Assume the risk free interest rate is 4 Would you implement

Solution

Solution:

In the table given,

T stands for Time period

R stands for Return (Cash Inflows)

C stands for Cost (Cash Outflow)

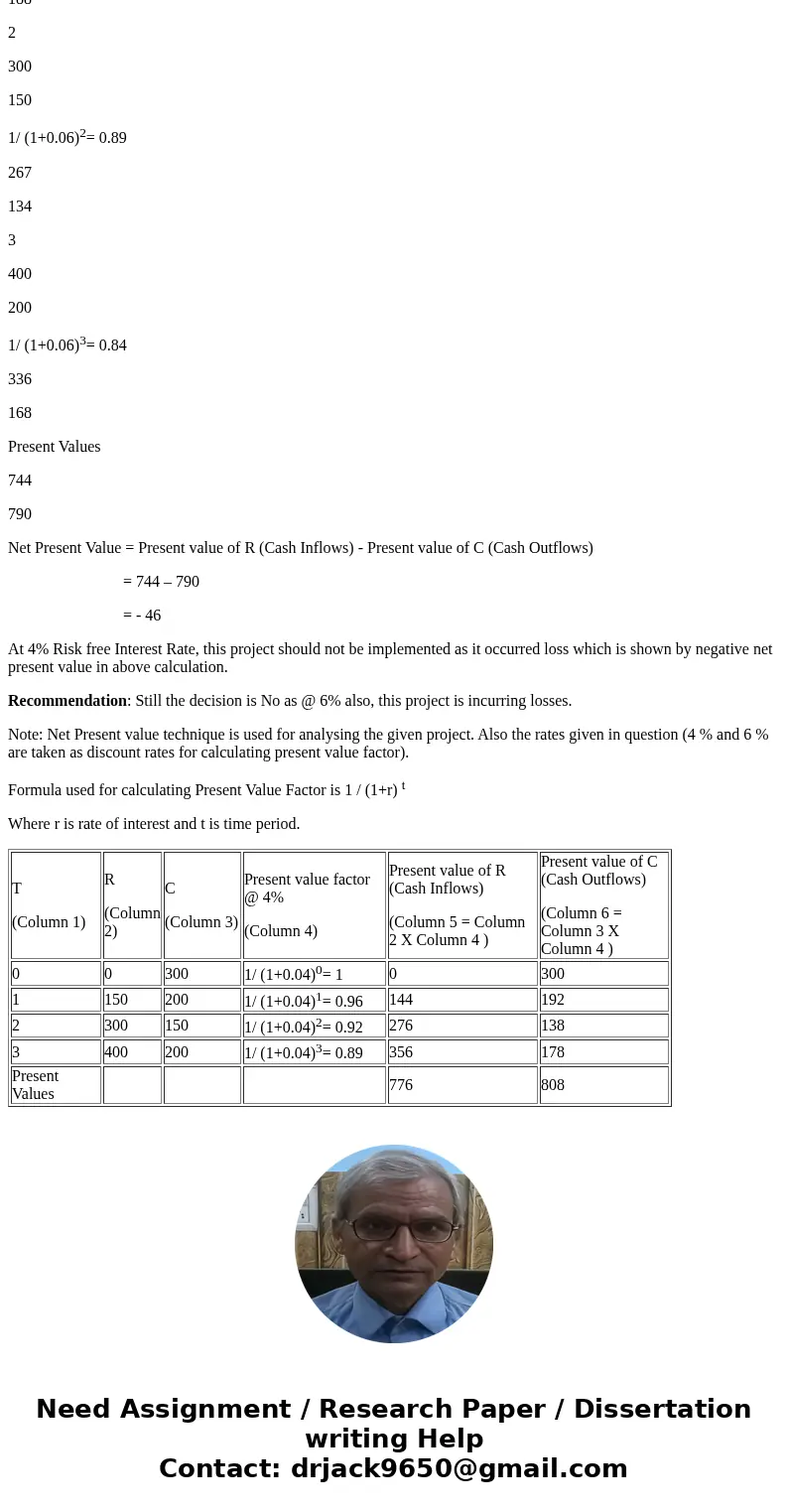

When Risk free Interest Rate 4%

T

(Column 1)

R

(Column 2)

C

(Column 3)

Present value factor @ 4%

(Column 4)

Present value of R (Cash Inflows)

(Column 5 = Column 2 X Column 4 )

Present value of C (Cash Outflows)

(Column 6 = Column 3 X Column 4 )

0

0

300

1/ (1+0.04)0= 1

0

300

1

150

200

1/ (1+0.04)1= 0.96

144

192

2

300

150

1/ (1+0.04)2= 0.92

276

138

3

400

200

1/ (1+0.04)3= 0.89

356

178

Present Values

776

808

Net Present Value = Present value of R (Cash Inflows) - Present value of C (Cash Outflows)

= 776 – 808

= - 32

At 4% Risk free Interest Rate, this project should not be implemented as it occurred loss which is shown by negative net present value in above calculation.

When Risk premium of project is 6 %

T

(Column 1)

R

(Column 2)

C

(Column 3)

Present value factor @ 6%

(Column 4)

Present value of R (Cash Inflows)

(Column 5 = Column 2 X Column 4 )

Present value of C (Cash Outflows)

(Column 6 = Column 3 X Column 4 )

0

0

300

1/ (1+0.06)0= 1

0

300

1

150

200

1/ (1+0.06)1= 0.94

141

188

2

300

150

1/ (1+0.06)2= 0.89

267

134

3

400

200

1/ (1+0.06)3= 0.84

336

168

Present Values

744

790

Net Present Value = Present value of R (Cash Inflows) - Present value of C (Cash Outflows)

= 744 – 790

= - 46

At 4% Risk free Interest Rate, this project should not be implemented as it occurred loss which is shown by negative net present value in above calculation.

Recommendation: Still the decision is No as @ 6% also, this project is incurring losses.

Note: Net Present value technique is used for analysing the given project. Also the rates given in question (4 % and 6 % are taken as discount rates for calculating present value factor).

Formula used for calculating Present Value Factor is 1 / (1+r) t

Where r is rate of interest and t is time period.

| T (Column 1) | R (Column 2) | C (Column 3) | Present value factor @ 4% (Column 4) | Present value of R (Cash Inflows) (Column 5 = Column 2 X Column 4 ) | Present value of C (Cash Outflows) (Column 6 = Column 3 X Column 4 ) |

| 0 | 0 | 300 | 1/ (1+0.04)0= 1 | 0 | 300 |

| 1 | 150 | 200 | 1/ (1+0.04)1= 0.96 | 144 | 192 |

| 2 | 300 | 150 | 1/ (1+0.04)2= 0.92 | 276 | 138 |

| 3 | 400 | 200 | 1/ (1+0.04)3= 0.89 | 356 | 178 |

| Present Values | 776 | 808 |

Homework Sourse

Homework Sourse