How networking capital depreciation and interest influence t

How networking capital, depreciation, and interest influence the decision to buy or not to buy when making capital investment decisions

Solution

Investment decision

The project is evaluated on merits of cash flows. The strong or higher cash flows which covers the investment early is desirable. The cash flow strength is determined on parameters of present value of money.

Net working capital is cash requirement of the project and it is negative cash flow or a cash out flow at initial stage of the project. However, the net working capital is recovered back at end of the project but at this stage the strength of working capital is lower because the present value of the working capital recovered is discounted value.

Depreciation is non-cash item for the project. It is derived from project cost by dividing with total number of years. As it is considered as cost of the project, it is a deducted from the inflows and as it is non-cash expense it ultimately gets the tax benefit or tax shield. Tax shields are important thing to be considered before taking any project or decision to invest.

Interest rate for any project is discounting factor. The interest rate is calculated based on cost of the capital which is mix of equity and debt. The interest is the rate which is used for discounting the net cash flow. The discounted cash flow is nothing but the present values. The sum of present value of cash inflow and outflows result in net present value.

If a project generates positive net present values considering net-working capital, depreciation or tax shield and interest cost or cost of capital then we can accept the project or else we can simply reject the project.

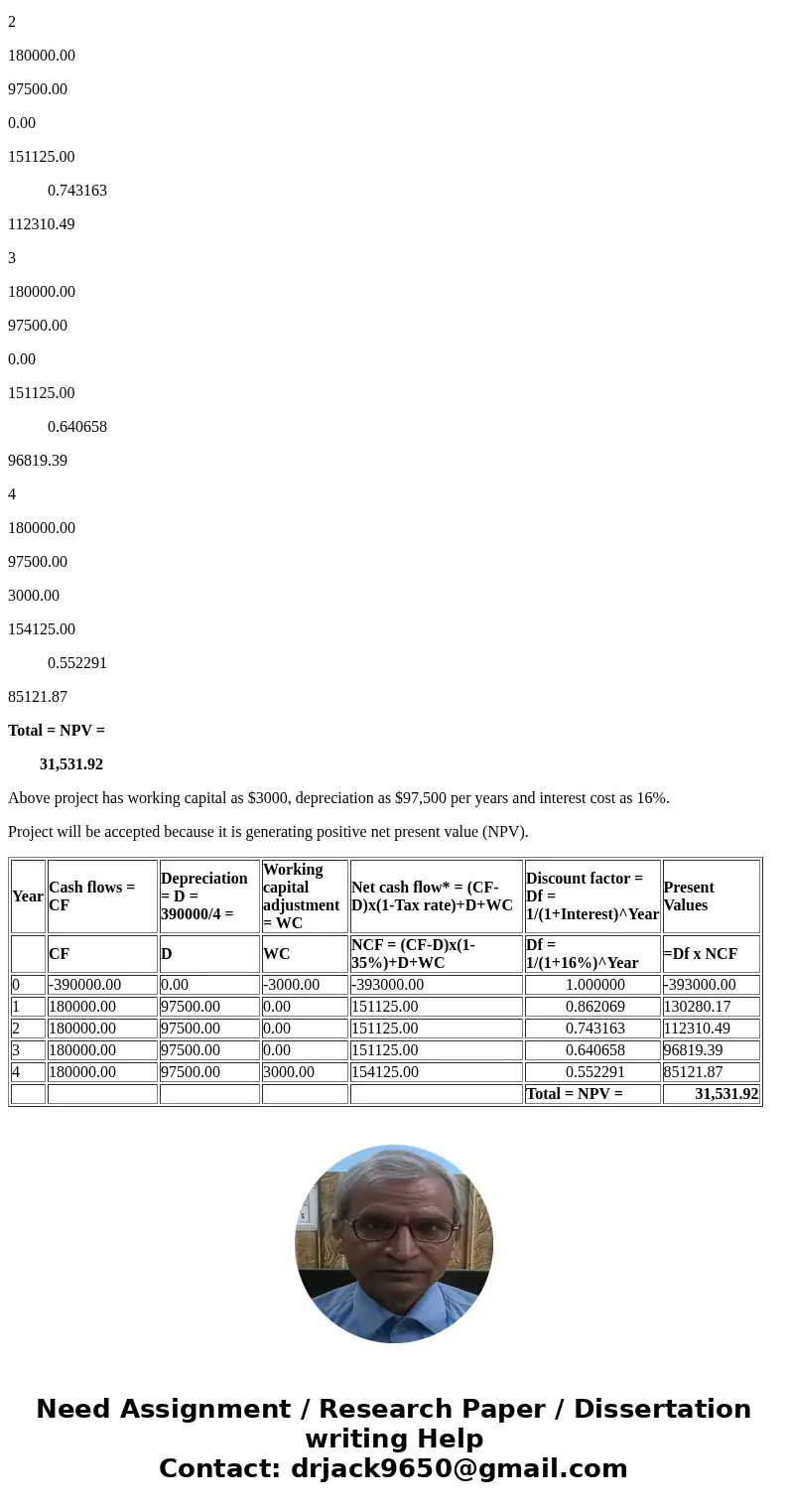

The following table will help us to understand the merit of above all item in numeric or quantitative terms:

Year

Cash flows = CF

Depreciation = D = 390000/4 =

Working capital adjustment = WC

Net cash flow* = (CF-D)x(1-Tax rate)+D+WC

Discount factor = Df = 1/(1+Interest)^Year

Present Values

CF

D

WC

NCF = (CF-D)x(1-35%)+D+WC

Df = 1/(1+16%)^Year

=Df x NCF

0

-390000.00

0.00

-3000.00

-393000.00

1.000000

-393000.00

1

180000.00

97500.00

0.00

151125.00

0.862069

130280.17

2

180000.00

97500.00

0.00

151125.00

0.743163

112310.49

3

180000.00

97500.00

0.00

151125.00

0.640658

96819.39

4

180000.00

97500.00

3000.00

154125.00

0.552291

85121.87

Total = NPV =

31,531.92

Above project has working capital as $3000, depreciation as $97,500 per years and interest cost as 16%.

Project will be accepted because it is generating positive net present value (NPV).

| Year | Cash flows = CF | Depreciation = D = 390000/4 = | Working capital adjustment = WC | Net cash flow* = (CF-D)x(1-Tax rate)+D+WC | Discount factor = Df = 1/(1+Interest)^Year | Present Values |

| CF | D | WC | NCF = (CF-D)x(1-35%)+D+WC | Df = 1/(1+16%)^Year | =Df x NCF | |

| 0 | -390000.00 | 0.00 | -3000.00 | -393000.00 | 1.000000 | -393000.00 |

| 1 | 180000.00 | 97500.00 | 0.00 | 151125.00 | 0.862069 | 130280.17 |

| 2 | 180000.00 | 97500.00 | 0.00 | 151125.00 | 0.743163 | 112310.49 |

| 3 | 180000.00 | 97500.00 | 0.00 | 151125.00 | 0.640658 | 96819.39 |

| 4 | 180000.00 | 97500.00 | 3000.00 | 154125.00 | 0.552291 | 85121.87 |

| Total = NPV = | 31,531.92 |

Homework Sourse

Homework Sourse