Instructions 1 Prepare a schedule showing the reversal of th

Solution

Pre-tax Income as per book = $40,000

Unearned Rent Income = $360,000

(Cash Received but income not accrued.

This Income is considered for the taxable purposes.)

Therefore,

Pre-tax Income as per Tax Laws = $400,000 (360,000+40,000)

Tax Rate as of 31 December, 2017 = 40%

Hence, Income Tax Payable = $400,000 * 40%

Or, $160,000

Unearned Rent Income is a temporary timing Difference.

Timing Difference (TD) = Taxable Income – Accounting income

TD = $ 400,000 – 40,000 = $360,000

Since, TD is positive balance, it will create Deferred Tax Asset.

(Also because, if we understand in layman’s language, the entity is entitled to pay tax in this period due to the cash accounting method carried for tax purposes. So when the rent will be actually “earned” by the entity, tax will be not charged over it and this is beneficial for the company)

Deferred Tax Asset 2017 will be calculated as under :

Timing difference = $360,000

Tax Rate Applicable = 40%

Deferred Tax Asset = TD * Tax Rate

= 360,000 * 40%

Or, $144,000

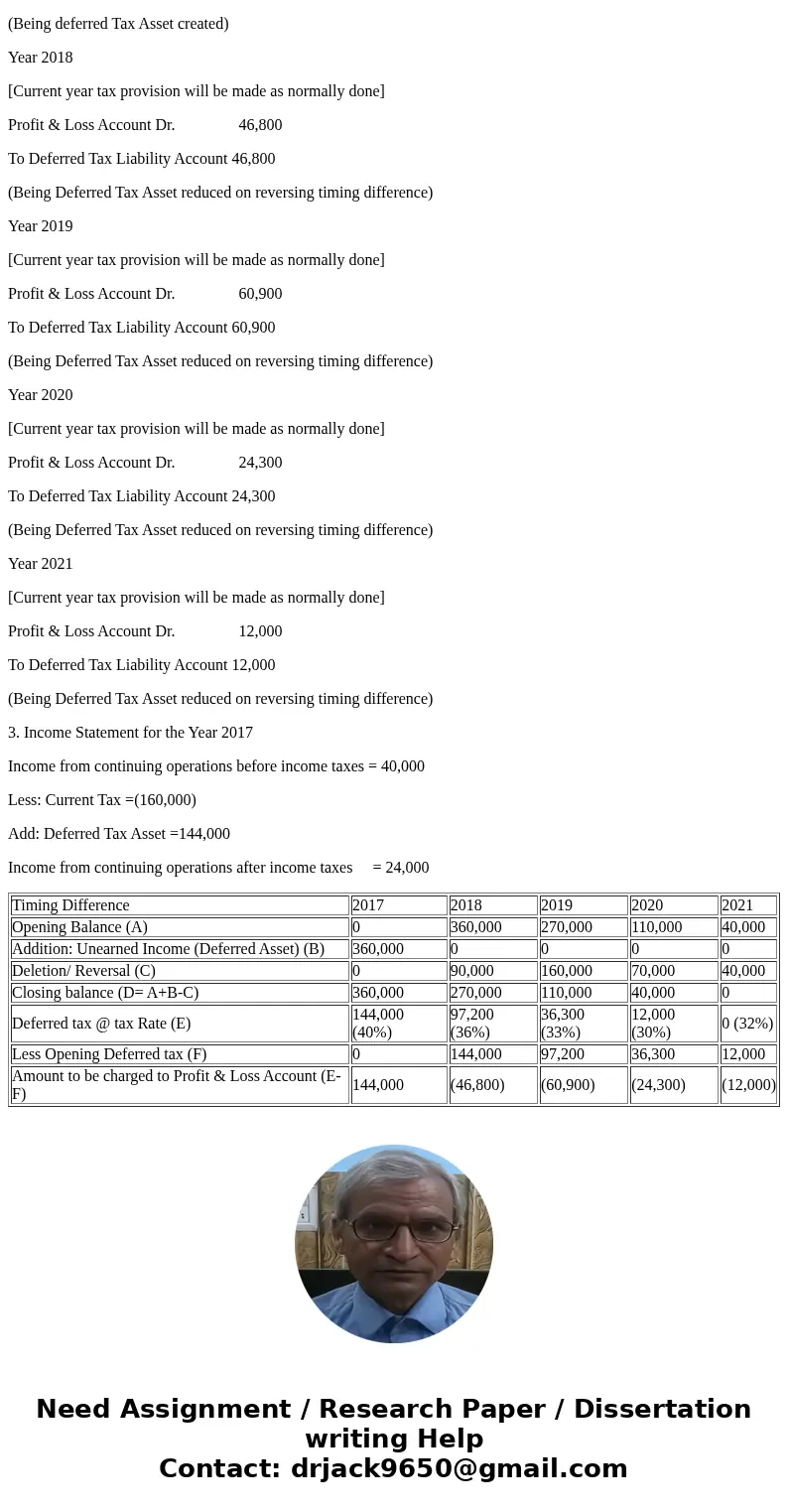

Schedule showing the reversal of the temporary difference

Timing Difference

2017

2018

2019

2020

2021

Opening Balance (A)

0

360,000

270,000

110,000

40,000

Addition: Unearned Income (Deferred Asset) (B)

360,000

0

0

0

0

Deletion/ Reversal (C)

0

90,000

160,000

70,000

40,000

Closing balance (D= A+B-C)

360,000

270,000

110,000

40,000

0

Deferred tax @ tax Rate (E)

144,000 (40%)

97,200 (36%)

36,300 (33%)

12,000 (30%)

0 (32%)

Less Opening Deferred tax (F)

0

144,000

97,200

36,300

12,000

Amount to be charged to Profit & Loss Account (E-F)

144,000

(46,800)

(60,900)

(24,300)

(12,000)

Note: Positive Balance of amount to be charged to Profit & Loss Account means crediting the balance of Profit and loss account thus, increasing it but negative balance means debiting the account and thus lowering the balance.

Since, Unearned Rent is temporary timing difference over the years in which the rent will be earned, the effect on the Profit & Loss Account will be nullified.

2. Journal Entries

Year 2017

Profit & Loss Account Dr. 160,000

To Current Tax 160,000

(Being provision made for current year tax)

Deferred Tax Asset Account Dr. 144,000

To Profit & Loss Account 144,000

(Being deferred Tax Asset created)

Year 2018

[Current year tax provision will be made as normally done]

Profit & Loss Account Dr. 46,800

To Deferred Tax Liability Account 46,800

(Being Deferred Tax Asset reduced on reversing timing difference)

Year 2019

[Current year tax provision will be made as normally done]

Profit & Loss Account Dr. 60,900

To Deferred Tax Liability Account 60,900

(Being Deferred Tax Asset reduced on reversing timing difference)

Year 2020

[Current year tax provision will be made as normally done]

Profit & Loss Account Dr. 24,300

To Deferred Tax Liability Account 24,300

(Being Deferred Tax Asset reduced on reversing timing difference)

Year 2021

[Current year tax provision will be made as normally done]

Profit & Loss Account Dr. 12,000

To Deferred Tax Liability Account 12,000

(Being Deferred Tax Asset reduced on reversing timing difference)

3. Income Statement for the Year 2017

Income from continuing operations before income taxes = 40,000

Less: Current Tax =(160,000)

Add: Deferred Tax Asset =144,000

Income from continuing operations after income taxes = 24,000

| Timing Difference | 2017 | 2018 | 2019 | 2020 | 2021 |

| Opening Balance (A) | 0 | 360,000 | 270,000 | 110,000 | 40,000 |

| Addition: Unearned Income (Deferred Asset) (B) | 360,000 | 0 | 0 | 0 | 0 |

| Deletion/ Reversal (C) | 0 | 90,000 | 160,000 | 70,000 | 40,000 |

| Closing balance (D= A+B-C) | 360,000 | 270,000 | 110,000 | 40,000 | 0 |

| Deferred tax @ tax Rate (E) | 144,000 (40%) | 97,200 (36%) | 36,300 (33%) | 12,000 (30%) | 0 (32%) |

| Less Opening Deferred tax (F) | 0 | 144,000 | 97,200 | 36,300 | 12,000 |

| Amount to be charged to Profit & Loss Account (E-F) | 144,000 | (46,800) | (60,900) | (24,300) | (12,000) |

Homework Sourse

Homework Sourse