Owner of a haulage business is planning to invest in a new e

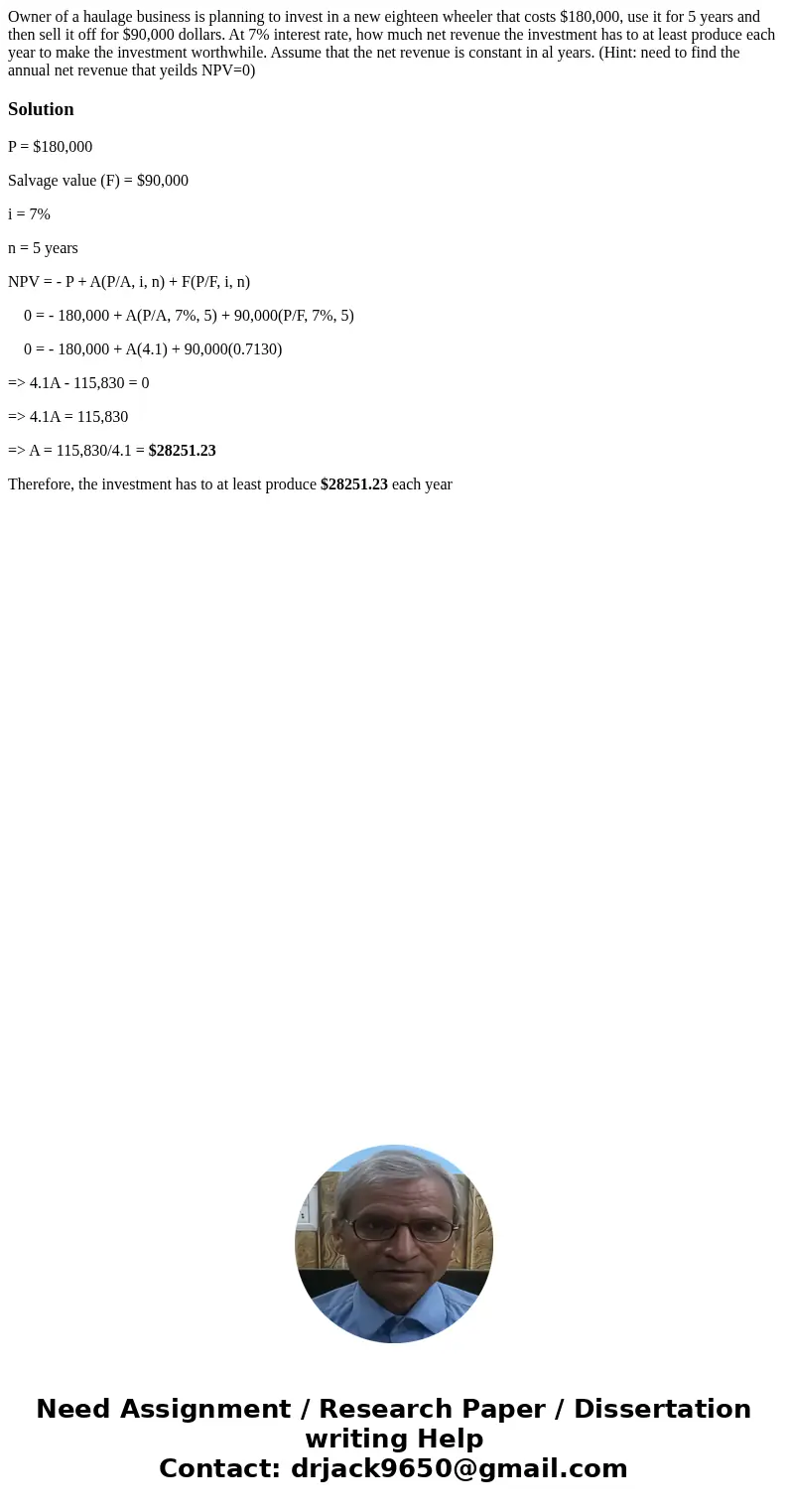

Owner of a haulage business is planning to invest in a new eighteen wheeler that costs $180,000, use it for 5 years and then sell it off for $90,000 dollars. At 7% interest rate, how much net revenue the investment has to at least produce each year to make the investment worthwhile. Assume that the net revenue is constant in al years. (Hint: need to find the annual net revenue that yeilds NPV=0)

Solution

P = $180,000

Salvage value (F) = $90,000

i = 7%

n = 5 years

NPV = - P + A(P/A, i, n) + F(P/F, i, n)

0 = - 180,000 + A(P/A, 7%, 5) + 90,000(P/F, 7%, 5)

0 = - 180,000 + A(4.1) + 90,000(0.7130)

=> 4.1A - 115,830 = 0

=> 4.1A = 115,830

=> A = 115,830/4.1 = $28251.23

Therefore, the investment has to at least produce $28251.23 each year

Homework Sourse

Homework Sourse