On 1012016 Hamilton Corporation issued 1 million of 135 bond

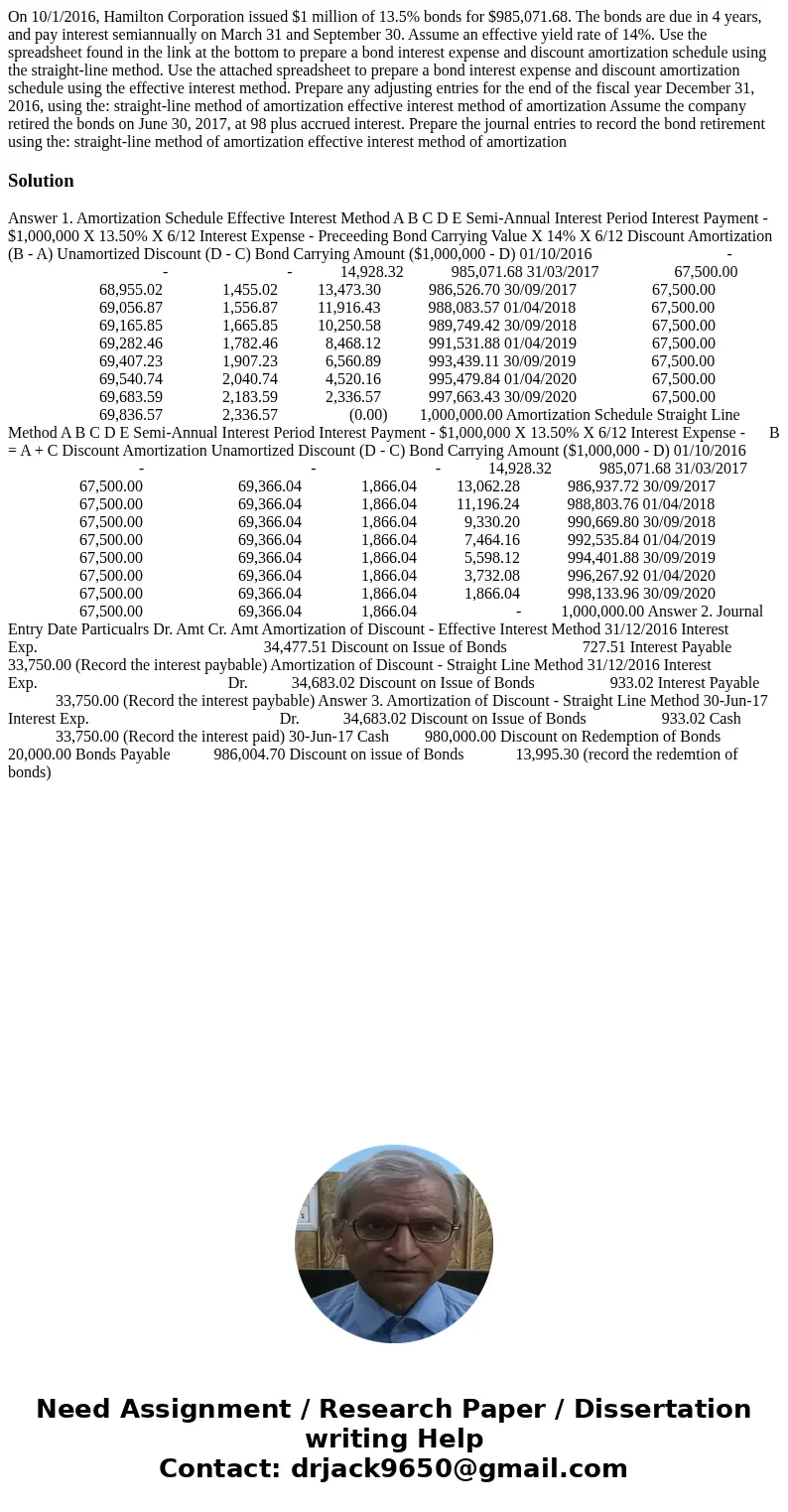

On 10/1/2016, Hamilton Corporation issued $1 million of 13.5% bonds for $985,071.68. The bonds are due in 4 years, and pay interest semiannually on March 31 and September 30. Assume an effective yield rate of 14%. Use the spreadsheet found in the link at the bottom to prepare a bond interest expense and discount amortization schedule using the straight-line method. Use the attached spreadsheet to prepare a bond interest expense and discount amortization schedule using the effective interest method. Prepare any adjusting entries for the end of the fiscal year December 31, 2016, using the: straight-line method of amortization effective interest method of amortization Assume the company retired the bonds on June 30, 2017, at 98 plus accrued interest. Prepare the journal entries to record the bond retirement using the: straight-line method of amortization effective interest method of amortization

Solution

Answer 1. Amortization Schedule Effective Interest Method A B C D E Semi-Annual Interest Period Interest Payment - $1,000,000 X 13.50% X 6/12 Interest Expense - Preceeding Bond Carrying Value X 14% X 6/12 Discount Amortization (B - A) Unamortized Discount (D - C) Bond Carrying Amount ($1,000,000 - D) 01/10/2016 - - - 14,928.32 985,071.68 31/03/2017 67,500.00 68,955.02 1,455.02 13,473.30 986,526.70 30/09/2017 67,500.00 69,056.87 1,556.87 11,916.43 988,083.57 01/04/2018 67,500.00 69,165.85 1,665.85 10,250.58 989,749.42 30/09/2018 67,500.00 69,282.46 1,782.46 8,468.12 991,531.88 01/04/2019 67,500.00 69,407.23 1,907.23 6,560.89 993,439.11 30/09/2019 67,500.00 69,540.74 2,040.74 4,520.16 995,479.84 01/04/2020 67,500.00 69,683.59 2,183.59 2,336.57 997,663.43 30/09/2020 67,500.00 69,836.57 2,336.57 (0.00) 1,000,000.00 Amortization Schedule Straight Line Method A B C D E Semi-Annual Interest Period Interest Payment - $1,000,000 X 13.50% X 6/12 Interest Expense - B = A + C Discount Amortization Unamortized Discount (D - C) Bond Carrying Amount ($1,000,000 - D) 01/10/2016 - - - 14,928.32 985,071.68 31/03/2017 67,500.00 69,366.04 1,866.04 13,062.28 986,937.72 30/09/2017 67,500.00 69,366.04 1,866.04 11,196.24 988,803.76 01/04/2018 67,500.00 69,366.04 1,866.04 9,330.20 990,669.80 30/09/2018 67,500.00 69,366.04 1,866.04 7,464.16 992,535.84 01/04/2019 67,500.00 69,366.04 1,866.04 5,598.12 994,401.88 30/09/2019 67,500.00 69,366.04 1,866.04 3,732.08 996,267.92 01/04/2020 67,500.00 69,366.04 1,866.04 1,866.04 998,133.96 30/09/2020 67,500.00 69,366.04 1,866.04 - 1,000,000.00 Answer 2. Journal Entry Date Particualrs Dr. Amt Cr. Amt Amortization of Discount - Effective Interest Method 31/12/2016 Interest Exp. 34,477.51 Discount on Issue of Bonds 727.51 Interest Payable 33,750.00 (Record the interest paybable) Amortization of Discount - Straight Line Method 31/12/2016 Interest Exp. Dr. 34,683.02 Discount on Issue of Bonds 933.02 Interest Payable 33,750.00 (Record the interest paybable) Answer 3. Amortization of Discount - Straight Line Method 30-Jun-17 Interest Exp. Dr. 34,683.02 Discount on Issue of Bonds 933.02 Cash 33,750.00 (Record the interest paid) 30-Jun-17 Cash 980,000.00 Discount on Redemption of Bonds 20,000.00 Bonds Payable 986,004.70 Discount on issue of Bonds 13,995.30 (record the redemtion of bonds)

Homework Sourse

Homework Sourse