Please help solve this problem without using Excel A company

Please help solve this problem without using Excel...

A company is planning on purchasing a machine. The engineering team approved 3 models. All models have the required specifications. The following table summarizes information which is associated with the three machines they are considering purchasing. Assume the company can replace the machine at the end of the useful life with the exact same machine and the same price. Note that M&0 stands for Maintenance & Operation Cost. The company\'s interest rate (MARR) is 10%, which machine should the company choose? Use Annual Cash Flow Analysis to answer the question. Solve the problem using compounding factors. Show all required compounding factors (X/X ¡%, n). Round the answer to zero decimal place. DO NOT use Excel to solve this problem Useful Life (Years) 13 First Cost Salvage Value Annual Benefit M&O; in year 1 M&0 annual increase12,00011,00010,000 $1,800,000|$2,180,000|$3,200,000 180,000 170,000250,000 535,000 650,000650,000 85,00082,00075,000Solution

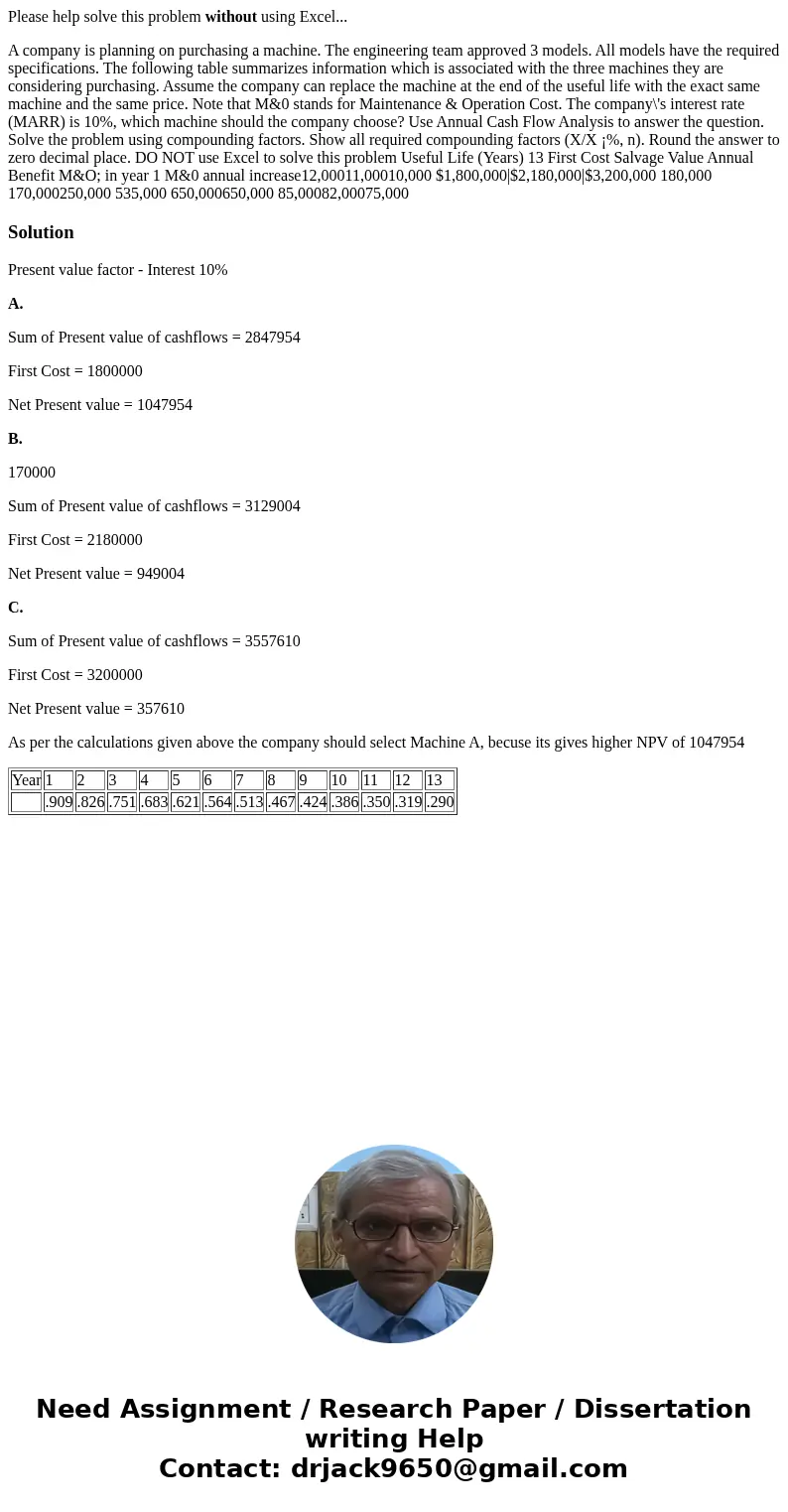

Present value factor - Interest 10%

A.

Sum of Present value of cashflows = 2847954

First Cost = 1800000

Net Present value = 1047954

B.

170000

Sum of Present value of cashflows = 3129004

First Cost = 2180000

Net Present value = 949004

C.

Sum of Present value of cashflows = 3557610

First Cost = 3200000

Net Present value = 357610

As per the calculations given above the company should select Machine A, becuse its gives higher NPV of 1047954

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| .909 | .826 | .751 | .683 | .621 | .564 | .513 | .467 | .424 | .386 | .350 | .319 | .290 |

Homework Sourse

Homework Sourse