LO4 6 Floyd a cash basis taxpayer has received an offer to p

Solution

Solution: The instalment sale is better because it will allow Floyd to move income to a lower tax section, and additionally defer tax on one-portion of the gain.

Working:

Option 1- Sell for cash

Cash received

100,000

Less: basis

-20,000

Recognized gain

80,000

Tax @ .25

20000

After-tax proceeds ($100,000 - $20,000)

80,000

Compounded 1 year: {1 + [(1 - .20) *.10]}

86400

86,400

Option 2 – Installment sale

Cash received: year 1

50,000

Gross profit % = ($100,000 - $20,000)/$100,000 =

0.8

Recognized gain

40000

Tax @ .25

10000

After-tax proceeds ($50,000 - $10,000)

40,000

Compounded 1 year: {1 + [(1 - .20) *.10]}

43200

43,200

Cash received: year 2

56,000

56,000

Interest: imputed at 4% * $56,000

2240

Tax on interest @ .20

448

-448

Sales proceeds

50,000

Gross profit % = ($100,000 - $20,000)/$100,000 =

0.8

Taxable gain

40000

Tax @ .20

8000

-8000

Total future value

90,752

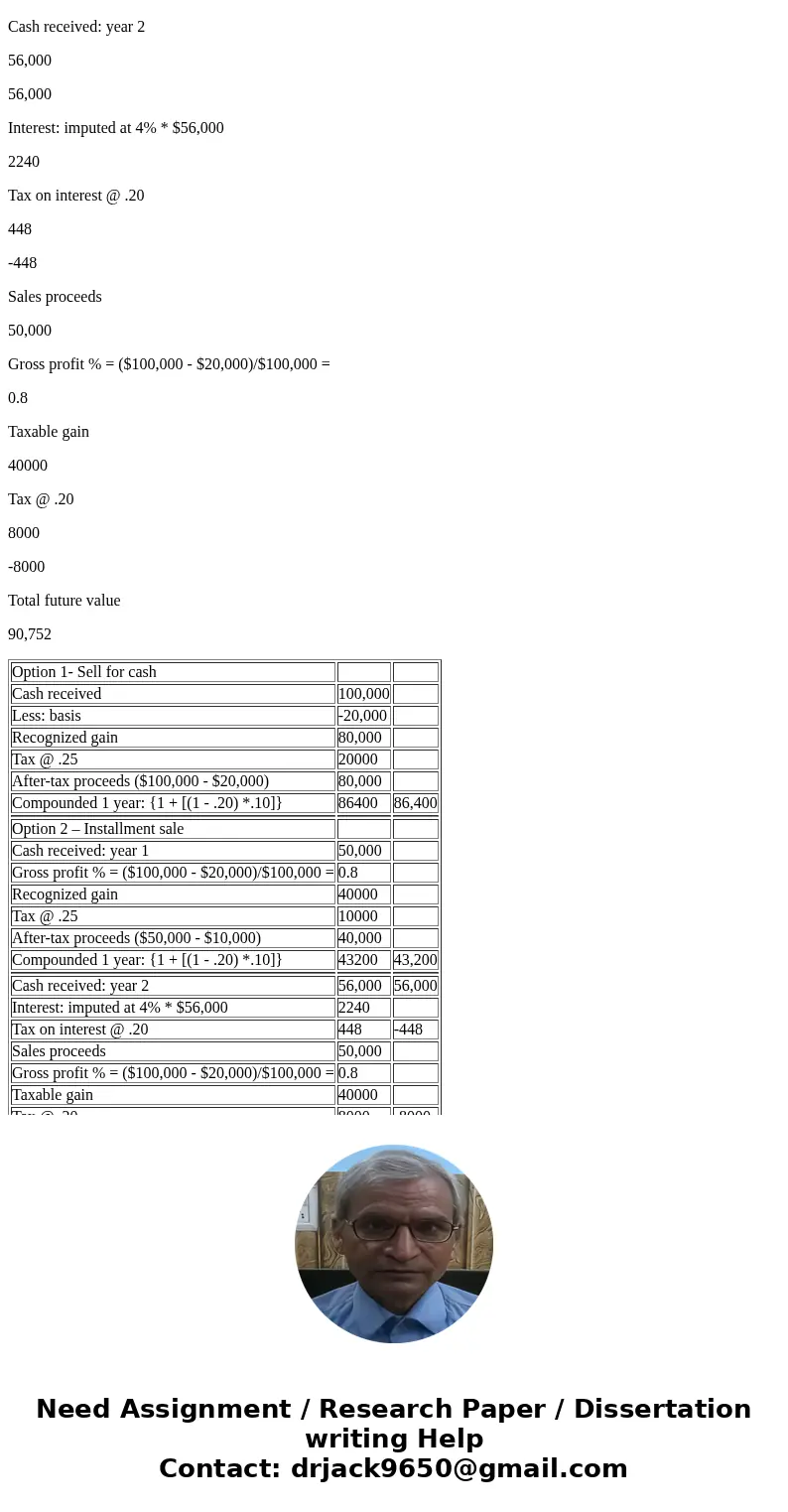

| Option 1- Sell for cash | ||

| Cash received | 100,000 | |

| Less: basis | -20,000 | |

| Recognized gain | 80,000 | |

| Tax @ .25 | 20000 | |

| After-tax proceeds ($100,000 - $20,000) | 80,000 | |

| Compounded 1 year: {1 + [(1 - .20) *.10]} | 86400 | 86,400 |

| Option 2 – Installment sale | ||

| Cash received: year 1 | 50,000 | |

| Gross profit % = ($100,000 - $20,000)/$100,000 = | 0.8 | |

| Recognized gain | 40000 | |

| Tax @ .25 | 10000 | |

| After-tax proceeds ($50,000 - $10,000) | 40,000 | |

| Compounded 1 year: {1 + [(1 - .20) *.10]} | 43200 | 43,200 |

| Cash received: year 2 | 56,000 | 56,000 |

| Interest: imputed at 4% * $56,000 | 2240 | |

| Tax on interest @ .20 | 448 | -448 |

| Sales proceeds | 50,000 | |

| Gross profit % = ($100,000 - $20,000)/$100,000 = | 0.8 | |

| Taxable gain | 40000 | |

| Tax @ .20 | 8000 | -8000 |

| Total future value | 90,752 |

Homework Sourse

Homework Sourse