b CoolAid pic produced the folowing trial balance as at 30 J

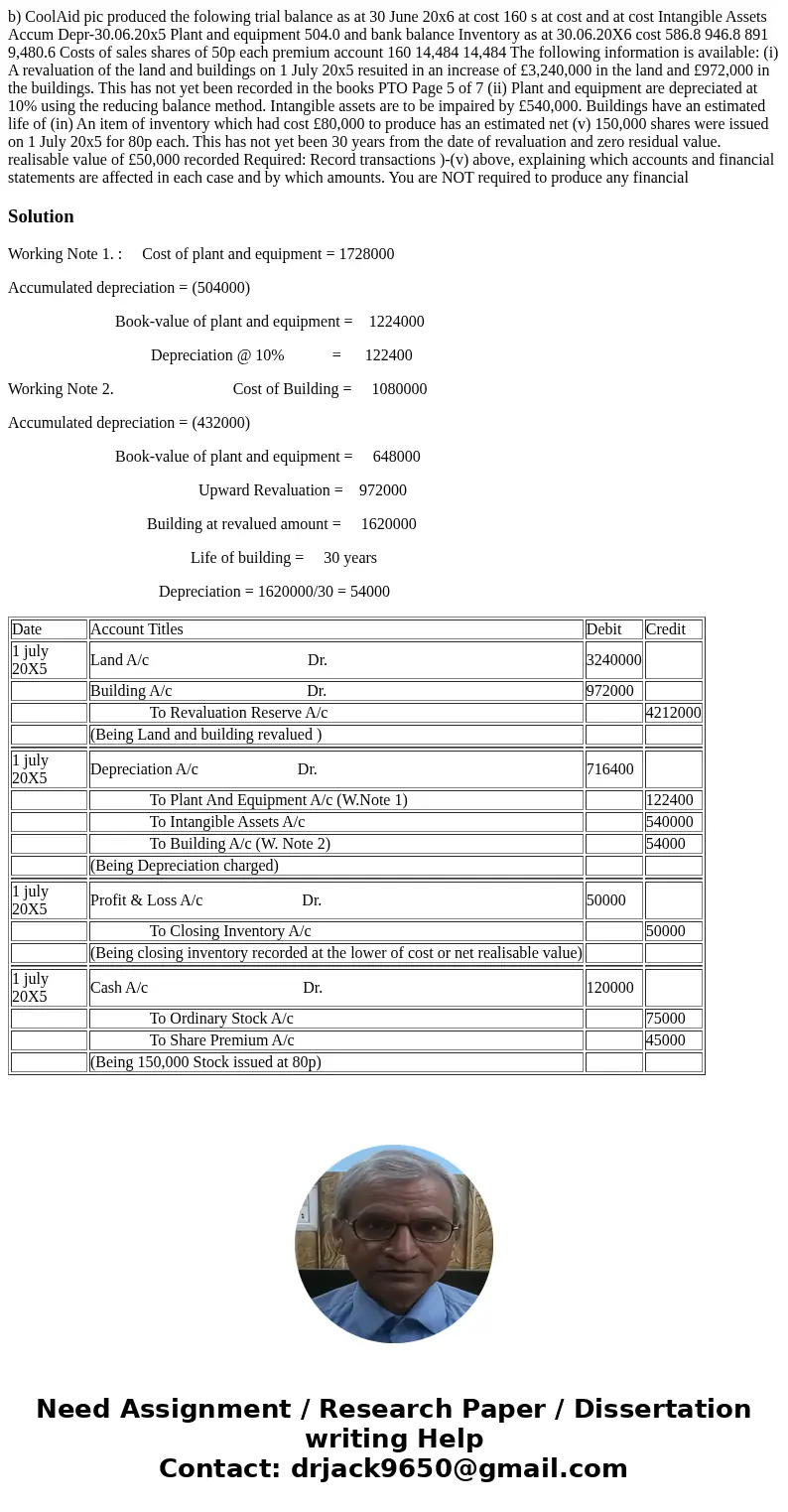

b) CoolAid pic produced the folowing trial balance as at 30 June 20x6 at cost 160 s at cost and at cost Intangible Assets Accum Depr-30.06.20x5 Plant and equipment 504.0 and bank balance Inventory as at 30.06.20X6 cost 586.8 946.8 891 9,480.6 Costs of sales shares of 50p each premium account 160 14,484 14,484 The following information is available: (i) A revaluation of the land and buildings on 1 July 20x5 resuited in an increase of £3,240,000 in the land and £972,000 in the buildings. This has not yet been recorded in the books PTO Page 5 of 7 (ii) Plant and equipment are depreciated at 10% using the reducing balance method. Intangible assets are to be impaired by £540,000. Buildings have an estimated life of (in) An item of inventory which had cost £80,000 to produce has an estimated net (v) 150,000 shares were issued on 1 July 20x5 for 80p each. This has not yet been 30 years from the date of revaluation and zero residual value. realisable value of £50,000 recorded Required: Record transactions )-(v) above, explaining which accounts and financial statements are affected in each case and by which amounts. You are NOT required to produce any financial

Solution

Working Note 1. : Cost of plant and equipment = 1728000

Accumulated depreciation = (504000)

Book-value of plant and equipment = 1224000

Depreciation @ 10% = 122400

Working Note 2. Cost of Building = 1080000

Accumulated depreciation = (432000)

Book-value of plant and equipment = 648000

Upward Revaluation = 972000

Building at revalued amount = 1620000

Life of building = 30 years

Depreciation = 1620000/30 = 54000

| Date | Account Titles | Debit | Credit |

| 1 july 20X5 | Land A/c Dr. | 3240000 | |

| Building A/c Dr. | 972000 | ||

| To Revaluation Reserve A/c | 4212000 | ||

| (Being Land and building revalued ) | |||

| 1 july 20X5 | Depreciation A/c Dr. | 716400 | |

| To Plant And Equipment A/c (W.Note 1) | 122400 | ||

| To Intangible Assets A/c | 540000 | ||

| To Building A/c (W. Note 2) | 54000 | ||

| (Being Depreciation charged) | |||

| 1 july 20X5 | Profit & Loss A/c Dr. | 50000 | |

| To Closing Inventory A/c | 50000 | ||

| (Being closing inventory recorded at the lower of cost or net realisable value) | |||

| 1 july 20X5 | Cash A/c Dr. | 120000 | |

| To Ordinary Stock A/c | 75000 | ||

| To Share Premium A/c | 45000 | ||

| (Being 150,000 Stock issued at 80p) |

Homework Sourse

Homework Sourse