Tabletop Ranches is considering the purchase of a new helico

Solution

Correct option is > a. IRR is 2.75% and does not maximize shareholder’s wealth

IRR should be more than WACC to maximize the wealth of shareholders.

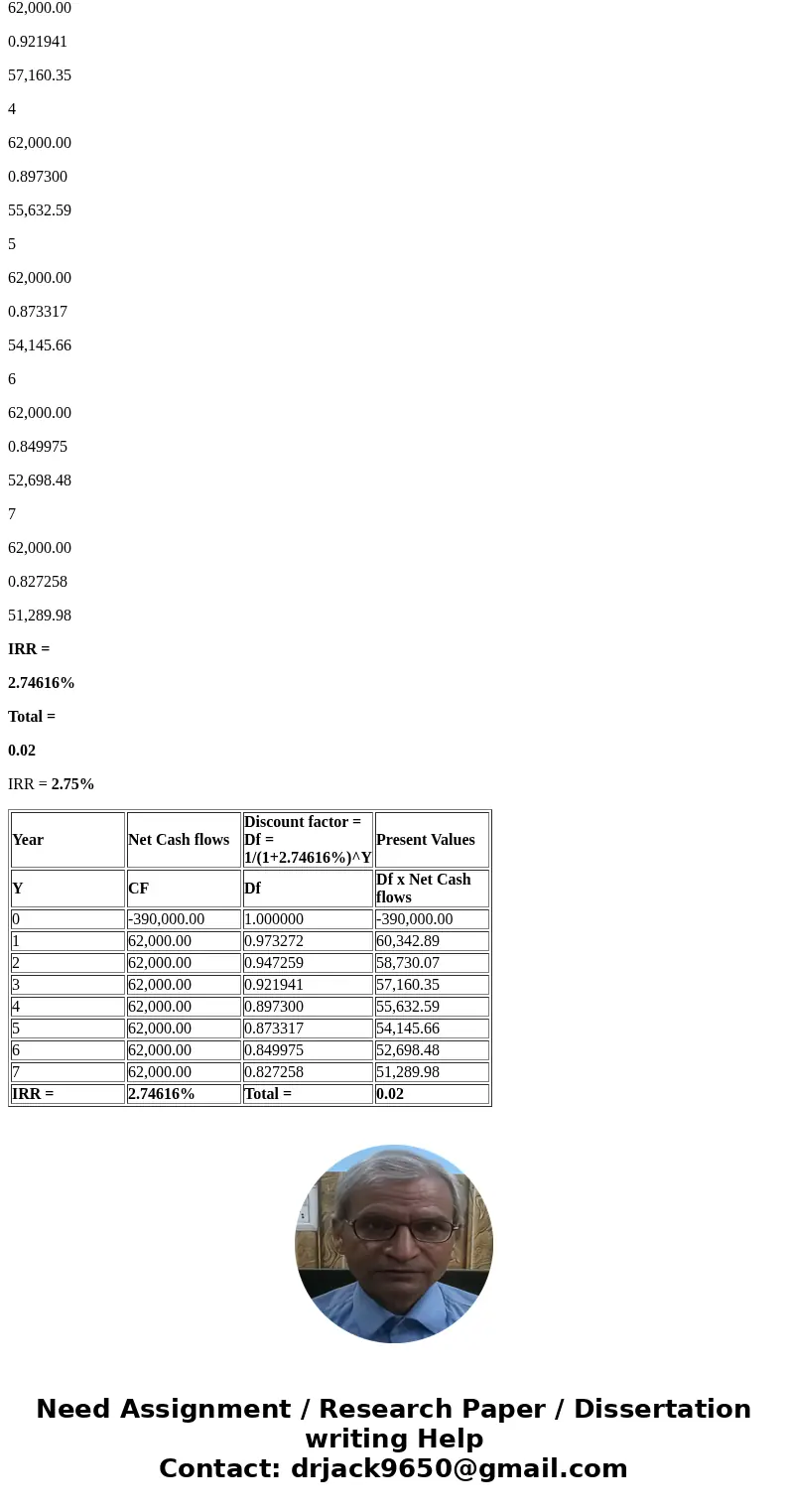

We should calculate for IRR by trial and error method. The IRR is rate where sum of all present values (in last column below) equals to zero or near to zero.

Year

Net Cash flows

Discount factor = Df = 1/(1+2.74616%)^Y

Present Values

Y

CF

Df

Df x Net Cash flows

0

-390,000.00

1.000000

-390,000.00

1

62,000.00

0.973272

60,342.89

2

62,000.00

0.947259

58,730.07

3

62,000.00

0.921941

57,160.35

4

62,000.00

0.897300

55,632.59

5

62,000.00

0.873317

54,145.66

6

62,000.00

0.849975

52,698.48

7

62,000.00

0.827258

51,289.98

IRR =

2.74616%

Total =

0.02

IRR = 2.75%

| Year | Net Cash flows | Discount factor = Df = 1/(1+2.74616%)^Y | Present Values |

| Y | CF | Df | Df x Net Cash flows |

| 0 | -390,000.00 | 1.000000 | -390,000.00 |

| 1 | 62,000.00 | 0.973272 | 60,342.89 |

| 2 | 62,000.00 | 0.947259 | 58,730.07 |

| 3 | 62,000.00 | 0.921941 | 57,160.35 |

| 4 | 62,000.00 | 0.897300 | 55,632.59 |

| 5 | 62,000.00 | 0.873317 | 54,145.66 |

| 6 | 62,000.00 | 0.849975 | 52,698.48 |

| 7 | 62,000.00 | 0.827258 | 51,289.98 |

| IRR = | 2.74616% | Total = | 0.02 |

Homework Sourse

Homework Sourse