Need to show work Thanks LG 6 P914 WACC Book weights and mar

Need to show work. Thanks!

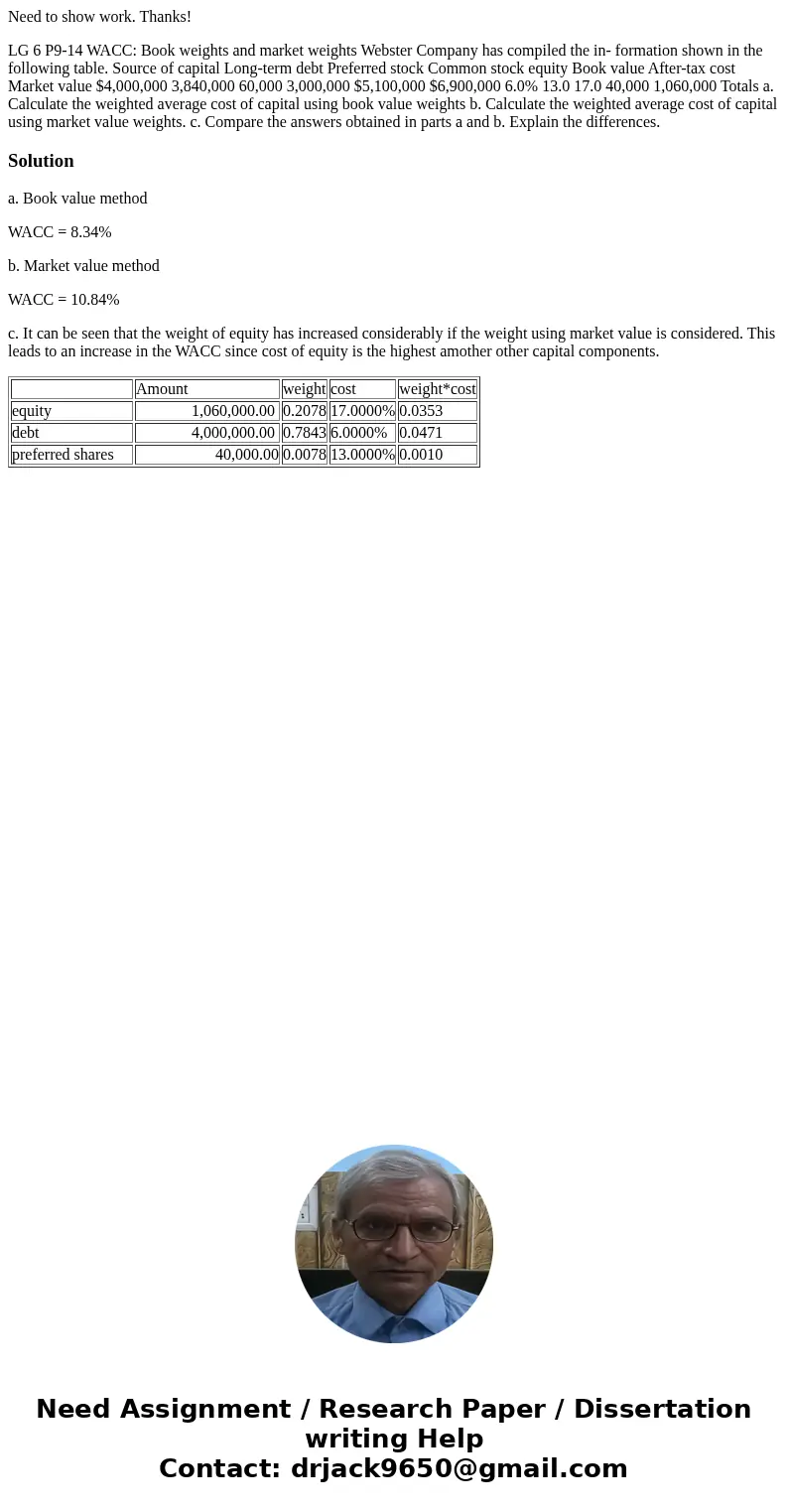

LG 6 P9-14 WACC: Book weights and market weights Webster Company has compiled the in- formation shown in the following table. Source of capital Long-term debt Preferred stock Common stock equity Book value After-tax cost Market value $4,000,000 3,840,000 60,000 3,000,000 $5,100,000 $6,900,000 6.0% 13.0 17.0 40,000 1,060,000 Totals a. Calculate the weighted average cost of capital using book value weights b. Calculate the weighted average cost of capital using market value weights. c. Compare the answers obtained in parts a and b. Explain the differences.Solution

a. Book value method

WACC = 8.34%

b. Market value method

WACC = 10.84%

c. It can be seen that the weight of equity has increased considerably if the weight using market value is considered. This leads to an increase in the WACC since cost of equity is the highest amother other capital components.

| Amount | weight | cost | weight*cost | |

| equity | 1,060,000.00 | 0.2078 | 17.0000% | 0.0353 |

| debt | 4,000,000.00 | 0.7843 | 6.0000% | 0.0471 |

| preferred shares | 40,000.00 | 0.0078 | 13.0000% | 0.0010 |

Homework Sourse

Homework Sourse