The following activities occurred during the year b Purchase

The following activities occurred during the year: b. Purchased equipment for use in the business at a cost of $34,000: one-fourth was paid in c Signed an agreement with a cleaning service to pay $280 per week for cleaning the d. Received an additional contribution from investors who provided $4,600 in cash and land e. Lent $4.100 to one of the investors who signed a note due in six months. shares of common stock with a par value of $0.10 per share cash and the company signed a note for the balance (due in six months). corporate offices next year valued at $31,000 in exchange for 2,600 shares of stock in the company Ted Granger borrowed $8.600 for personal use from a local bank, signing a one-year note! f. Erd Bal End Bal

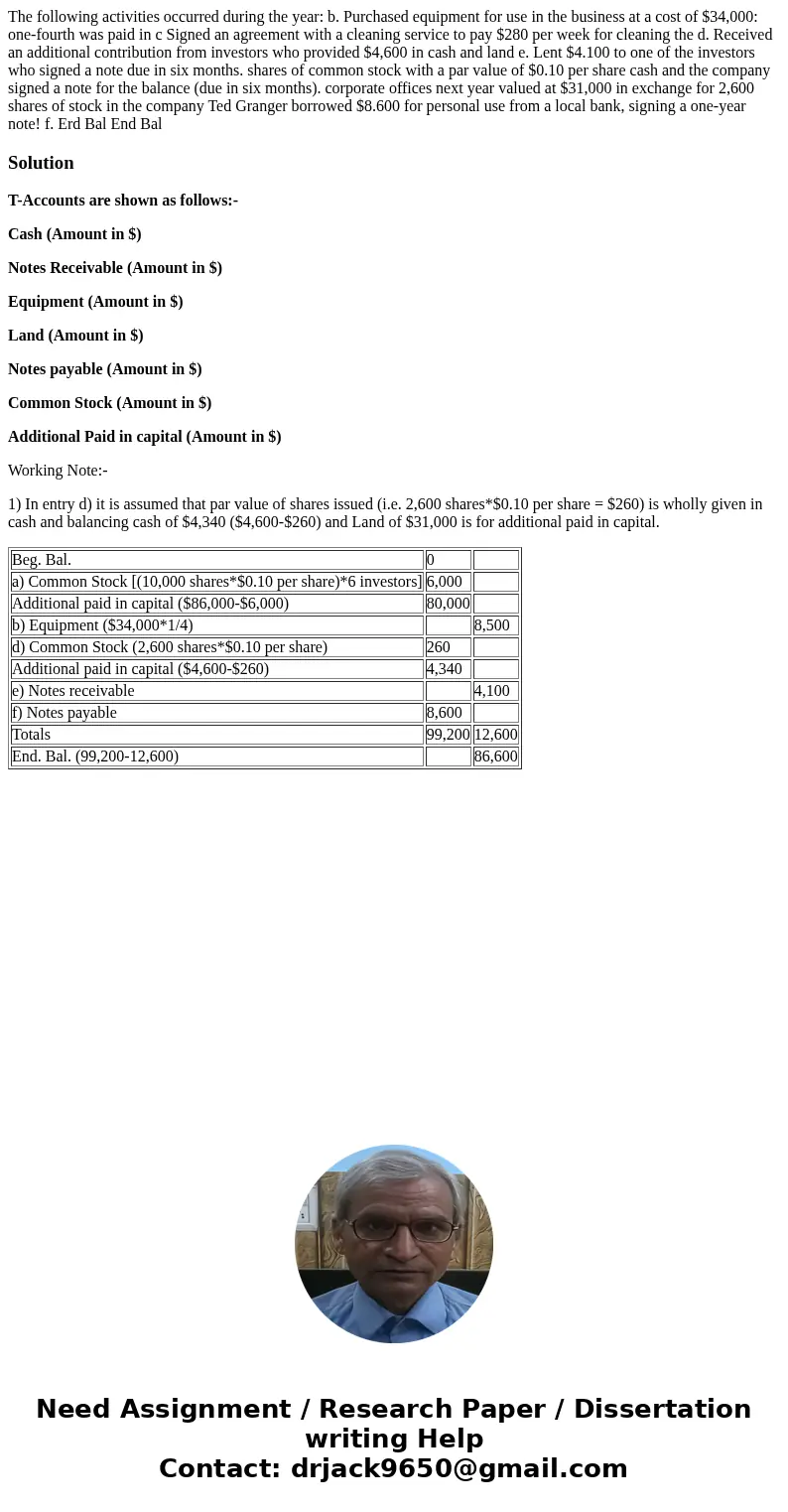

Solution

T-Accounts are shown as follows:-

Cash (Amount in $)

Notes Receivable (Amount in $)

Equipment (Amount in $)

Land (Amount in $)

Notes payable (Amount in $)

Common Stock (Amount in $)

Additional Paid in capital (Amount in $)

Working Note:-

1) In entry d) it is assumed that par value of shares issued (i.e. 2,600 shares*$0.10 per share = $260) is wholly given in cash and balancing cash of $4,340 ($4,600-$260) and Land of $31,000 is for additional paid in capital.

| Beg. Bal. | 0 | |

| a) Common Stock [(10,000 shares*$0.10 per share)*6 investors] | 6,000 | |

| Additional paid in capital ($86,000-$6,000) | 80,000 | |

| b) Equipment ($34,000*1/4) | 8,500 | |

| d) Common Stock (2,600 shares*$0.10 per share) | 260 | |

| Additional paid in capital ($4,600-$260) | 4,340 | |

| e) Notes receivable | 4,100 | |

| f) Notes payable | 8,600 | |

| Totals | 99,200 | 12,600 |

| End. Bal. (99,200-12,600) | 86,600 |

Homework Sourse

Homework Sourse