Problem 4 2015 at 8000 each During assurance warranties that

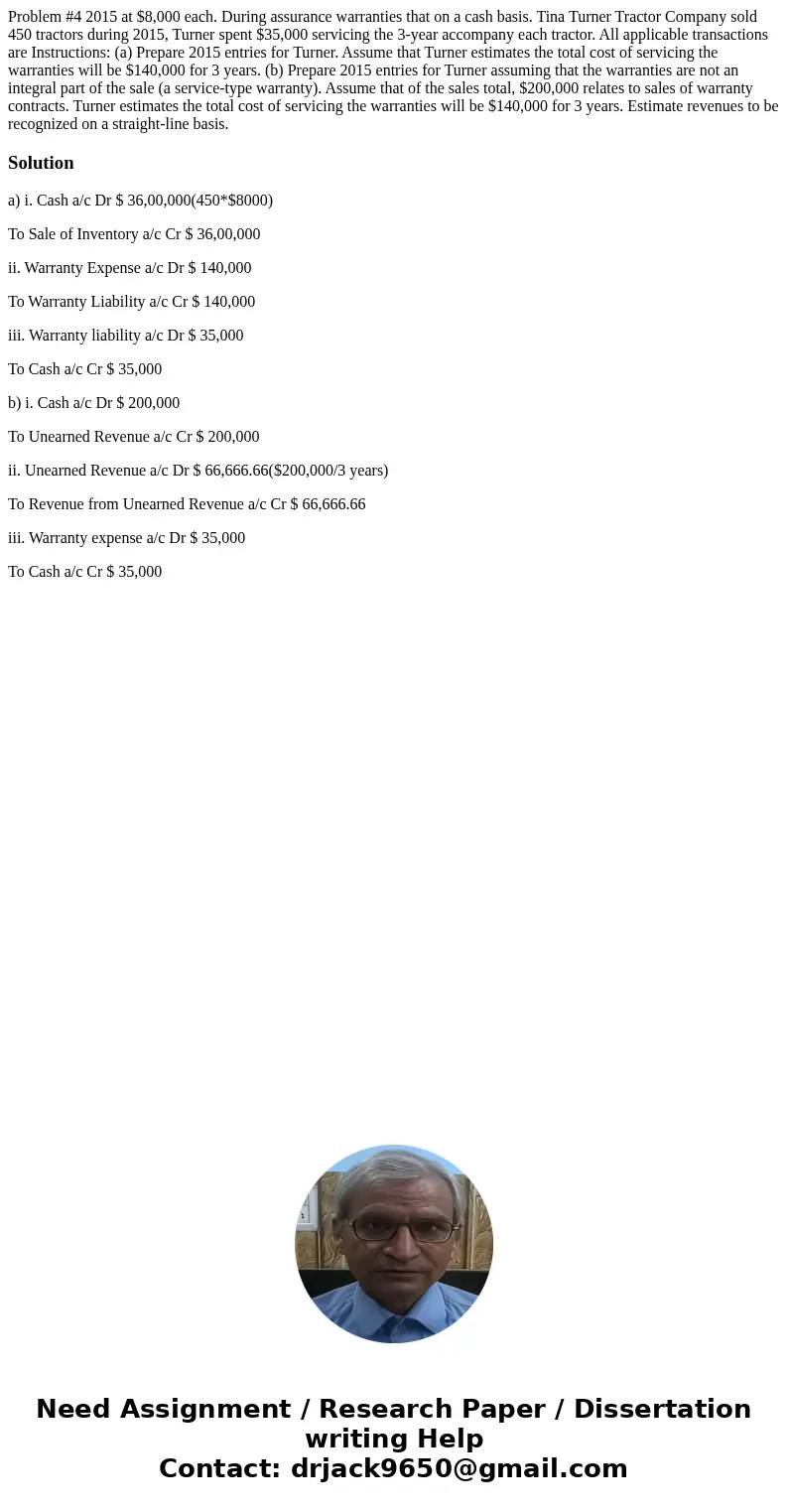

Problem #4 2015 at $8,000 each. During assurance warranties that on a cash basis. Tina Turner Tractor Company sold 450 tractors during 2015, Turner spent $35,000 servicing the 3-year accompany each tractor. All applicable transactions are Instructions: (a) Prepare 2015 entries for Turner. Assume that Turner estimates the total cost of servicing the warranties will be $140,000 for 3 years. (b) Prepare 2015 entries for Turner assuming that the warranties are not an integral part of the sale (a service-type warranty). Assume that of the sales total, $200,000 relates to sales of warranty contracts. Turner estimates the total cost of servicing the warranties will be $140,000 for 3 years. Estimate revenues to be recognized on a straight-line basis.

Solution

a) i. Cash a/c Dr $ 36,00,000(450*$8000)

To Sale of Inventory a/c Cr $ 36,00,000

ii. Warranty Expense a/c Dr $ 140,000

To Warranty Liability a/c Cr $ 140,000

iii. Warranty liability a/c Dr $ 35,000

To Cash a/c Cr $ 35,000

b) i. Cash a/c Dr $ 200,000

To Unearned Revenue a/c Cr $ 200,000

ii. Unearned Revenue a/c Dr $ 66,666.66($200,000/3 years)

To Revenue from Unearned Revenue a/c Cr $ 66,666.66

iii. Warranty expense a/c Dr $ 35,000

To Cash a/c Cr $ 35,000

Homework Sourse

Homework Sourse