A new operating system for an existing machine is expected t

A new operating system for an existing machine is expected to cost $770,000 and have a useful life of six years. The system yields an incremental after-tax income of $295,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $18,600.

| Compute the net present value of each potential investment. |

| Assume the company requires a 10% rate of return on its investments. (FV of $1, PV of $1, FVA of $1and PVA of $1) (Use appropriate factor(s) from the tables provided.) |

Solution

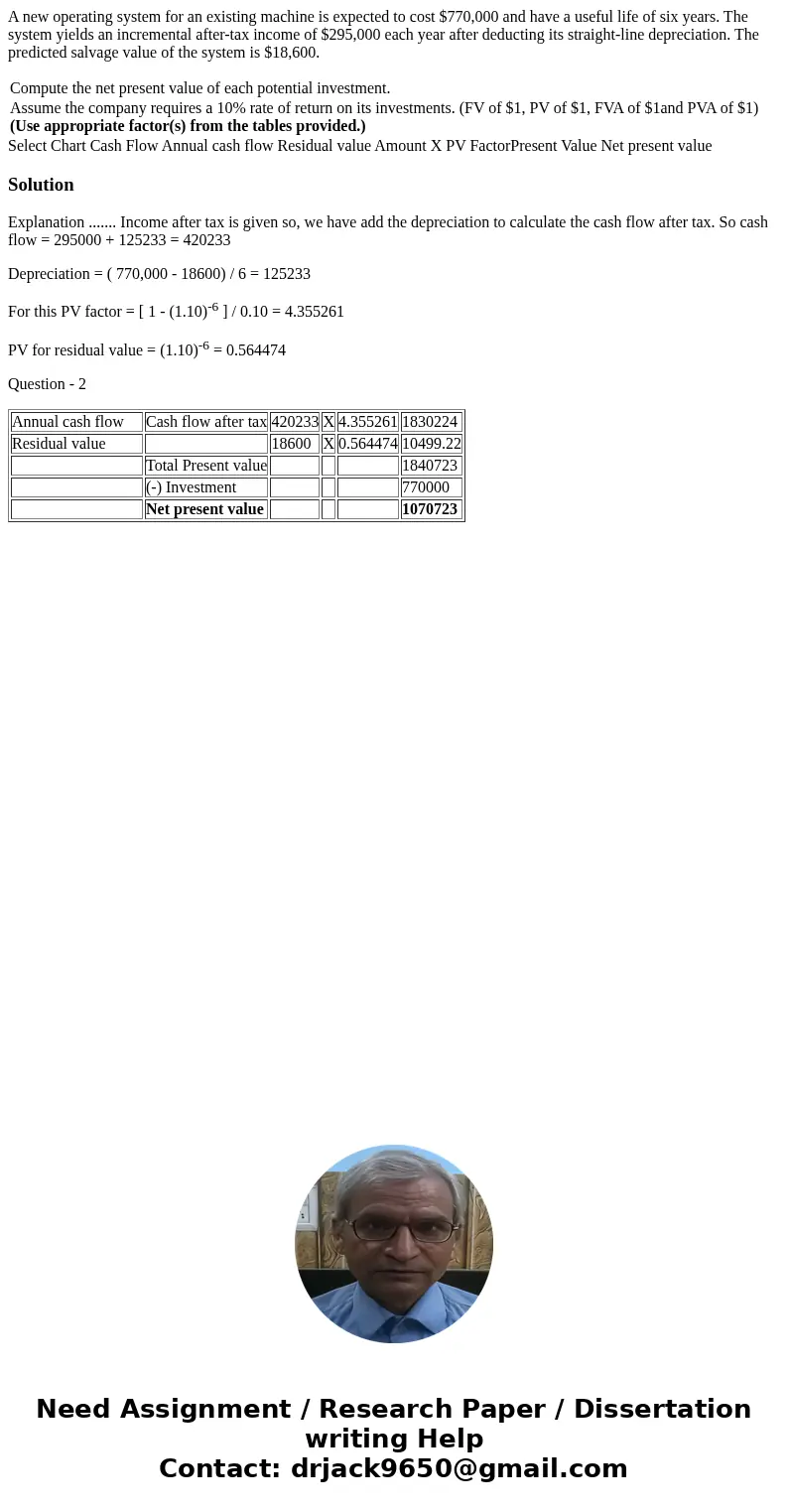

Explanation ....... Income after tax is given so, we have add the depreciation to calculate the cash flow after tax. So cash flow = 295000 + 125233 = 420233

Depreciation = ( 770,000 - 18600) / 6 = 125233

For this PV factor = [ 1 - (1.10)-6 ] / 0.10 = 4.355261

PV for residual value = (1.10)-6 = 0.564474

Question - 2

| Annual cash flow | Cash flow after tax | 420233 | X | 4.355261 | 1830224 |

| Residual value | 18600 | X | 0.564474 | 10499.22 | |

| Total Present value | 1840723 | ||||

| (-) Investment | 770000 | ||||

| Net present value | 1070723 |

Homework Sourse

Homework Sourse