The following transactions occurred during March 2018 for th

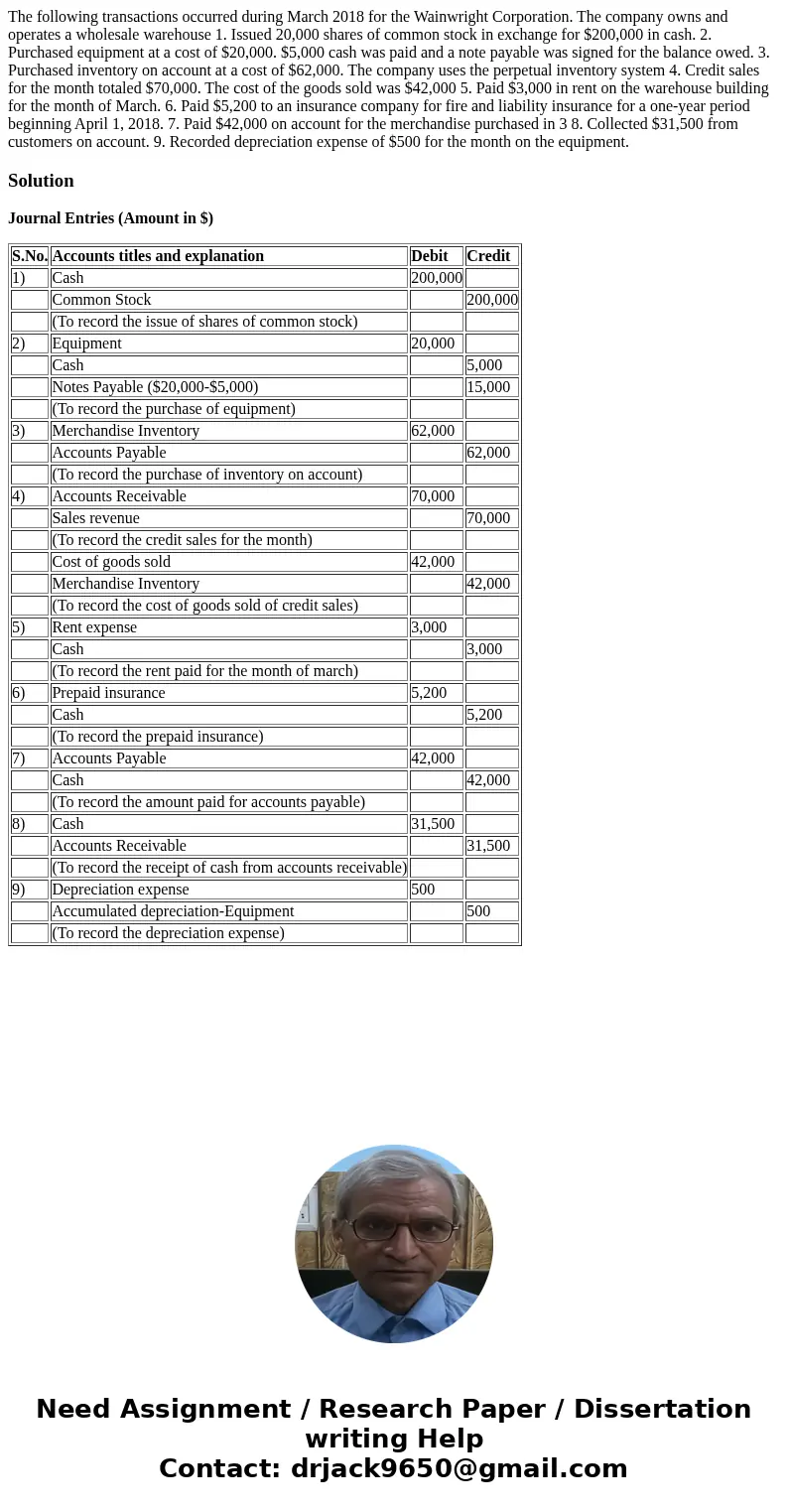

The following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse 1. Issued 20,000 shares of common stock in exchange for $200,000 in cash. 2. Purchased equipment at a cost of $20,000. $5,000 cash was paid and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $62,000. The company uses the perpetual inventory system 4. Credit sales for the month totaled $70,000. The cost of the goods sold was $42,000 5. Paid $3,000 in rent on the warehouse building for the month of March. 6. Paid $5,200 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2018. 7. Paid $42,000 on account for the merchandise purchased in 3 8. Collected $31,500 from customers on account. 9. Recorded depreciation expense of $500 for the month on the equipment.

Solution

Journal Entries (Amount in $)

| S.No. | Accounts titles and explanation | Debit | Credit |

| 1) | Cash | 200,000 | |

| Common Stock | 200,000 | ||

| (To record the issue of shares of common stock) | |||

| 2) | Equipment | 20,000 | |

| Cash | 5,000 | ||

| Notes Payable ($20,000-$5,000) | 15,000 | ||

| (To record the purchase of equipment) | |||

| 3) | Merchandise Inventory | 62,000 | |

| Accounts Payable | 62,000 | ||

| (To record the purchase of inventory on account) | |||

| 4) | Accounts Receivable | 70,000 | |

| Sales revenue | 70,000 | ||

| (To record the credit sales for the month) | |||

| Cost of goods sold | 42,000 | ||

| Merchandise Inventory | 42,000 | ||

| (To record the cost of goods sold of credit sales) | |||

| 5) | Rent expense | 3,000 | |

| Cash | 3,000 | ||

| (To record the rent paid for the month of march) | |||

| 6) | Prepaid insurance | 5,200 | |

| Cash | 5,200 | ||

| (To record the prepaid insurance) | |||

| 7) | Accounts Payable | 42,000 | |

| Cash | 42,000 | ||

| (To record the amount paid for accounts payable) | |||

| 8) | Cash | 31,500 | |

| Accounts Receivable | 31,500 | ||

| (To record the receipt of cash from accounts receivable) | |||

| 9) | Depreciation expense | 500 | |

| Accumulated depreciation-Equipment | 500 | ||

| (To record the depreciation expense) |

Homework Sourse

Homework Sourse