ACC 1101 SEM 120172018 GROUP EXERCISE 3 TIME ALLOWED 45 minu

ACC 1101 SEM 1/2017/2018 GROUP EXERCISE 3 TIME ALLOWED: 45 minutes RiDecor Sdn. Bhd. is a retailer specializing in wedding decorations. The following trial balance was extracted at 31 December 2016. Debit Credit (RM (RM) 130,000 Sales revenue Sales return Cost of sales Other income Administrative expenses . Distribution expenses Income tax expense Allowance for doubtful account Inventory, 31/12/2015 Motor vehicle and equipment Accumulated depreciation Land 115 51,095 6,000 27,000 17.500 3,300 500 12,500 116,000 30,040 150,000 Revaluation surplus 120,000 16,400 23.750 19,200 Trade receivables and payables Unearned sales revenue Prepayment (expenses paid in advance) Cash and cash equivalent 3,100 11,530 28,400 Dividend Ordinary share capital Retained earning 90,000 17,450 436.940 436.940 The following information is unrecorded and need to be updated in the accounts of the business; 1. Accrued sundry expense RM590 was unrecorded at year-end. Sundry expenses are included in administrative expense. 2. Half of the unearned sales revenue amount has been earned by year-end 31 December 3. RM400 of accounts receivable was determined to be uncollectible and is written-off. It 4· The motor vehicle and equipment is depreciated using straight line method at the rate 2016 is estimated from past experience that 4% of trade receivables is uncollectible at year- end. The bad debt expense is treated as administrative expense of 10% per year. Depreciation expense of motor vehicle and equipment is treated as an administrative. Required: Prepare Statement of Profit or Loss and Other Comprehensive Income, Statement of Changes in Equity for the year ended 31 December 2016 and Statement of Financial Position as at 31 December 2016.

Solution

As per policy, only one question is allowed to answer, so answering question 1:

Q1)

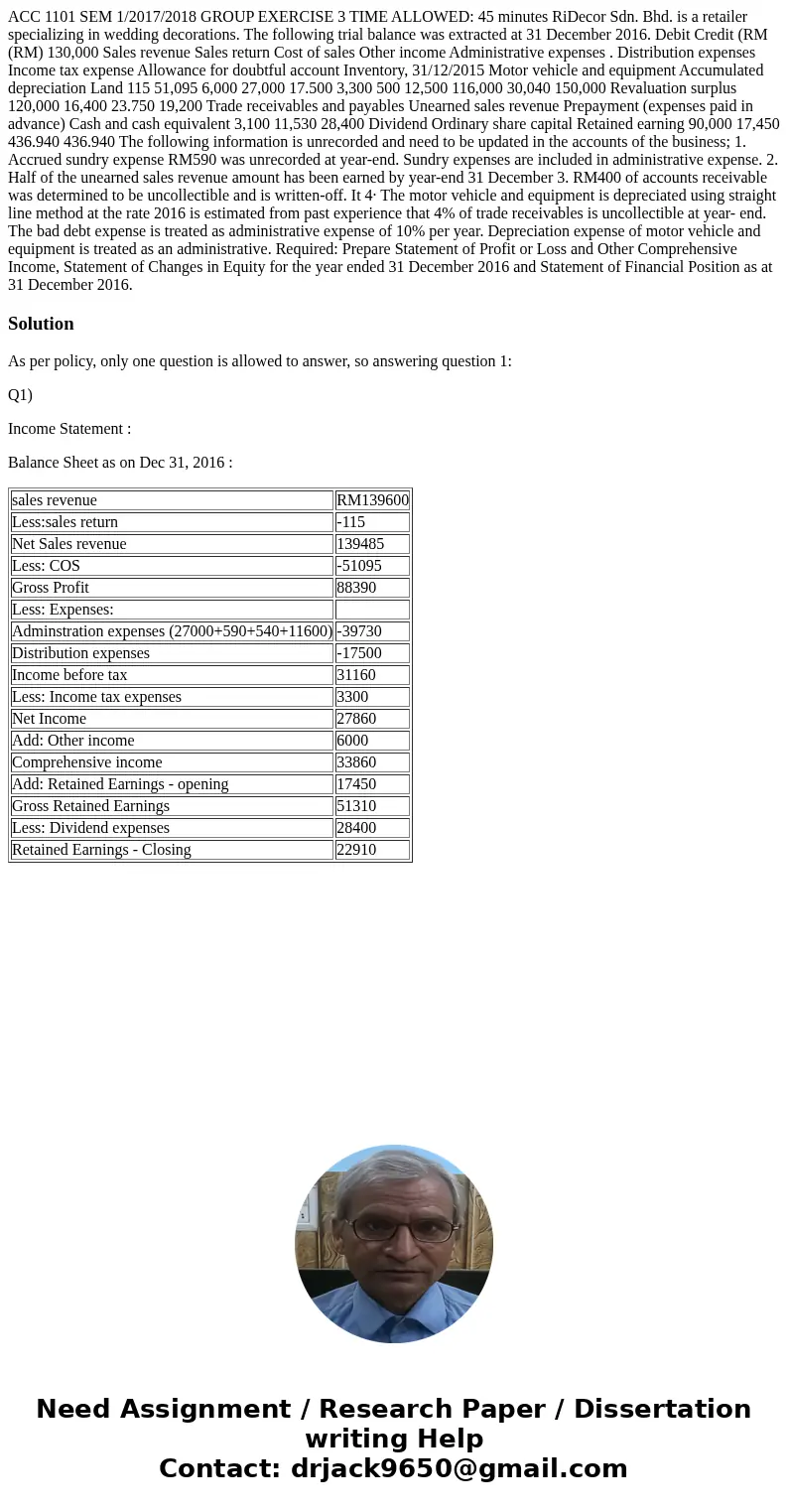

Income Statement :

Balance Sheet as on Dec 31, 2016 :

| sales revenue | RM139600 |

| Less:sales return | -115 |

| Net Sales revenue | 139485 |

| Less: COS | -51095 |

| Gross Profit | 88390 |

| Less: Expenses: | |

| Adminstration expenses (27000+590+540+11600) | -39730 |

| Distribution expenses | -17500 |

| Income before tax | 31160 |

| Less: Income tax expenses | 3300 |

| Net Income | 27860 |

| Add: Other income | 6000 |

| Comprehensive income | 33860 |

| Add: Retained Earnings - opening | 17450 |

| Gross Retained Earnings | 51310 |

| Less: Dividend expenses | 28400 |

| Retained Earnings - Closing | 22910 |

Homework Sourse

Homework Sourse