The Fairmont Hotel in San Francisco needs to replace its air

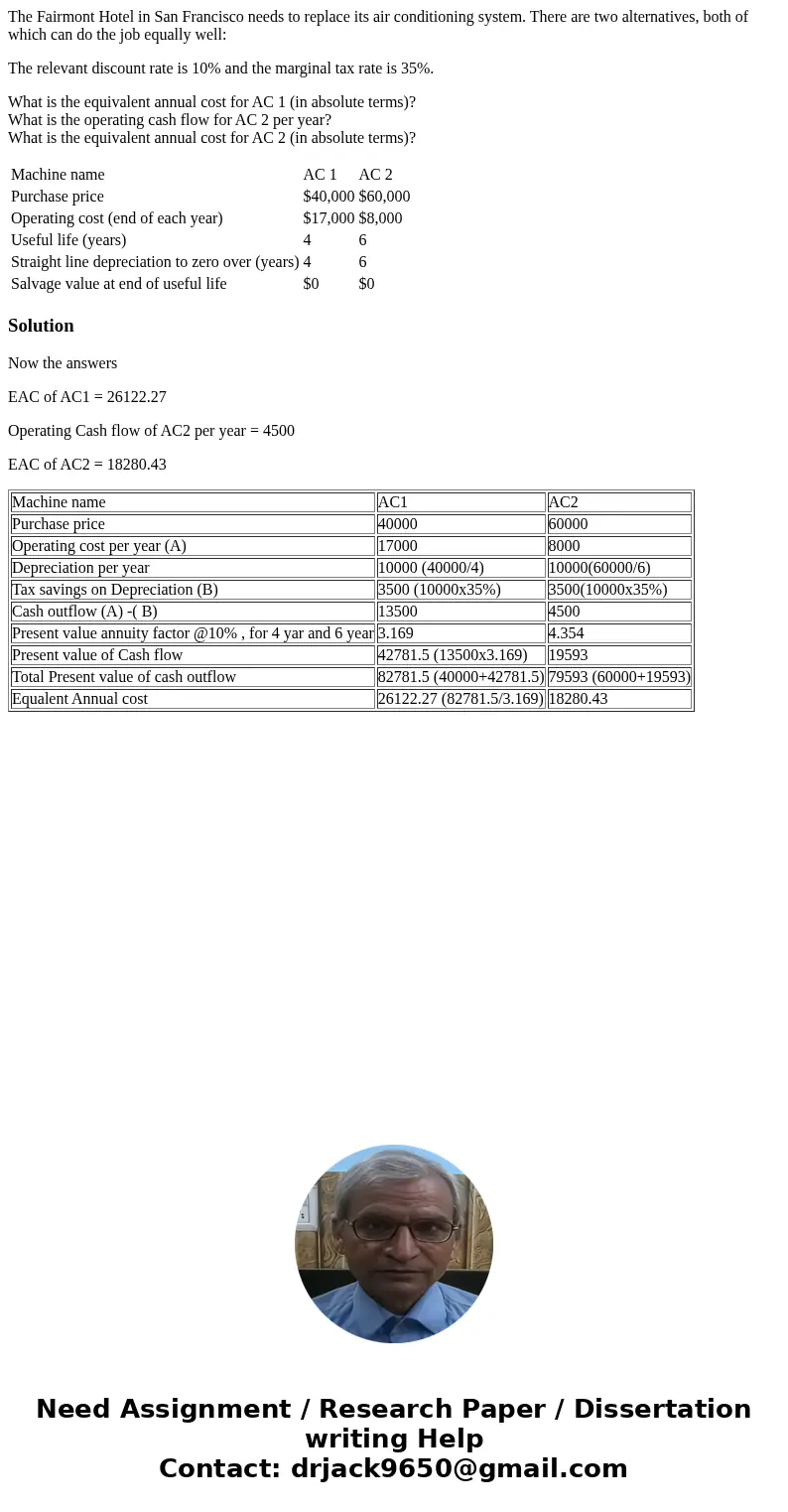

The Fairmont Hotel in San Francisco needs to replace its air conditioning system. There are two alternatives, both of which can do the job equally well:

The relevant discount rate is 10% and the marginal tax rate is 35%.

What is the equivalent annual cost for AC 1 (in absolute terms)?

What is the operating cash flow for AC 2 per year?

What is the equivalent annual cost for AC 2 (in absolute terms)?

| Machine name | AC 1 | AC 2 |

| Purchase price | $40,000 | $60,000 |

| Operating cost (end of each year) | $17,000 | $8,000 |

| Useful life (years) | 4 | 6 |

| Straight line depreciation to zero over (years) | 4 | 6 |

| Salvage value at end of useful life | $0 | $0 |

Solution

Now the answers

EAC of AC1 = 26122.27

Operating Cash flow of AC2 per year = 4500

EAC of AC2 = 18280.43

| Machine name | AC1 | AC2 |

| Purchase price | 40000 | 60000 |

| Operating cost per year (A) | 17000 | 8000 |

| Depreciation per year | 10000 (40000/4) | 10000(60000/6) |

| Tax savings on Depreciation (B) | 3500 (10000x35%) | 3500(10000x35%) |

| Cash outflow (A) -( B) | 13500 | 4500 |

| Present value annuity factor @10% , for 4 yar and 6 year | 3.169 | 4.354 |

| Present value of Cash flow | 42781.5 (13500x3.169) | 19593 |

| Total Present value of cash outflow | 82781.5 (40000+42781.5) | 79593 (60000+19593) |

| Equalent Annual cost | 26122.27 (82781.5/3.169) | 18280.43 |

Homework Sourse

Homework Sourse