Tutors 111 429 AM Problem 3 Blue Night Software Companys pay

Solution

Part 1

Total

factory

sales

administrative

Wage

245000

141000

48500

55500

FICA

17410

10787

141000*7.65%

2377

(21500*1.45%)+(27000*7.65%)

4246

55500*7.65%

Federal UC

360

264

33000*0.8%

36

4500*0.8%

60

7500*0.8%

State UC

1440

1056

33000*3.2%

144

4500*3.2%

240

7500*3.2%

total

264210

153107

51057

60046

PART 2 journal entries

Factory payroll

Wages/salaries expense Dr. 141000

Withholding taxes payable Cr. 19200

FICA payable Cr. 10787

Cash (balancing figure) Cr. 111013

Payroll tax expense Dr. 12107

FICA payable Cr. 10787

FUTA payable Cr. 264

SUTA payable Cr. 1056

Sales payroll

Wages/salaries expense Dr. 48500

Withholding taxes payable Cr. 9400

FICA payable Cr. 2377

Cash (balancing figure) Cr. 36723

Payroll tax expense Dr. 2557

FICA payable Cr. 2377

FUTA payable Cr. 36

SUTA payable Cr. 144

Administrative payroll

Wages/salaries expense Dr. 55500

Withholding taxes payable Cr. 11400

FICA payable Cr. 4246

Cash (balancing figure) Cr. 39854

Payroll tax expense Dr. 4546

FICA payable Cr. 4246

FUTA payable Cr. 60

SUTA payable Cr. 240

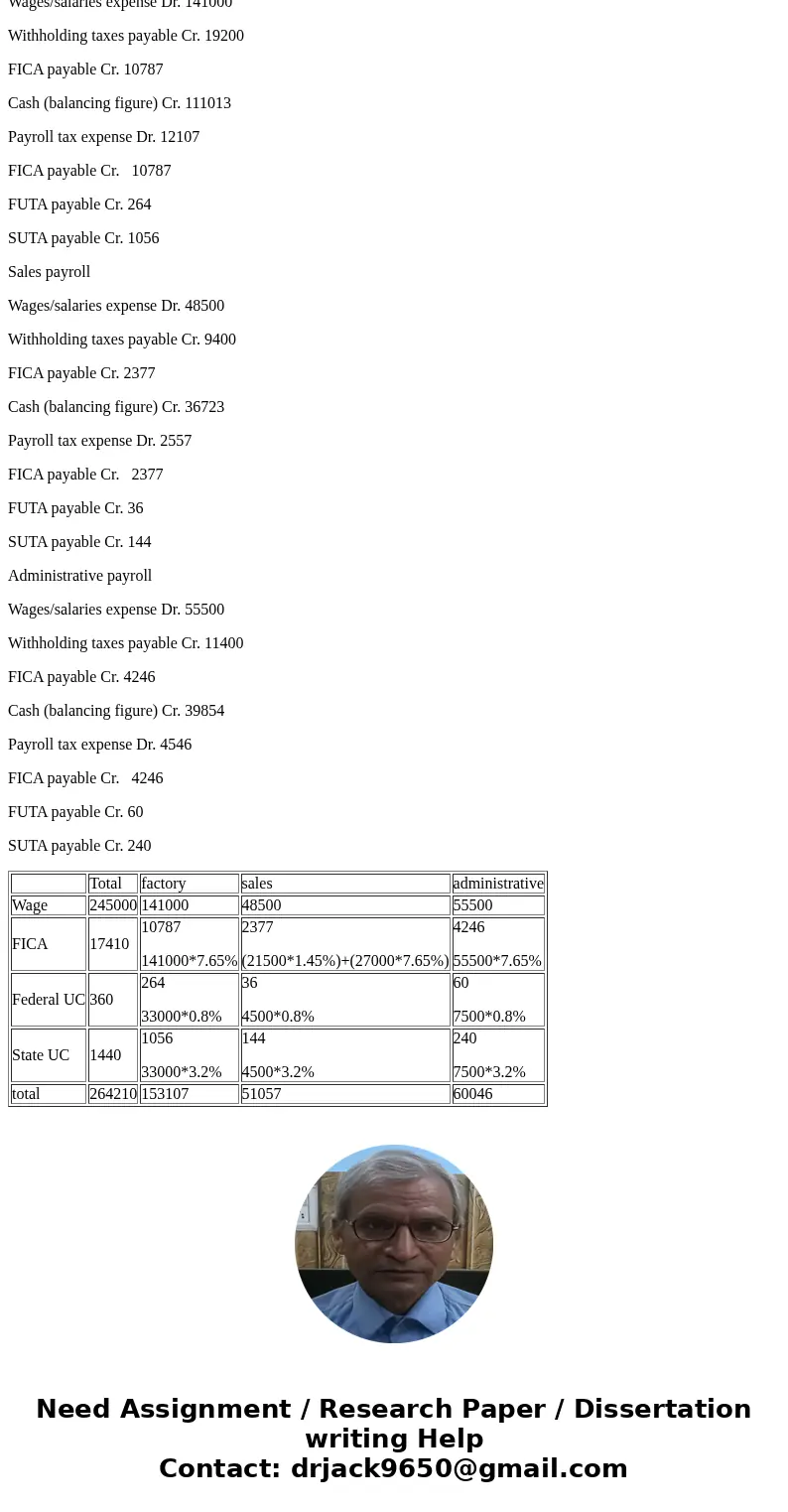

| Total | factory | sales | administrative | |

| Wage | 245000 | 141000 | 48500 | 55500 |

| FICA | 17410 | 10787 141000*7.65% | 2377 (21500*1.45%)+(27000*7.65%) | 4246 55500*7.65% |

| Federal UC | 360 | 264 33000*0.8% | 36 4500*0.8% | 60 7500*0.8% |

| State UC | 1440 | 1056 33000*3.2% | 144 4500*3.2% | 240 7500*3.2% |

| total | 264210 | 153107 | 51057 | 60046 |

Homework Sourse

Homework Sourse