5 pts Question 5 Mullen Group is considering adding another

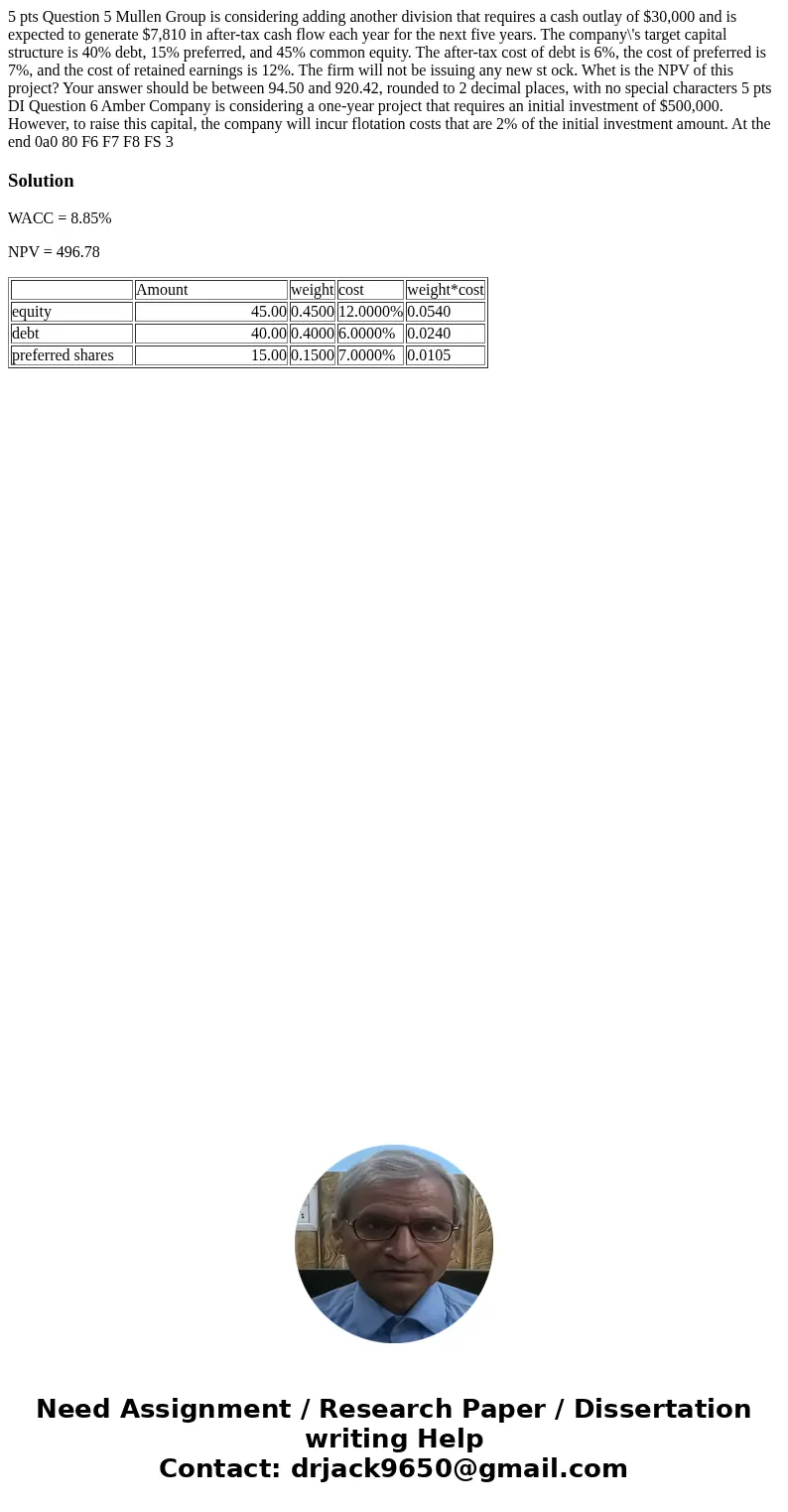

5 pts Question 5 Mullen Group is considering adding another division that requires a cash outlay of $30,000 and is expected to generate $7,810 in after-tax cash flow each year for the next five years. The company\'s target capital structure is 40% debt, 15% preferred, and 45% common equity. The after-tax cost of debt is 6%, the cost of preferred is 7%, and the cost of retained earnings is 12%. The firm will not be issuing any new st ock. Whet is the NPV of this project? Your answer should be between 94.50 and 920.42, rounded to 2 decimal places, with no special characters 5 pts DI Question 6 Amber Company is considering a one-year project that requires an initial investment of $500,000. However, to raise this capital, the company will incur flotation costs that are 2% of the initial investment amount. At the end 0a0 80 F6 F7 F8 FS 3

Solution

WACC = 8.85%

NPV = 496.78

| Amount | weight | cost | weight*cost | |

| equity | 45.00 | 0.4500 | 12.0000% | 0.0540 |

| debt | 40.00 | 0.4000 | 6.0000% | 0.0240 |

| preferred shares | 15.00 | 0.1500 | 7.0000% | 0.0105 |

Homework Sourse

Homework Sourse