Otten Corporation Balance Sheet December 31 2014 and 2013 As

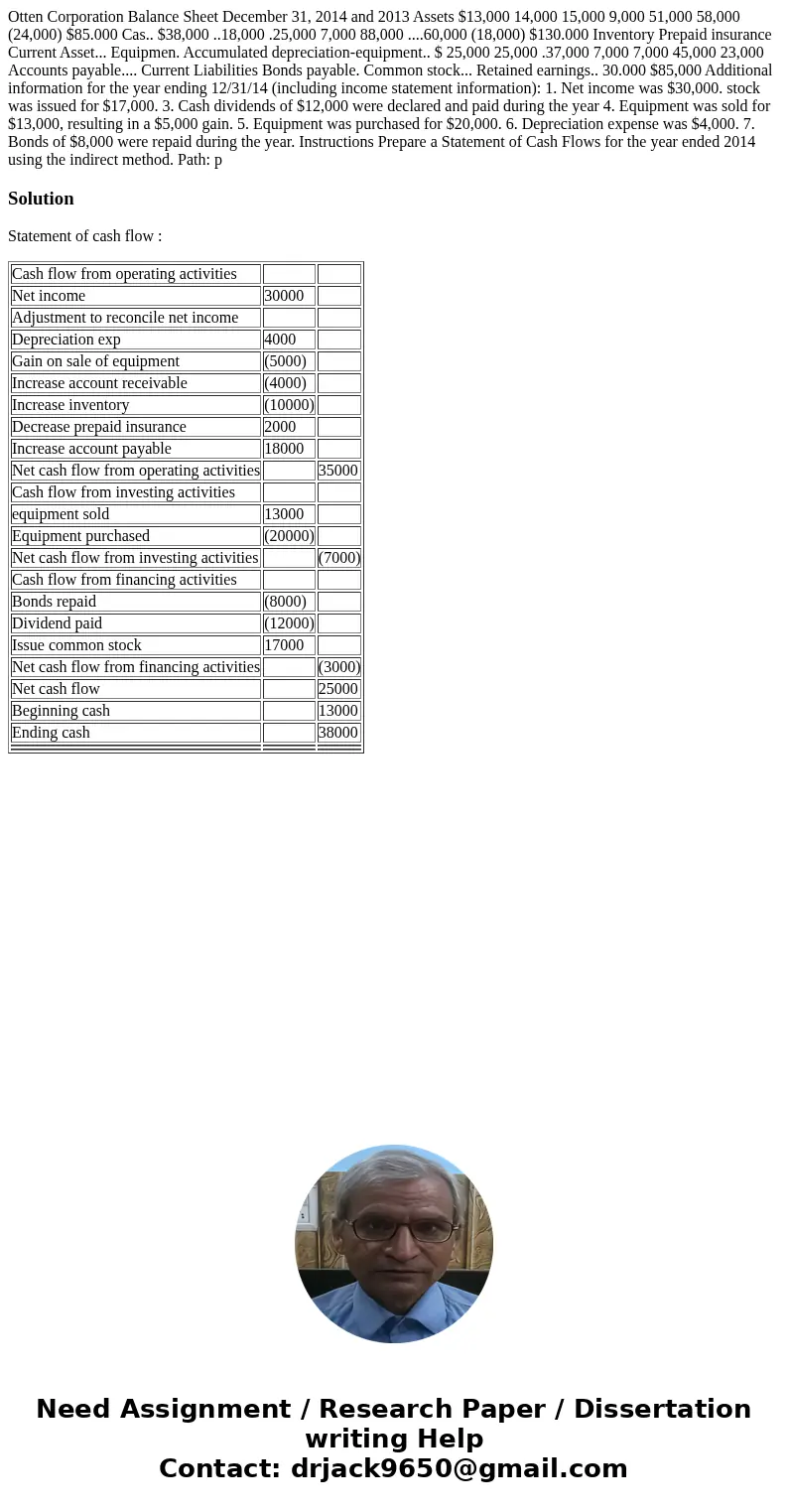

Otten Corporation Balance Sheet December 31, 2014 and 2013 Assets $13,000 14,000 15,000 9,000 51,000 58,000 (24,000) $85.000 Cas.. $38,000 ..18,000 .25,000 7,000 88,000 ....60,000 (18,000) $130.000 Inventory Prepaid insurance Current Asset... Equipmen. Accumulated depreciation-equipment.. $ 25,000 25,000 .37,000 7,000 7,000 45,000 23,000 Accounts payable.... Current Liabilities Bonds payable. Common stock... Retained earnings.. 30.000 $85,000 Additional information for the year ending 12/31/14 (including income statement information): 1. Net income was $30,000. stock was issued for $17,000. 3. Cash dividends of $12,000 were declared and paid during the year 4. Equipment was sold for $13,000, resulting in a $5,000 gain. 5. Equipment was purchased for $20,000. 6. Depreciation expense was $4,000. 7. Bonds of $8,000 were repaid during the year. Instructions Prepare a Statement of Cash Flows for the year ended 2014 using the indirect method. Path: p

Solution

Statement of cash flow :

| Cash flow from operating activities | ||

| Net income | 30000 | |

| Adjustment to reconcile net income | ||

| Depreciation exp | 4000 | |

| Gain on sale of equipment | (5000) | |

| Increase account receivable | (4000) | |

| Increase inventory | (10000) | |

| Decrease prepaid insurance | 2000 | |

| Increase account payable | 18000 | |

| Net cash flow from operating activities | 35000 | |

| Cash flow from investing activities | ||

| equipment sold | 13000 | |

| Equipment purchased | (20000) | |

| Net cash flow from investing activities | (7000) | |

| Cash flow from financing activities | ||

| Bonds repaid | (8000) | |

| Dividend paid | (12000) | |

| Issue common stock | 17000 | |

| Net cash flow from financing activities | (3000) | |

| Net cash flow | 25000 | |

| Beginning cash | 13000 | |

| Ending cash | 38000 | |

Homework Sourse

Homework Sourse