An investor has two bonds in her portfolio Bond C and Bond Z

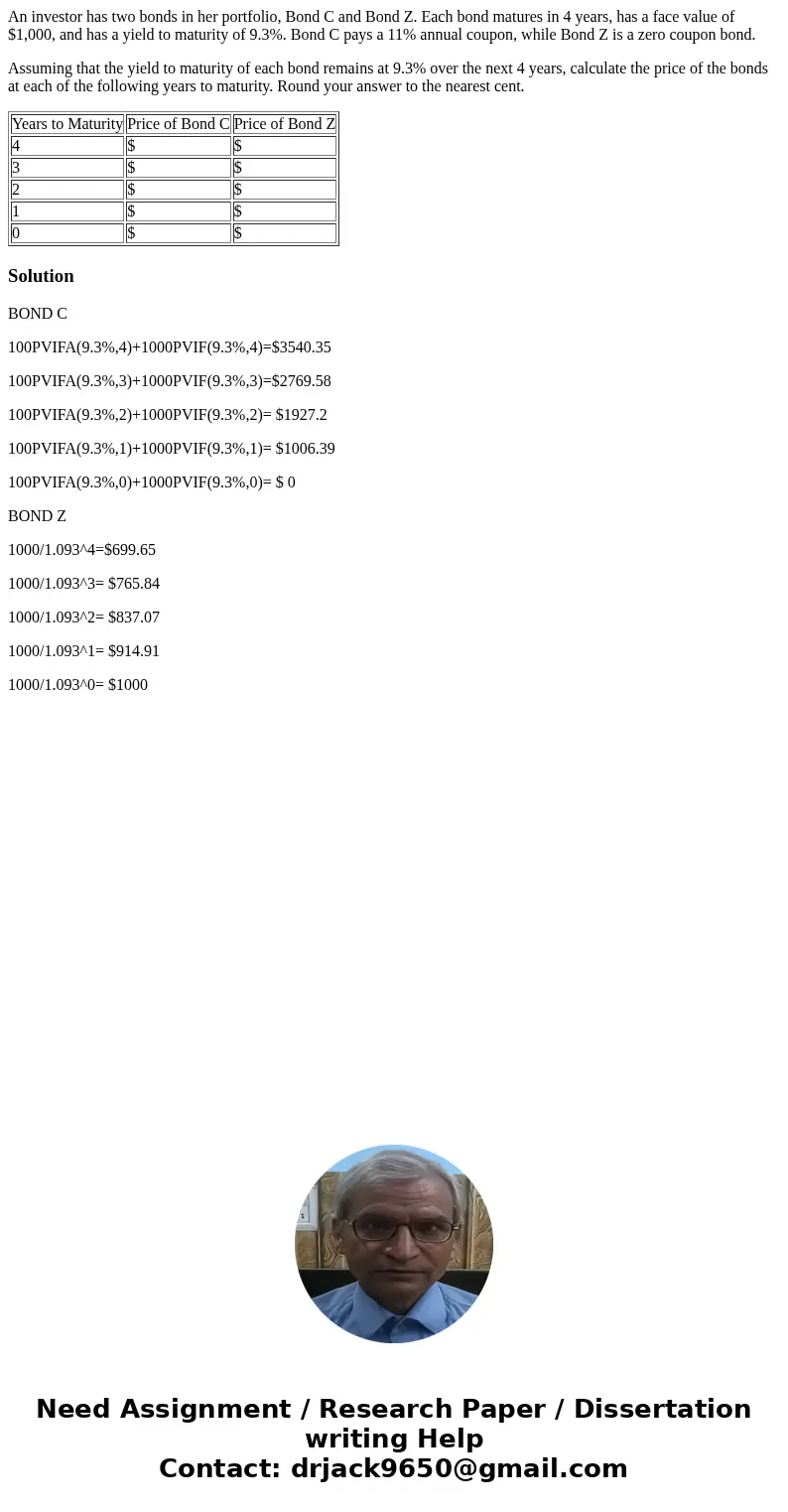

An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 9.3%. Bond C pays a 11% annual coupon, while Bond Z is a zero coupon bond.

Assuming that the yield to maturity of each bond remains at 9.3% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answer to the nearest cent.

| Years to Maturity | Price of Bond C | Price of Bond Z |

| 4 | $ | $ |

| 3 | $ | $ |

| 2 | $ | $ |

| 1 | $ | $ |

| 0 | $ | $ |

Solution

BOND C

100PVIFA(9.3%,4)+1000PVIF(9.3%,4)=$3540.35

100PVIFA(9.3%,3)+1000PVIF(9.3%,3)=$2769.58

100PVIFA(9.3%,2)+1000PVIF(9.3%,2)= $1927.2

100PVIFA(9.3%,1)+1000PVIF(9.3%,1)= $1006.39

100PVIFA(9.3%,0)+1000PVIF(9.3%,0)= $ 0

BOND Z

1000/1.093^4=$699.65

1000/1.093^3= $765.84

1000/1.093^2= $837.07

1000/1.093^1= $914.91

1000/1.093^0= $1000

Homework Sourse

Homework Sourse