Suppose the returns of a particular group of mutual funds ar

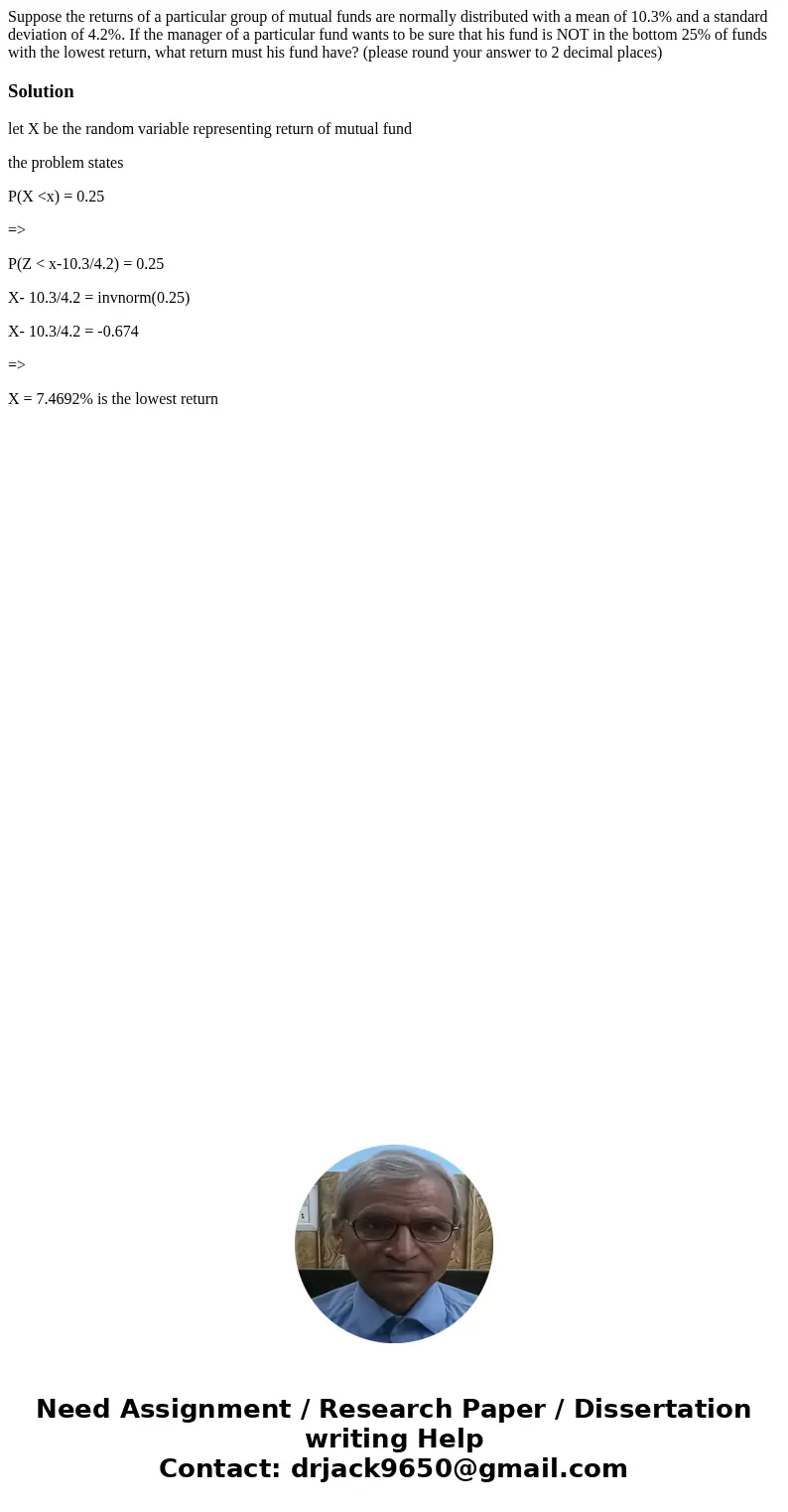

Suppose the returns of a particular group of mutual funds are normally distributed with a mean of 10.3% and a standard deviation of 4.2%. If the manager of a particular fund wants to be sure that his fund is NOT in the bottom 25% of funds with the lowest return, what return must his fund have? (please round your answer to 2 decimal places)

Solution

let X be the random variable representing return of mutual fund

the problem states

P(X <x) = 0.25

=>

P(Z < x-10.3/4.2) = 0.25

X- 10.3/4.2 = invnorm(0.25)

X- 10.3/4.2 = -0.674

=>

X = 7.4692% is the lowest return

Homework Sourse

Homework Sourse