Make the year end 123117 general journal adjustments for Mac

Make the year end, 12-31-17, general journal adjustments for Macomb Mold Company.

Company only prepares adjustments and financial statements once a year on 12-31.

Here is this information to make the adjustments:

1 On 9-1-17 Company paid for a one yr. liability. insurance policy where coverage began 9-1-17.

Paid and Debited to the acct. Prepaid Insurance 2,850.00

+ During the year the company borrowed money from a bank.

Interest will be paid 5-15-18 but accrued interest @ 12-31-17 is 825.00

3 For the year, Depreciation on Machinery is 4,500 and on Office Furniture 1,300

4 Supplies acct. balance is now 2,150 but an inventory shows on hand 750.00

5 Company wages are 5,000 a week, paid weekly on Monday for the previous week worked.

Assume Dec 31, 2017 fell on a Wednesday

6 At 12-31-17 half of a 20,000 service was completed but can not be invoiced until March, 2018

7 On 10-1-17 we were paid 5,000 up front for a job we will finish sometime in 2018.

On 12-31-17 this job is 25% completed. The orig. collection was credited to unearned rev.

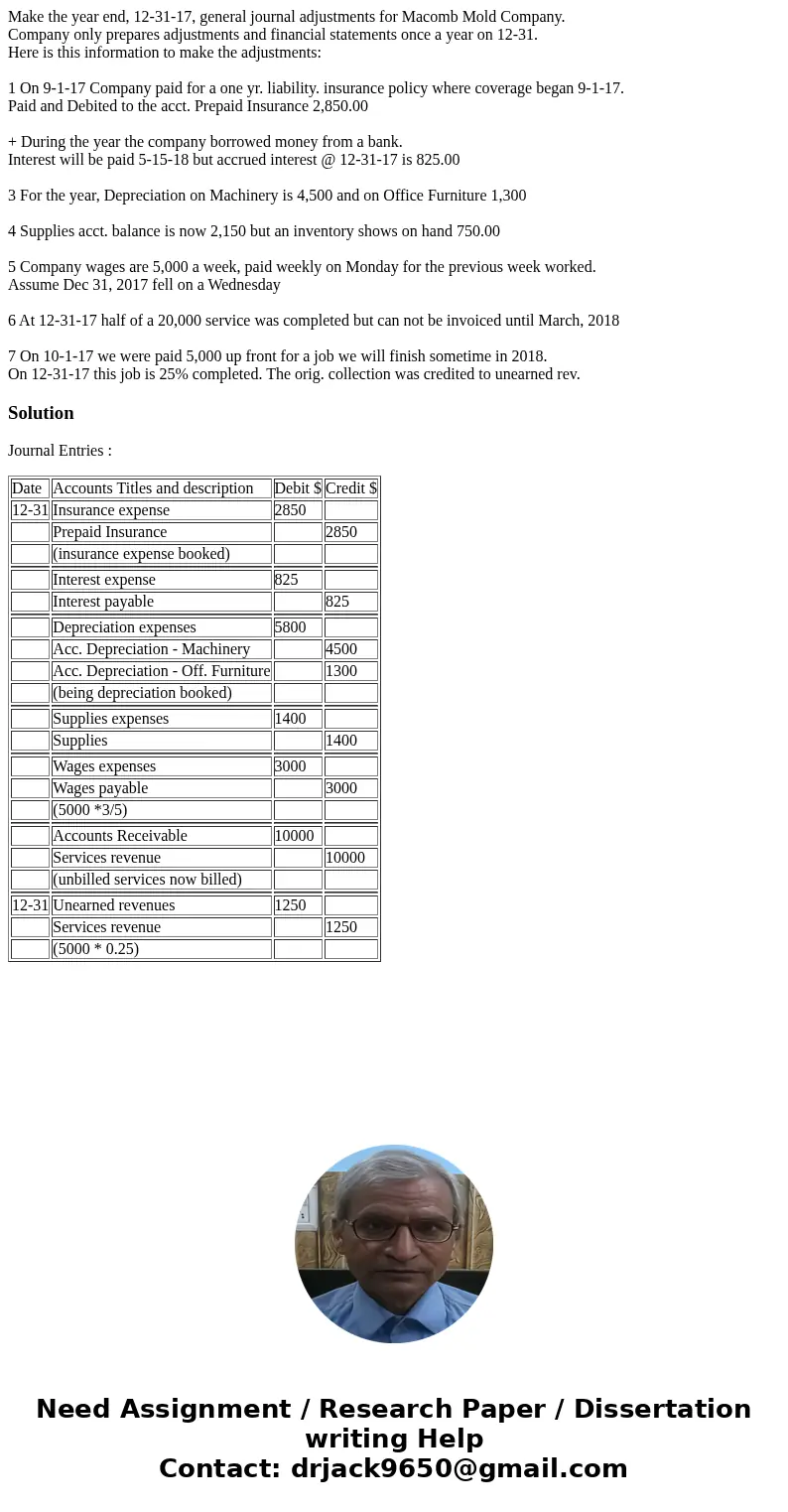

Solution

Journal Entries :

| Date | Accounts Titles and description | Debit $ | Credit $ |

| 12-31 | Insurance expense | 2850 | |

| Prepaid Insurance | 2850 | ||

| (insurance expense booked) | |||

| Interest expense | 825 | ||

| Interest payable | 825 | ||

| Depreciation expenses | 5800 | ||

| Acc. Depreciation - Machinery | 4500 | ||

| Acc. Depreciation - Off. Furniture | 1300 | ||

| (being depreciation booked) | |||

| Supplies expenses | 1400 | ||

| Supplies | 1400 | ||

| Wages expenses | 3000 | ||

| Wages payable | 3000 | ||

| (5000 *3/5) | |||

| Accounts Receivable | 10000 | ||

| Services revenue | 10000 | ||

| (unbilled services now billed) | |||

| 12-31 | Unearned revenues | 1250 | |

| Services revenue | 1250 | ||

| (5000 * 0.25) |

Homework Sourse

Homework Sourse