Problem 133 Cedarville Company pays its office employee payr

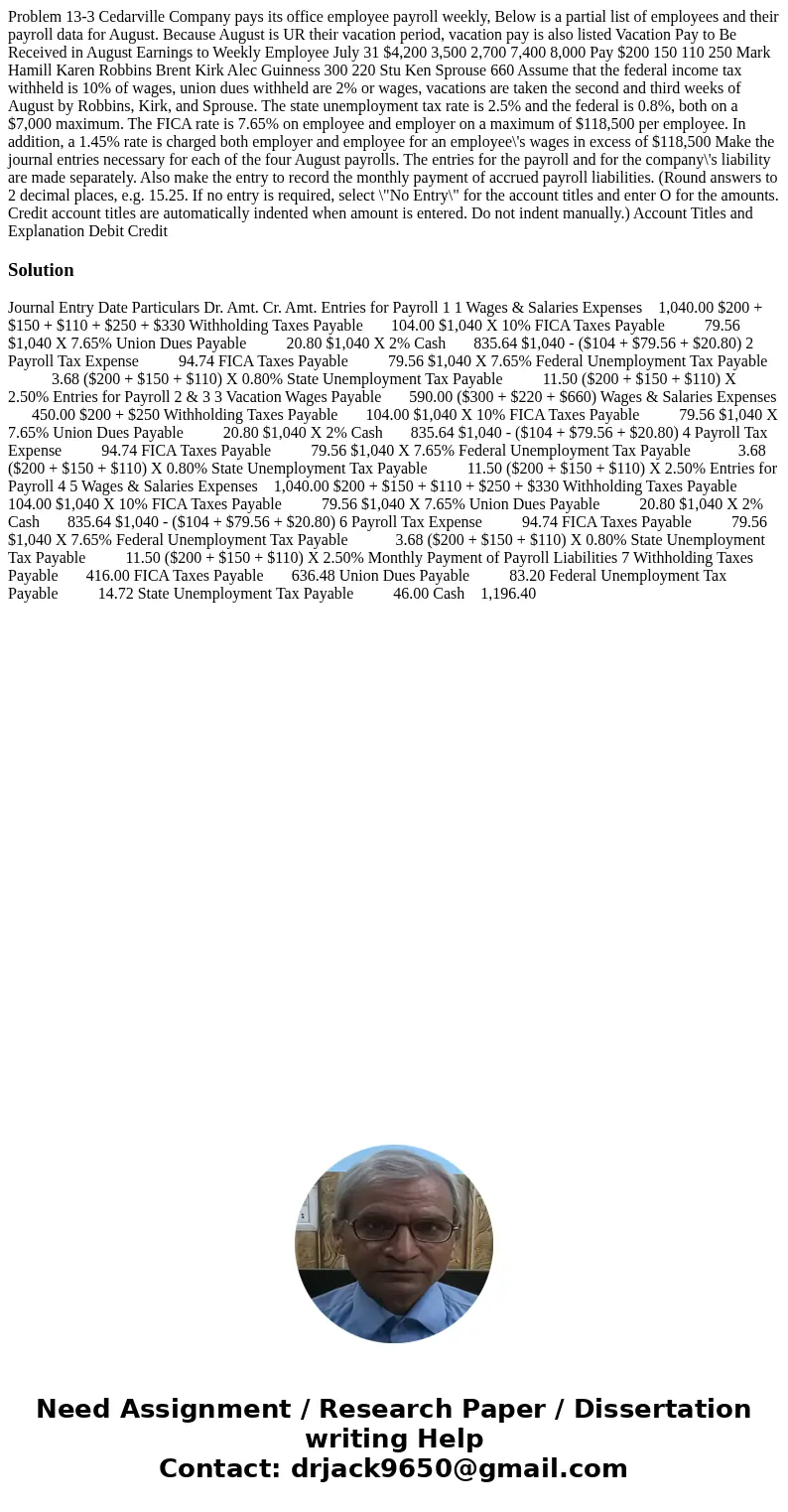

Problem 13-3 Cedarville Company pays its office employee payroll weekly, Below is a partial list of employees and their payroll data for August. Because August is UR their vacation period, vacation pay is also listed Vacation Pay to Be Received in August Earnings to Weekly Employee July 31 $4,200 3,500 2,700 7,400 8,000 Pay $200 150 110 250 Mark Hamill Karen Robbins Brent Kirk Alec Guinness 300 220 Stu Ken Sprouse 660 Assume that the federal income tax withheld is 10% of wages, union dues withheld are 2% or wages, vacations are taken the second and third weeks of August by Robbins, Kirk, and Sprouse. The state unemployment tax rate is 2.5% and the federal is 0.8%, both on a $7,000 maximum. The FICA rate is 7.65% on employee and employer on a maximum of $118,500 per employee. In addition, a 1.45% rate is charged both employer and employee for an employee\'s wages in excess of $118,500 Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for the company\'s liability are made separately. Also make the entry to record the monthly payment of accrued payroll liabilities. (Round answers to 2 decimal places, e.g. 15.25. If no entry is required, select \"No Entry\" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit

Solution

Journal Entry Date Particulars Dr. Amt. Cr. Amt. Entries for Payroll 1 1 Wages & Salaries Expenses 1,040.00 $200 + $150 + $110 + $250 + $330 Withholding Taxes Payable 104.00 $1,040 X 10% FICA Taxes Payable 79.56 $1,040 X 7.65% Union Dues Payable 20.80 $1,040 X 2% Cash 835.64 $1,040 - ($104 + $79.56 + $20.80) 2 Payroll Tax Expense 94.74 FICA Taxes Payable 79.56 $1,040 X 7.65% Federal Unemployment Tax Payable 3.68 ($200 + $150 + $110) X 0.80% State Unemployment Tax Payable 11.50 ($200 + $150 + $110) X 2.50% Entries for Payroll 2 & 3 3 Vacation Wages Payable 590.00 ($300 + $220 + $660) Wages & Salaries Expenses 450.00 $200 + $250 Withholding Taxes Payable 104.00 $1,040 X 10% FICA Taxes Payable 79.56 $1,040 X 7.65% Union Dues Payable 20.80 $1,040 X 2% Cash 835.64 $1,040 - ($104 + $79.56 + $20.80) 4 Payroll Tax Expense 94.74 FICA Taxes Payable 79.56 $1,040 X 7.65% Federal Unemployment Tax Payable 3.68 ($200 + $150 + $110) X 0.80% State Unemployment Tax Payable 11.50 ($200 + $150 + $110) X 2.50% Entries for Payroll 4 5 Wages & Salaries Expenses 1,040.00 $200 + $150 + $110 + $250 + $330 Withholding Taxes Payable 104.00 $1,040 X 10% FICA Taxes Payable 79.56 $1,040 X 7.65% Union Dues Payable 20.80 $1,040 X 2% Cash 835.64 $1,040 - ($104 + $79.56 + $20.80) 6 Payroll Tax Expense 94.74 FICA Taxes Payable 79.56 $1,040 X 7.65% Federal Unemployment Tax Payable 3.68 ($200 + $150 + $110) X 0.80% State Unemployment Tax Payable 11.50 ($200 + $150 + $110) X 2.50% Monthly Payment of Payroll Liabilities 7 Withholding Taxes Payable 416.00 FICA Taxes Payable 636.48 Union Dues Payable 83.20 Federal Unemployment Tax Payable 14.72 State Unemployment Tax Payable 46.00 Cash 1,196.40

Homework Sourse

Homework Sourse