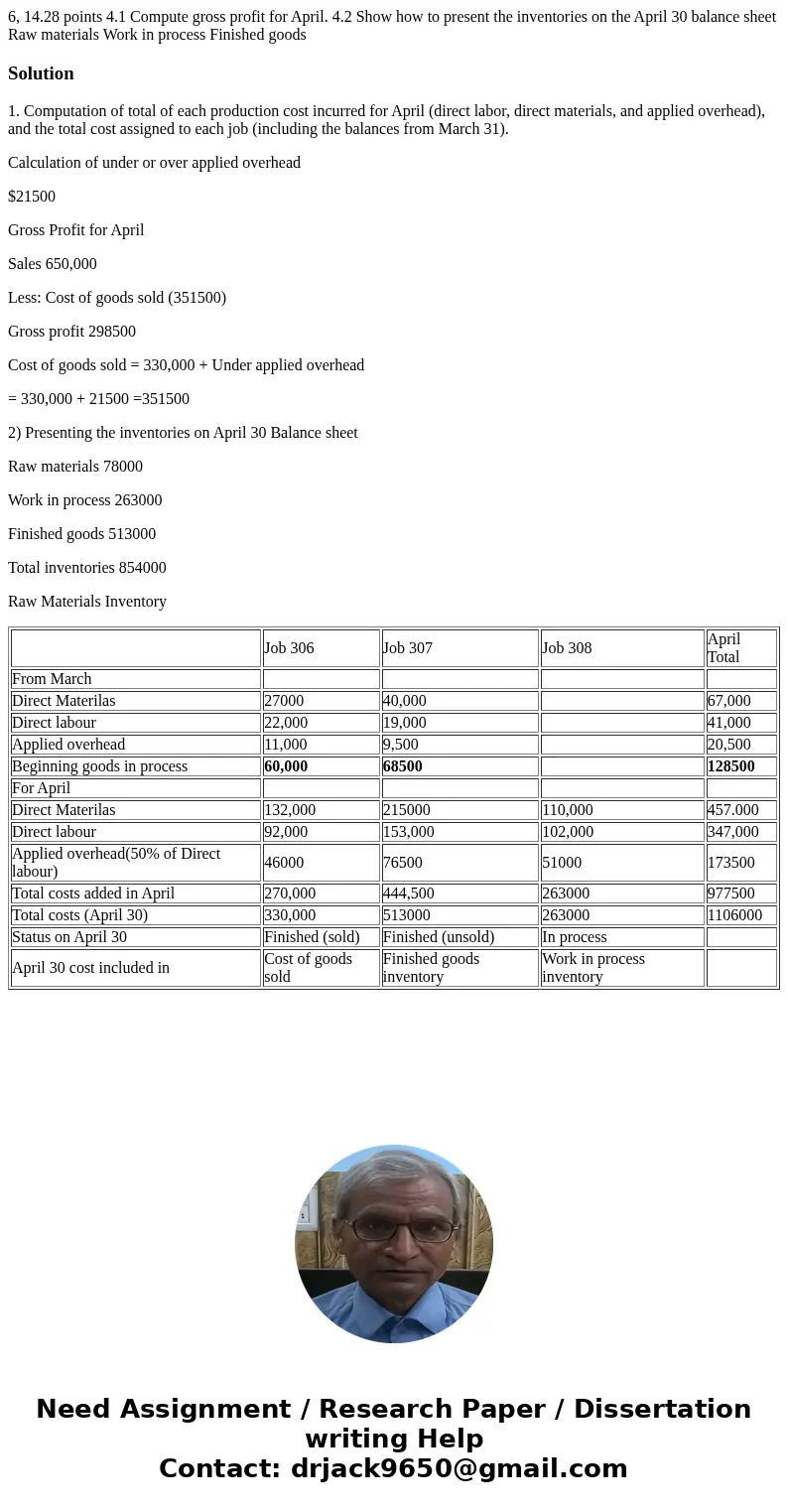

6 1428 points 41 Compute gross profit for April 42 Show how

6, 14.28 points 4.1 Compute gross profit for April. 4.2 Show how to present the inventories on the April 30 balance sheet Raw materials Work in process Finished goods

Solution

1. Computation of total of each production cost incurred for April (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from March 31).

Calculation of under or over applied overhead

$21500

Gross Profit for April

Sales 650,000

Less: Cost of goods sold (351500)

Gross profit 298500

Cost of goods sold = 330,000 + Under applied overhead

= 330,000 + 21500 =351500

2) Presenting the inventories on April 30 Balance sheet

Raw materials 78000

Work in process 263000

Finished goods 513000

Total inventories 854000

Raw Materials Inventory

| Job 306 | Job 307 | Job 308 | April Total | |

| From March | ||||

| Direct Materilas | 27000 | 40,000 | 67,000 | |

| Direct labour | 22,000 | 19,000 | 41,000 | |

| Applied overhead | 11,000 | 9,500 | 20,500 | |

| Beginning goods in process | 60,000 | 68500 | 128500 | |

| For April | ||||

| Direct Materilas | 132,000 | 215000 | 110,000 | 457.000 |

| Direct labour | 92,000 | 153,000 | 102,000 | 347,000 |

| Applied overhead(50% of Direct labour) | 46000 | 76500 | 51000 | 173500 |

| Total costs added in April | 270,000 | 444,500 | 263000 | 977500 |

| Total costs (April 30) | 330,000 | 513000 | 263000 | 1106000 |

| Status on April 30 | Finished (sold) | Finished (unsold) | In process | |

| April 30 cost included in | Cost of goods sold | Finished goods inventory | Work in process inventory |

Homework Sourse

Homework Sourse