Exercise 618A Asset replacement decision LO 65 A machine pur

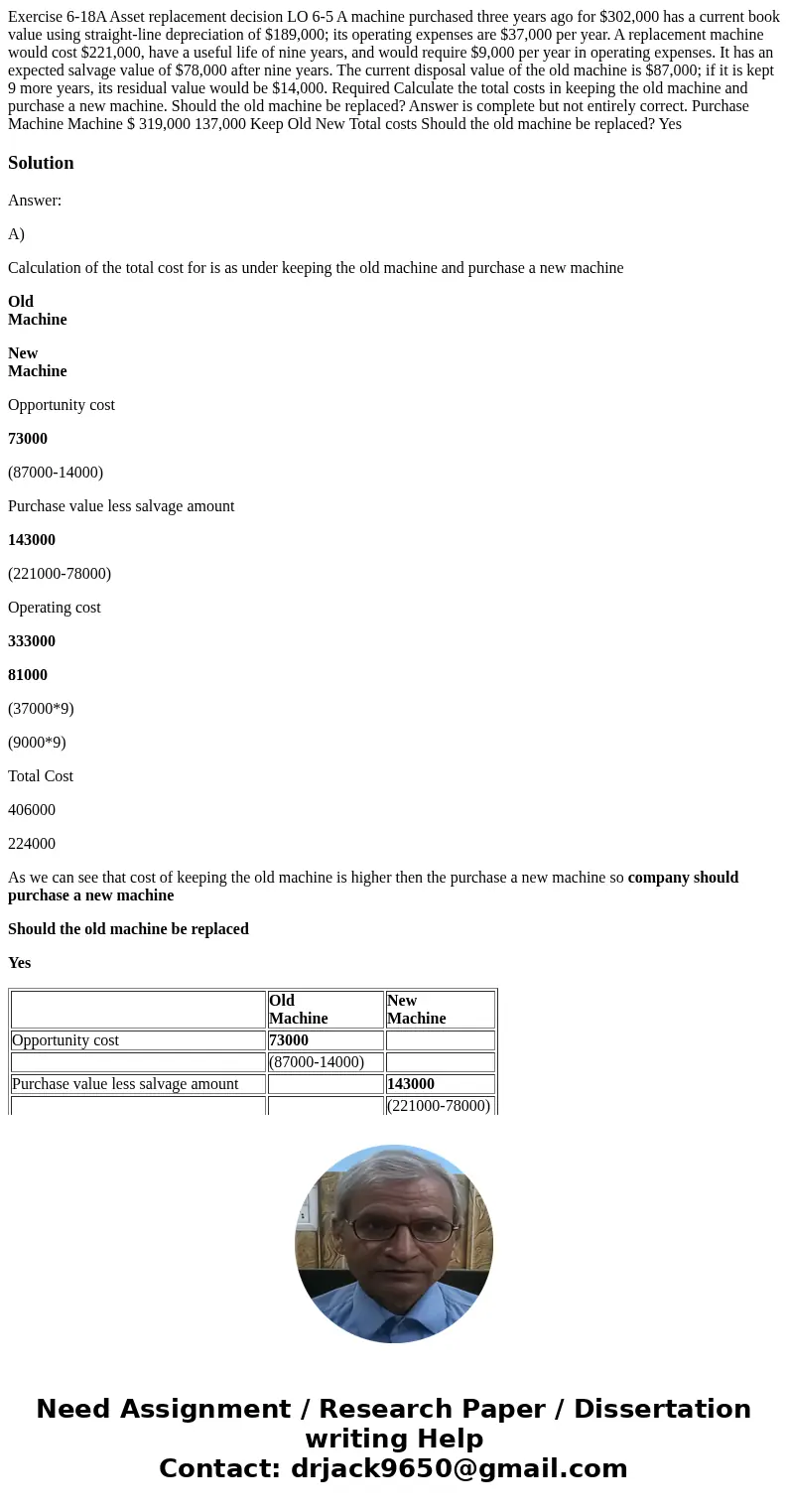

Exercise 6-18A Asset replacement decision LO 6-5 A machine purchased three years ago for $302,000 has a current book value using straight-line depreciation of $189,000; its operating expenses are $37,000 per year. A replacement machine would cost $221,000, have a useful life of nine years, and would require $9,000 per year in operating expenses. It has an expected salvage value of $78,000 after nine years. The current disposal value of the old machine is $87,000; if it is kept 9 more years, its residual value would be $14,000. Required Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced? Answer is complete but not entirely correct. Purchase Machine Machine $ 319,000 137,000 Keep Old New Total costs Should the old machine be replaced? Yes

Solution

Answer:

A)

Calculation of the total cost for is as under keeping the old machine and purchase a new machine

Old

Machine

New

Machine

Opportunity cost

73000

(87000-14000)

Purchase value less salvage amount

143000

(221000-78000)

Operating cost

333000

81000

(37000*9)

(9000*9)

Total Cost

406000

224000

As we can see that cost of keeping the old machine is higher then the purchase a new machine so company should purchase a new machine

Should the old machine be replaced

Yes

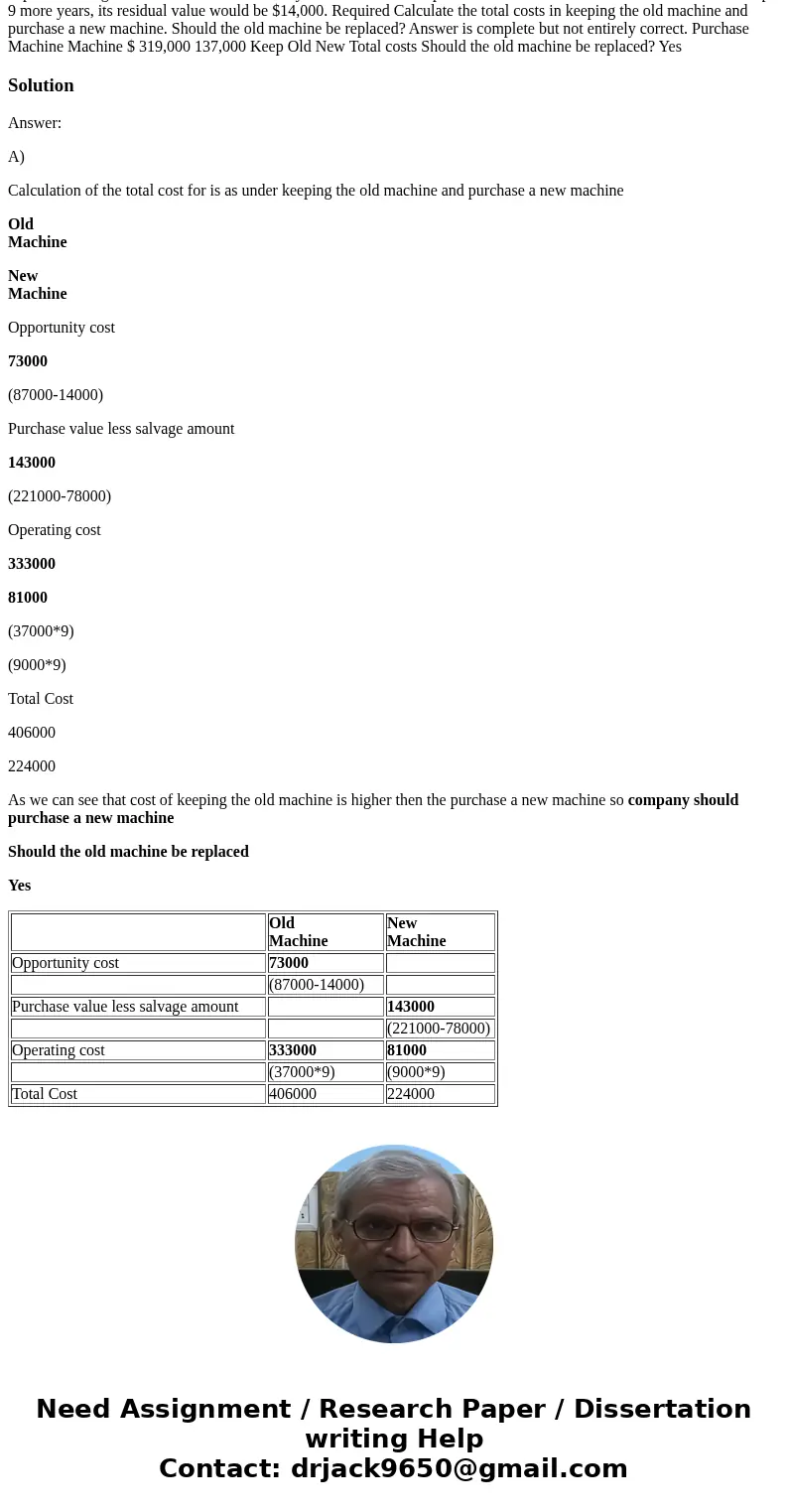

| Old | New | |

| Opportunity cost | 73000 | |

| (87000-14000) | ||

| Purchase value less salvage amount | 143000 | |

| (221000-78000) | ||

| Operating cost | 333000 | 81000 |

| (37000*9) | (9000*9) | |

| Total Cost | 406000 | 224000 |

Homework Sourse

Homework Sourse