round to two decimal places Requlred Informetlon The followi

round to two decimal places

Requlred Informetlon The following information applies to the questions displayed below Simon Company\'s year-end balance sheets follow. 2816 2815 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by $38,880 35,75e 37,88e 88,488 61,8ae 111,58e 82,888 55,83e 4, 788 278,880 251,588 231,98e $519,48e $448,58e $ 377,280 18,78e 9,45e $129, 28e 75,758 $ 51,48e mortgages on plant assets Common stock, $1e par Retained earnings Total liabilities and equity 95,58e 188,75e 81,48e 161,50e 161,588 161,58e 102,58e82,989 $519,48e $448,58e $ 377,280 value 133,200 The company\'s income statements for the years ended December 31, 2017 and 2016, follow. 2816 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income 2017 $785,88e 618,8ae $486, 78e 243,35e 11,688 9.488 $ 384, 386 146,488 13,18e 9,888 75 $ 33,95e $ 2.18 $ 57,28e $3.54 Earnings per share Evaluate the company\'s efficiency and profitability by computing the following for 2017 and 2016.Solution

profit margin ratio

net income

sales

net income/sales

profit margin ratio

2017

33950

785000

33950/785000

4.32%

2016

57200

610000

57200/610000

9.38%

total asset turnover ratio

sales

average assets

sales/total average assets

2017

785000

479950

785000/479950

1.635587

2016

610000

408850

610000/408850

1.49199

average assets = (opening+closing)/2

2017

(519400+440500)/2

479950

2016

(440500+377200)/2

408850

return on total assets

net income

average assets

net income/average assets

2017

33950

479950

33950/479950

7.07%

2016

57200

408850

57200/408850

13.99%

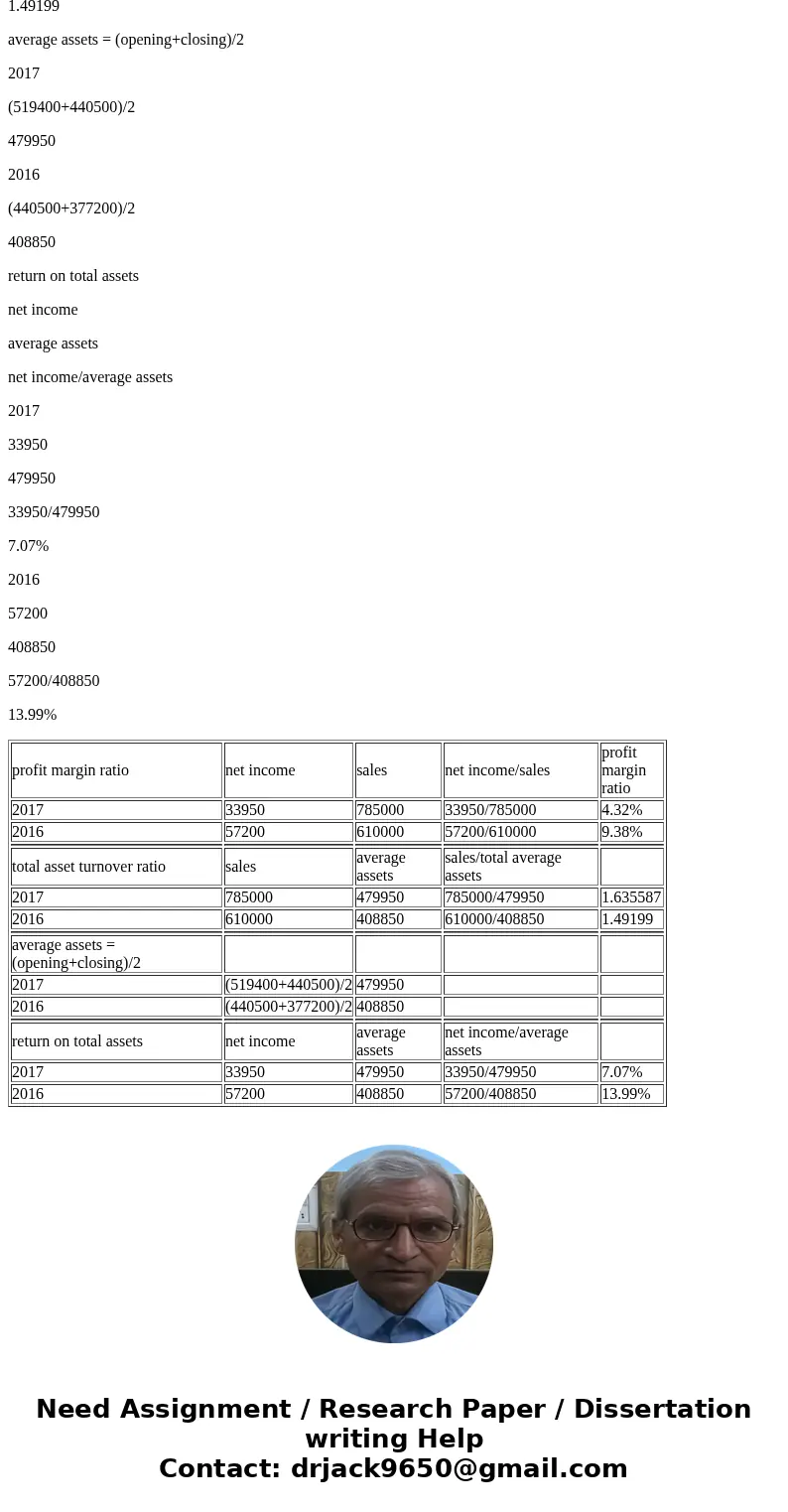

| profit margin ratio | net income | sales | net income/sales | profit margin ratio |

| 2017 | 33950 | 785000 | 33950/785000 | 4.32% |

| 2016 | 57200 | 610000 | 57200/610000 | 9.38% |

| total asset turnover ratio | sales | average assets | sales/total average assets | |

| 2017 | 785000 | 479950 | 785000/479950 | 1.635587 |

| 2016 | 610000 | 408850 | 610000/408850 | 1.49199 |

| average assets = (opening+closing)/2 | ||||

| 2017 | (519400+440500)/2 | 479950 | ||

| 2016 | (440500+377200)/2 | 408850 | ||

| return on total assets | net income | average assets | net income/average assets | |

| 2017 | 33950 | 479950 | 33950/479950 | 7.07% |

| 2016 | 57200 | 408850 | 57200/408850 | 13.99% |

Homework Sourse

Homework Sourse