3 The group product manager for ointments at American Therap

Solution

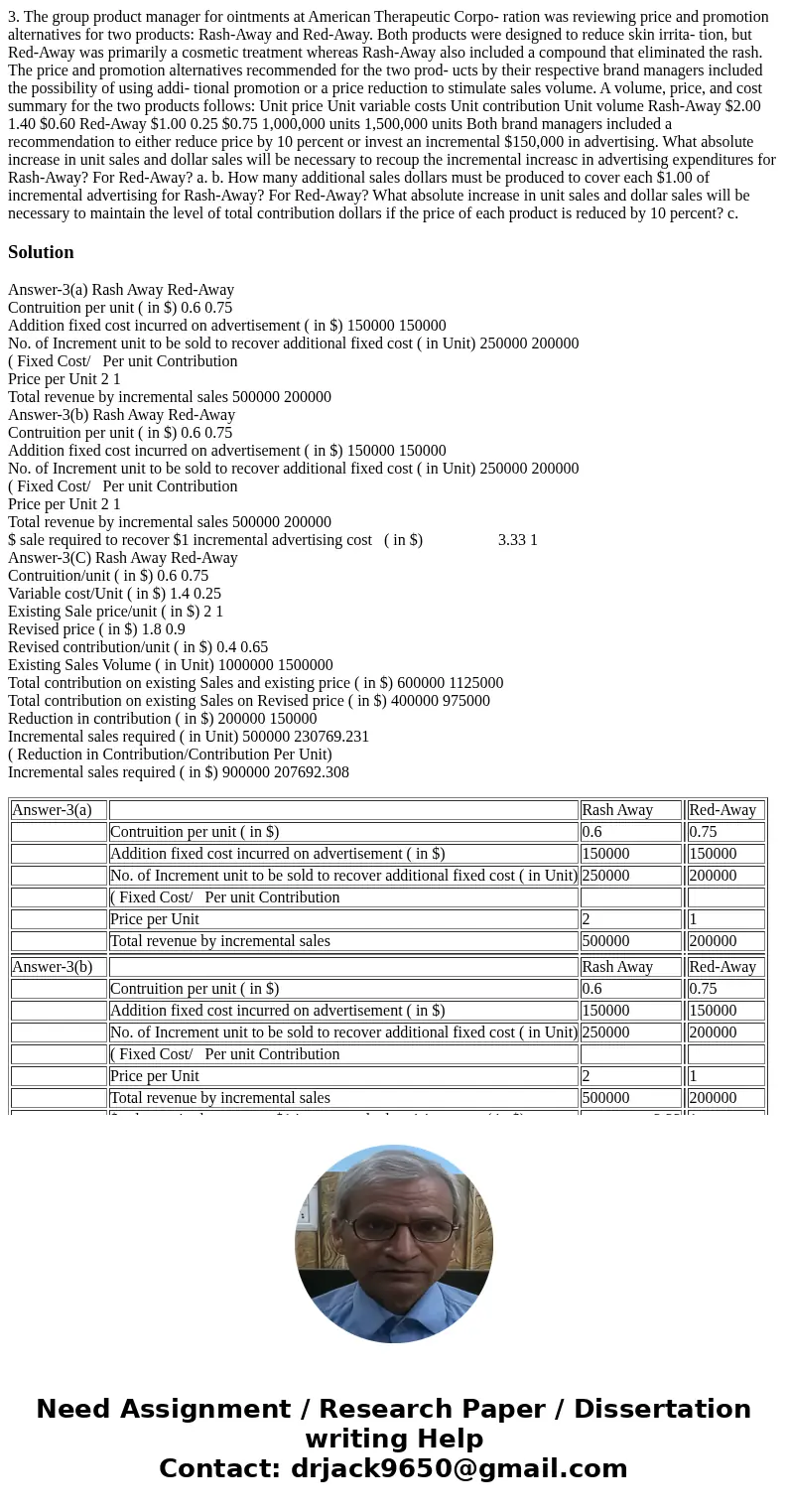

Answer-3(a) Rash Away Red-Away

Contruition per unit ( in $) 0.6 0.75

Addition fixed cost incurred on advertisement ( in $) 150000 150000

No. of Increment unit to be sold to recover additional fixed cost ( in Unit) 250000 200000

( Fixed Cost/ Per unit Contribution

Price per Unit 2 1

Total revenue by incremental sales 500000 200000

Answer-3(b) Rash Away Red-Away

Contruition per unit ( in $) 0.6 0.75

Addition fixed cost incurred on advertisement ( in $) 150000 150000

No. of Increment unit to be sold to recover additional fixed cost ( in Unit) 250000 200000

( Fixed Cost/ Per unit Contribution

Price per Unit 2 1

Total revenue by incremental sales 500000 200000

$ sale required to recover $1 incremental advertising cost ( in $) 3.33 1

Answer-3(C) Rash Away Red-Away

Contruition/unit ( in $) 0.6 0.75

Variable cost/Unit ( in $) 1.4 0.25

Existing Sale price/unit ( in $) 2 1

Revised price ( in $) 1.8 0.9

Revised contribution/unit ( in $) 0.4 0.65

Existing Sales Volume ( in Unit) 1000000 1500000

Total contribution on existing Sales and existing price ( in $) 600000 1125000

Total contribution on existing Sales on Revised price ( in $) 400000 975000

Reduction in contribution ( in $) 200000 150000

Incremental sales required ( in Unit) 500000 230769.231

( Reduction in Contribution/Contribution Per Unit)

Incremental sales required ( in $) 900000 207692.308

| Answer-3(a) | Rash Away | Red-Away | ||

| Contruition per unit ( in $) | 0.6 | 0.75 | ||

| Addition fixed cost incurred on advertisement ( in $) | 150000 | 150000 | ||

| No. of Increment unit to be sold to recover additional fixed cost ( in Unit) | 250000 | 200000 | ||

| ( Fixed Cost/ Per unit Contribution | ||||

| Price per Unit | 2 | 1 | ||

| Total revenue by incremental sales | 500000 | 200000 | ||

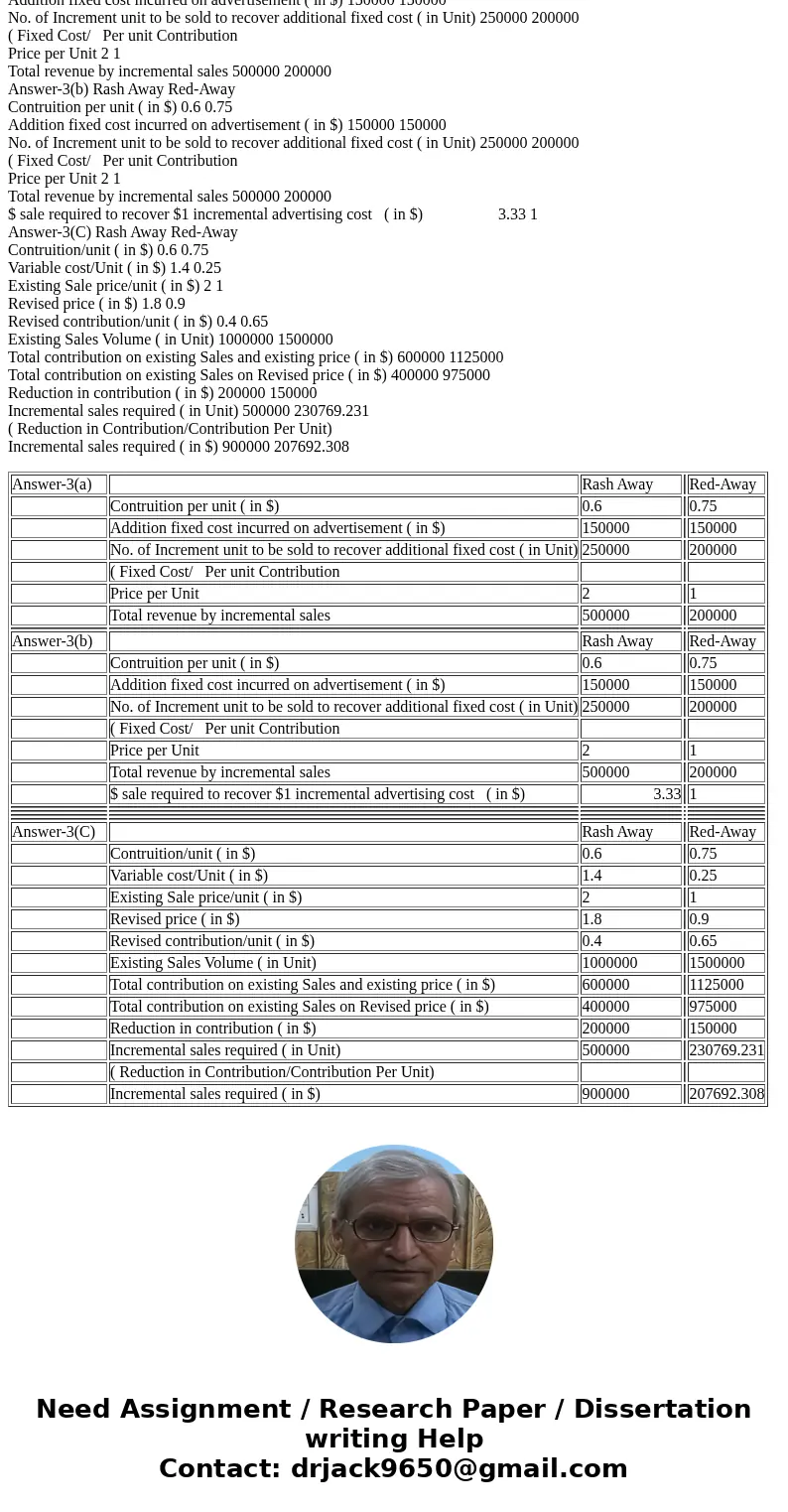

| Answer-3(b) | Rash Away | Red-Away | ||

| Contruition per unit ( in $) | 0.6 | 0.75 | ||

| Addition fixed cost incurred on advertisement ( in $) | 150000 | 150000 | ||

| No. of Increment unit to be sold to recover additional fixed cost ( in Unit) | 250000 | 200000 | ||

| ( Fixed Cost/ Per unit Contribution | ||||

| Price per Unit | 2 | 1 | ||

| Total revenue by incremental sales | 500000 | 200000 | ||

| $ sale required to recover $1 incremental advertising cost ( in $) | 3.33 | 1 | ||

| Answer-3(C) | Rash Away | Red-Away | ||

| Contruition/unit ( in $) | 0.6 | 0.75 | ||

| Variable cost/Unit ( in $) | 1.4 | 0.25 | ||

| Existing Sale price/unit ( in $) | 2 | 1 | ||

| Revised price ( in $) | 1.8 | 0.9 | ||

| Revised contribution/unit ( in $) | 0.4 | 0.65 | ||

| Existing Sales Volume ( in Unit) | 1000000 | 1500000 | ||

| Total contribution on existing Sales and existing price ( in $) | 600000 | 1125000 | ||

| Total contribution on existing Sales on Revised price ( in $) | 400000 | 975000 | ||

| Reduction in contribution ( in $) | 200000 | 150000 | ||

| Incremental sales required ( in Unit) | 500000 | 230769.231 | ||

| ( Reduction in Contribution/Contribution Per Unit) | ||||

| Incremental sales required ( in $) | 900000 | 207692.308 |

Homework Sourse

Homework Sourse