15 pts The manufacturing facility where you work wants to bu

Solution

Year

0

1

2

3

4

5

6

7

8

9

10

11

purchase of building

-4.5

retrofit of machine

-3.5

sales

1.5

1.5

2.5

2.5

2.5

2.5

2.5

2.5

2.5

2.5

less operating expenses

1.1

1.1

1.1

1.1

1.1

1.1

1.1

1.1

1.1

1.1

operating profit

0.4

0.4

1.4

1.4

1.4

1.4

1.4

1.4

1.4

1.4

salvage value of building

3

net operating cash flow

-4.5

-3.5

0.4

0.4

1.4

1.4

1.4

1.4

1.4

1.4

1.4

4.4

present value factor at 12% = 1/(1+r)^n r= 12%

1

0.892857

0.797194

0.71178

0.635518

0.567427

0.506631

0.452349

0.403883

0.36061

0.321973

0.287476

present value of net operating cash flow = net operating cash flow*present value factor

-4.5

-3.125

0.318878

0.284712

0.889725

0.794398

0.709284

0.633289

0.565437

0.504854

0.450763

1.264895

NPV = sum of present value of cash flow

-1.20877

No we should not proceed with the idea as its results in negative present worth

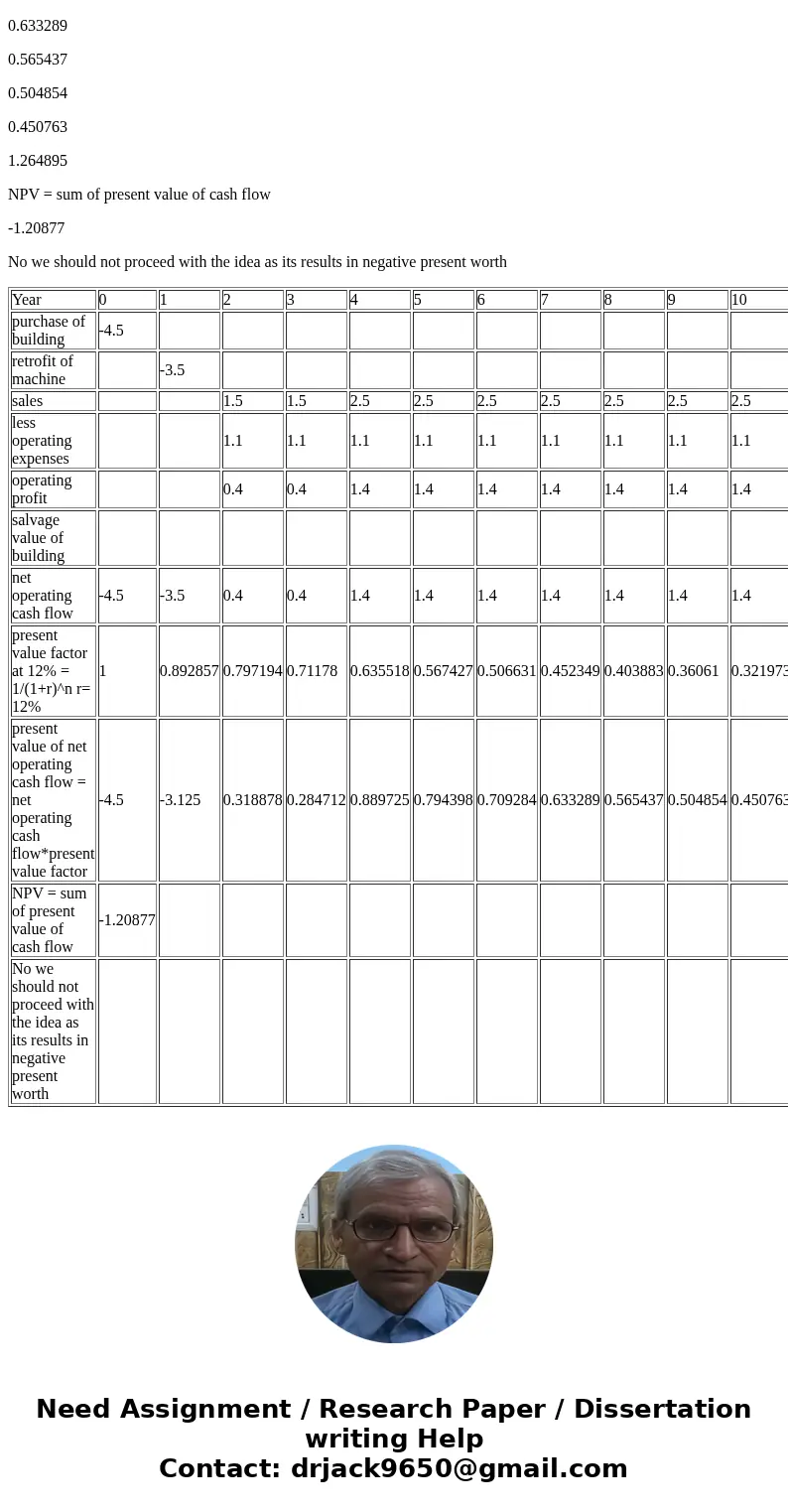

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| purchase of building | -4.5 | |||||||||||

| retrofit of machine | -3.5 | |||||||||||

| sales | 1.5 | 1.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | 2.5 | ||

| less operating expenses | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | ||

| operating profit | 0.4 | 0.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | ||

| salvage value of building | 3 | |||||||||||

| net operating cash flow | -4.5 | -3.5 | 0.4 | 0.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 4.4 |

| present value factor at 12% = 1/(1+r)^n r= 12% | 1 | 0.892857 | 0.797194 | 0.71178 | 0.635518 | 0.567427 | 0.506631 | 0.452349 | 0.403883 | 0.36061 | 0.321973 | 0.287476 |

| present value of net operating cash flow = net operating cash flow*present value factor | -4.5 | -3.125 | 0.318878 | 0.284712 | 0.889725 | 0.794398 | 0.709284 | 0.633289 | 0.565437 | 0.504854 | 0.450763 | 1.264895 |

| NPV = sum of present value of cash flow | -1.20877 | |||||||||||

| No we should not proceed with the idea as its results in negative present worth |

Homework Sourse

Homework Sourse