WACC and Beta HintUse the WACC formula to determine cost of

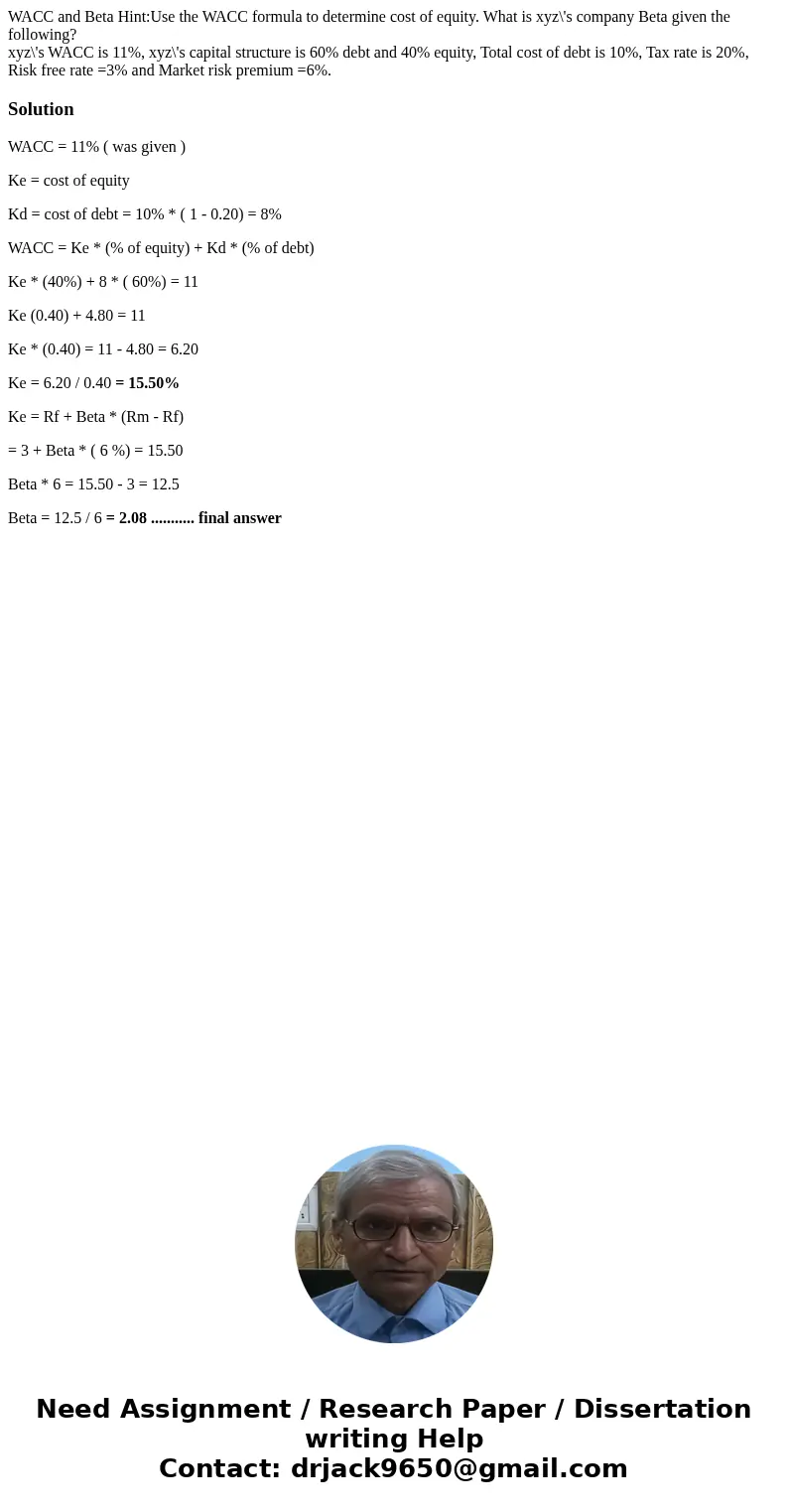

WACC and Beta Hint:Use the WACC formula to determine cost of equity. What is xyz\'s company Beta given the following?

xyz\'s WACC is 11%, xyz\'s capital structure is 60% debt and 40% equity, Total cost of debt is 10%, Tax rate is 20%, Risk free rate =3% and Market risk premium =6%.

Solution

WACC = 11% ( was given )

Ke = cost of equity

Kd = cost of debt = 10% * ( 1 - 0.20) = 8%

WACC = Ke * (% of equity) + Kd * (% of debt)

Ke * (40%) + 8 * ( 60%) = 11

Ke (0.40) + 4.80 = 11

Ke * (0.40) = 11 - 4.80 = 6.20

Ke = 6.20 / 0.40 = 15.50%

Ke = Rf + Beta * (Rm - Rf)

= 3 + Beta * ( 6 %) = 15.50

Beta * 6 = 15.50 - 3 = 12.5

Beta = 12.5 / 6 = 2.08 ........... final answer

Homework Sourse

Homework Sourse