A stocks returns have the following distribution Calculate t

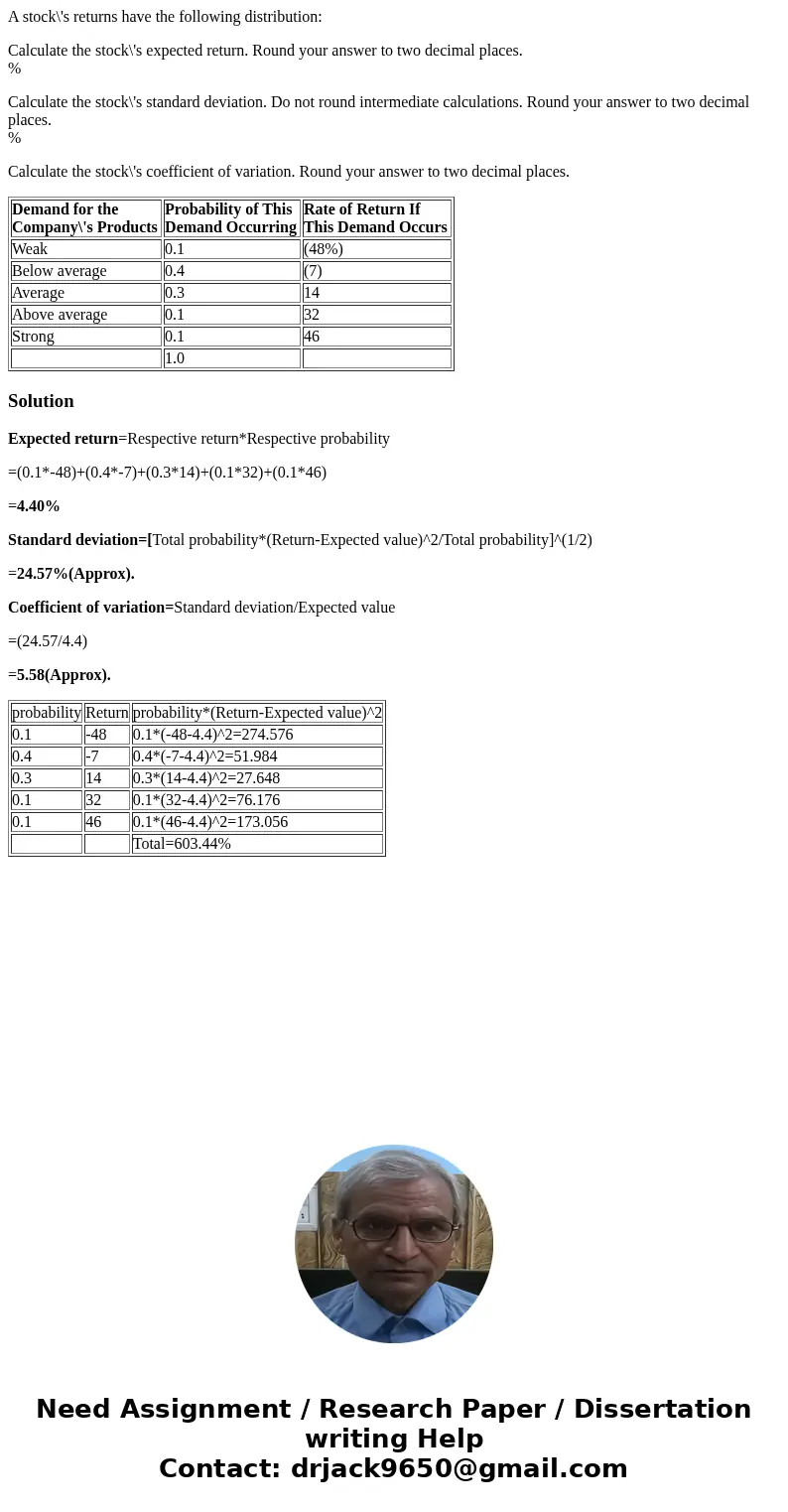

A stock\'s returns have the following distribution:

Calculate the stock\'s expected return. Round your answer to two decimal places.

%

Calculate the stock\'s standard deviation. Do not round intermediate calculations. Round your answer to two decimal places.

%

Calculate the stock\'s coefficient of variation. Round your answer to two decimal places.

| Demand for the Company\'s Products | Probability of This Demand Occurring | Rate of Return If This Demand Occurs |

| Weak | 0.1 | (48%) |

| Below average | 0.4 | (7) |

| Average | 0.3 | 14 |

| Above average | 0.1 | 32 |

| Strong | 0.1 | 46 |

| 1.0 |

Solution

Expected return=Respective return*Respective probability

=(0.1*-48)+(0.4*-7)+(0.3*14)+(0.1*32)+(0.1*46)

=4.40%

Standard deviation=[Total probability*(Return-Expected value)^2/Total probability]^(1/2)

=24.57%(Approx).

Coefficient of variation=Standard deviation/Expected value

=(24.57/4.4)

=5.58(Approx).

| probability | Return | probability*(Return-Expected value)^2 |

| 0.1 | -48 | 0.1*(-48-4.4)^2=274.576 |

| 0.4 | -7 | 0.4*(-7-4.4)^2=51.984 |

| 0.3 | 14 | 0.3*(14-4.4)^2=27.648 |

| 0.1 | 32 | 0.1*(32-4.4)^2=76.176 |

| 0.1 | 46 | 0.1*(46-4.4)^2=173.056 |

| Total=603.44% |

Homework Sourse

Homework Sourse