Income Statement QuizAll numbers are pretax and some account

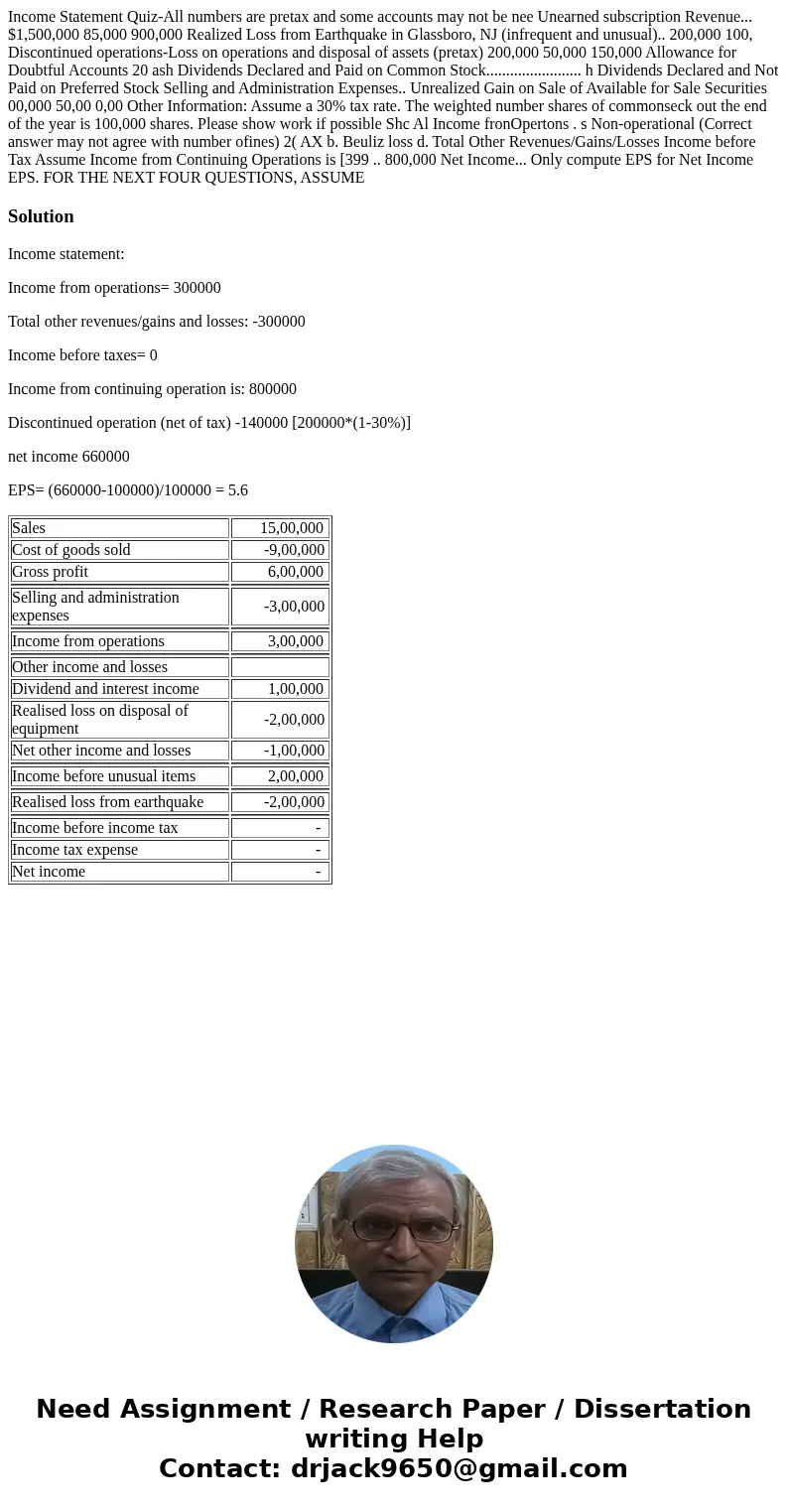

Income Statement Quiz-All numbers are pretax and some accounts may not be nee Unearned subscription Revenue... $1,500,000 85,000 900,000 Realized Loss from Earthquake in Glassboro, NJ (infrequent and unusual).. 200,000 100, Discontinued operations-Loss on operations and disposal of assets (pretax) 200,000 50,000 150,000 Allowance for Doubtful Accounts 20 ash Dividends Declared and Paid on Common Stock........................ h Dividends Declared and Not Paid on Preferred Stock Selling and Administration Expenses.. Unrealized Gain on Sale of Available for Sale Securities 00,000 50,00 0,00 Other Information: Assume a 30% tax rate. The weighted number shares of commonseck out the end of the year is 100,000 shares. Please show work if possible Shc Al Income fronOpertons . s Non-operational (Correct answer may not agree with number ofines) 2( AX b. Beuliz loss d. Total Other Revenues/Gains/Losses Income before Tax Assume Income from Continuing Operations is [399 .. 800,000 Net Income... Only compute EPS for Net Income EPS. FOR THE NEXT FOUR QUESTIONS, ASSUME

Solution

Income statement:

Income from operations= 300000

Total other revenues/gains and losses: -300000

Income before taxes= 0

Income from continuing operation is: 800000

Discontinued operation (net of tax) -140000 [200000*(1-30%)]

net income 660000

EPS= (660000-100000)/100000 = 5.6

| Sales | 15,00,000 |

| Cost of goods sold | -9,00,000 |

| Gross profit | 6,00,000 |

| Selling and administration expenses | -3,00,000 |

| Income from operations | 3,00,000 |

| Other income and losses | |

| Dividend and interest income | 1,00,000 |

| Realised loss on disposal of equipment | -2,00,000 |

| Net other income and losses | -1,00,000 |

| Income before unusual items | 2,00,000 |

| Realised loss from earthquake | -2,00,000 |

| Income before income tax | - |

| Income tax expense | - |

| Net income | - |

Homework Sourse

Homework Sourse