Ex 14120Entries for Bonds Payable Prepare journal entries to

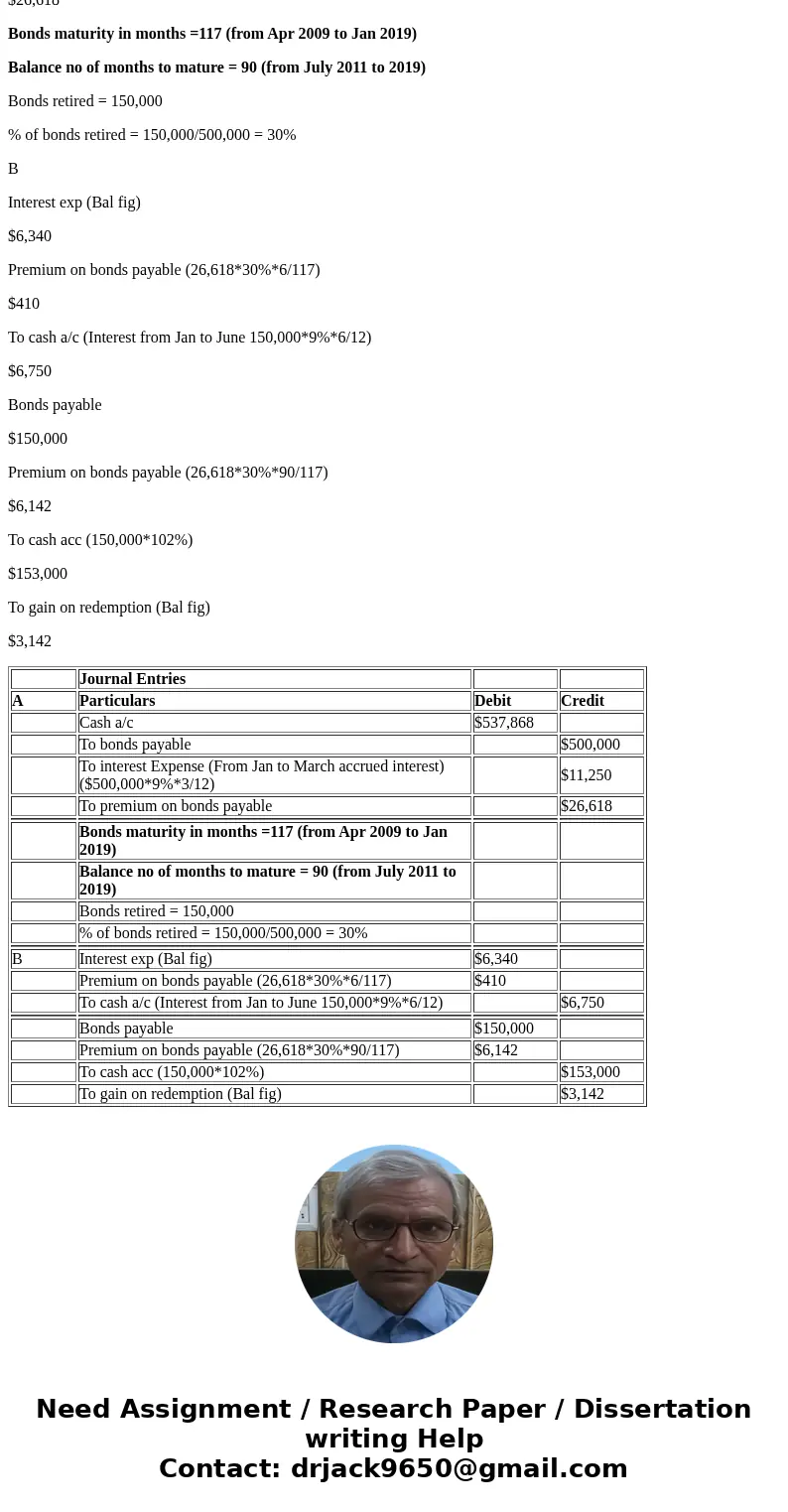

Ex. 14-120—Entries for Bonds Payable.

Prepare journal entries to record the following transactions related to long-term bonds of Quirk Co.

(a) On April 1, 2009, Quirk issued $500,000, 9% bonds for $537,868 including accrued interest. Interest is payable annually on January 1, and the bonds mature on January 1, 2019.

(b) On July 1, 2011 Quirk retired $150,000 of the bonds at 102 plus accrued interest. Quirk uses straight-line amortization.

Solution

Journal Entries

A

Particulars

Debit

Credit

Cash a/c

$537,868

To bonds payable

$500,000

To interest Expense (From Jan to March accrued interest) ($500,000*9%*3/12)

$11,250

To premium on bonds payable

$26,618

Bonds maturity in months =117 (from Apr 2009 to Jan 2019)

Balance no of months to mature = 90 (from July 2011 to 2019)

Bonds retired = 150,000

% of bonds retired = 150,000/500,000 = 30%

B

Interest exp (Bal fig)

$6,340

Premium on bonds payable (26,618*30%*6/117)

$410

To cash a/c (Interest from Jan to June 150,000*9%*6/12)

$6,750

Bonds payable

$150,000

Premium on bonds payable (26,618*30%*90/117)

$6,142

To cash acc (150,000*102%)

$153,000

To gain on redemption (Bal fig)

$3,142

| Journal Entries | |||

| A | Particulars | Debit | Credit |

| Cash a/c | $537,868 | ||

| To bonds payable | $500,000 | ||

| To interest Expense (From Jan to March accrued interest) ($500,000*9%*3/12) | $11,250 | ||

| To premium on bonds payable | $26,618 | ||

| Bonds maturity in months =117 (from Apr 2009 to Jan 2019) | |||

| Balance no of months to mature = 90 (from July 2011 to 2019) | |||

| Bonds retired = 150,000 | |||

| % of bonds retired = 150,000/500,000 = 30% | |||

| B | Interest exp (Bal fig) | $6,340 | |

| Premium on bonds payable (26,618*30%*6/117) | $410 | ||

| To cash a/c (Interest from Jan to June 150,000*9%*6/12) | $6,750 | ||

| Bonds payable | $150,000 | ||

| Premium on bonds payable (26,618*30%*90/117) | $6,142 | ||

| To cash acc (150,000*102%) | $153,000 | ||

| To gain on redemption (Bal fig) | $3,142 |

Homework Sourse

Homework Sourse