Sourse