Salaries expense Customer service expense Cost of goods manu

Solution

Problem-6;

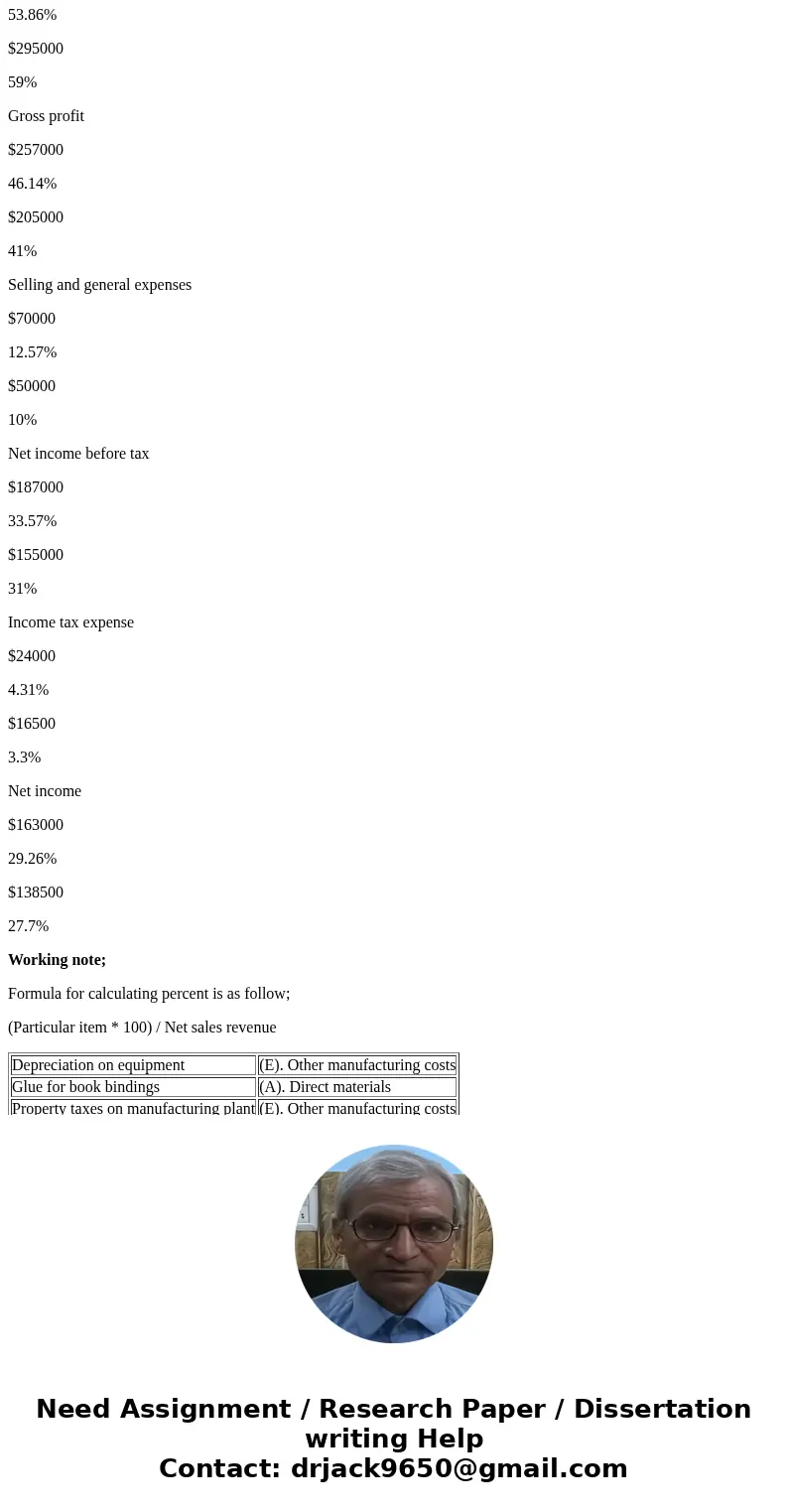

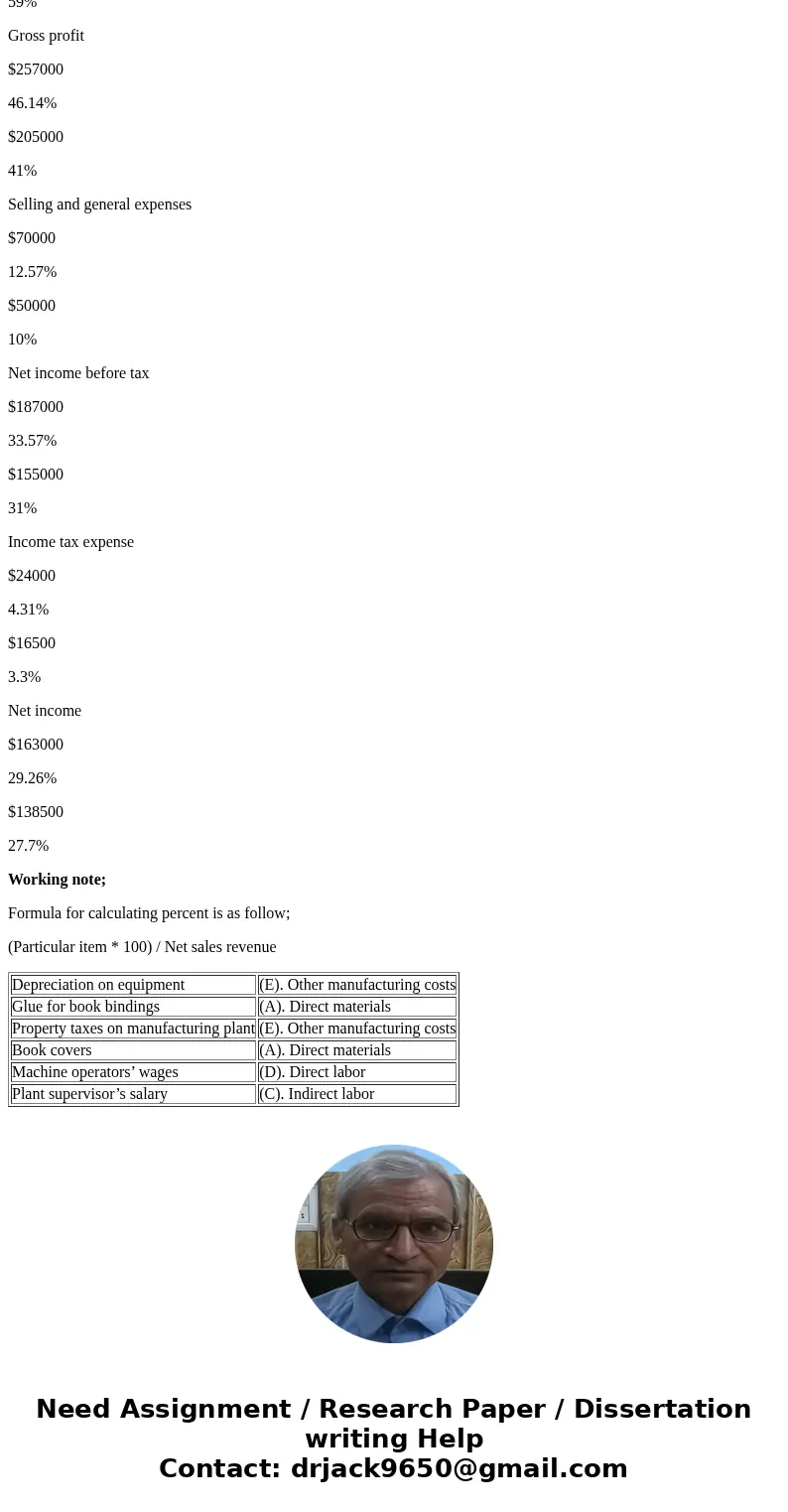

Depreciation on equipment

(E). Other manufacturing costs

Glue for book bindings

(A). Direct materials

Property taxes on manufacturing plant

(E). Other manufacturing costs

Book covers

(A). Direct materials

Machine operators’ wages

(D). Direct labor

Plant supervisor’s salary

(C). Indirect labor

Problem-7;

Note: As per information given in your income statement. Some calculation was incorrect like gross profit, income before tax because when you will deduct cost of goods sold from net sales revenue then you will find following amount that I have done in following income statement.

Account

2007

Percent

2006

Percent

Net sales revenue

$557000

100%

$500000

100%

Cost of goods sold

$300000

53.86%

$295000

59%

Gross profit

$257000

46.14%

$205000

41%

Selling and general expenses

$70000

12.57%

$50000

10%

Net income before tax

$187000

33.57%

$155000

31%

Income tax expense

$24000

4.31%

$16500

3.3%

Net income

$163000

29.26%

$138500

27.7%

Working note;

Formula for calculating percent is as follow;

(Particular item * 100) / Net sales revenue

| Depreciation on equipment | (E). Other manufacturing costs |

| Glue for book bindings | (A). Direct materials |

| Property taxes on manufacturing plant | (E). Other manufacturing costs |

| Book covers | (A). Direct materials |

| Machine operators’ wages | (D). Direct labor |

| Plant supervisor’s salary | (C). Indirect labor |

Homework Sourse

Homework Sourse