81 258 STRAIGHTLINE DECLINING BALANCE SUMOFTHEYEARSDIGIIS AN

Solution

Part 1

Depreciation under SLM

Cost of Machine = $59,000

Salvage Value = $3,000

Period = 8years

Formula for SLM method of depreciation is

Cost of Machine - Salvage Value So $59,000 - $3,000 = $7,000

No of years or Useful Life 8

Hence the Machinery will be depreciated each year at $7,000.

Part 2

Double Discount method

To calculate depreciation under the double declining method, multiply the asset book value at the beginning of the fiscal year by a multiple of the straight-line rate of depreciation. The double declining balance formula is:

Double-declining balance (ceases when the book value = the estimated salvage value)

2 × Straight-line depreciation rate × Book value at the beginning of the year

Straight Line rate of Depreciation = Depreciation as per SLM which is 7000 = 12.5%

Cost of machine - Salvage value 59000-3000

Part 3

Sum of the year Digit method

Formula = n(n+1) = 8(8+1) = 36

2 2

Annual Depreciation is calculated by mulplying Net cost of machine which is ( Cost of machine- Salvage value) $59000-$3000=$56000 with the allocated percentage.

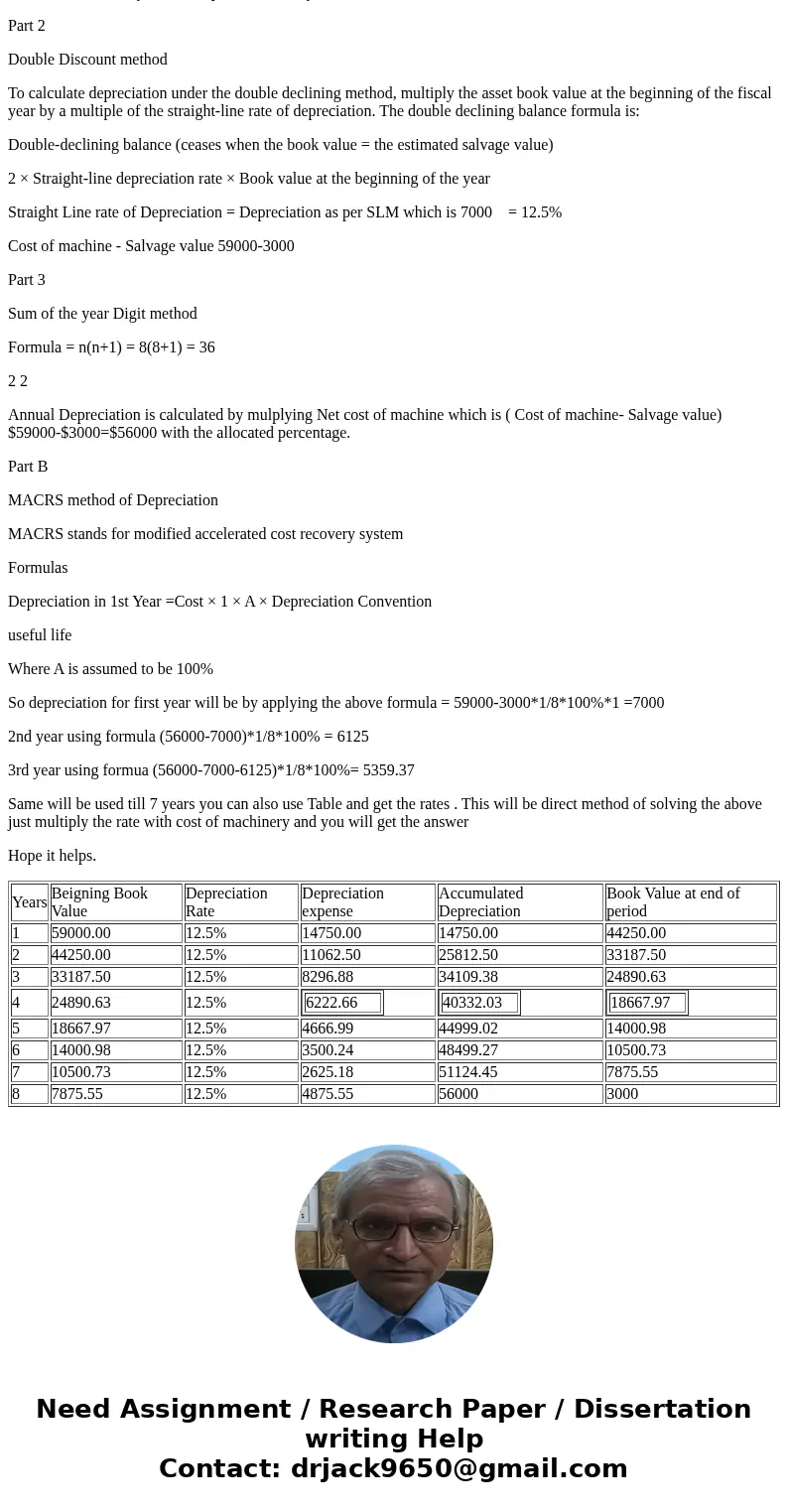

Part B

MACRS method of Depreciation

MACRS stands for modified accelerated cost recovery system

Formulas

Depreciation in 1st Year =Cost × 1 × A × Depreciation Convention

useful life

Where A is assumed to be 100%

So depreciation for first year will be by applying the above formula = 59000-3000*1/8*100%*1 =7000

2nd year using formula (56000-7000)*1/8*100% = 6125

3rd year using formua (56000-7000-6125)*1/8*100%= 5359.37

Same will be used till 7 years you can also use Table and get the rates . This will be direct method of solving the above just multiply the rate with cost of machinery and you will get the answer

Hope it helps.

| Years | Beigning Book Value | Depreciation Rate | Depreciation expense | Accumulated Depreciation | Book Value at end of period | |||

| 1 | 59000.00 | 12.5% | 14750.00 | 14750.00 | 44250.00 | |||

| 2 | 44250.00 | 12.5% | 11062.50 | 25812.50 | 33187.50 | |||

| 3 | 33187.50 | 12.5% | 8296.88 | 34109.38 | 24890.63 | |||

| 4 | 24890.63 | 12.5% |

|

|

| |||

| 5 | 18667.97 | 12.5% | 4666.99 | 44999.02 | 14000.98 | |||

| 6 | 14000.98 | 12.5% | 3500.24 | 48499.27 | 10500.73 | |||

| 7 | 10500.73 | 12.5% | 2625.18 | 51124.45 | 7875.55 | |||

| 8 | 7875.55 | 12.5% | 4875.55 | 56000 | 3000 |

Homework Sourse

Homework Sourse