Mark for follow up Question 15 of 75 Kevin a 69yearold singl

Mark for follow up Question 15 of 75 Kevin, a 69-year-old single taxpayer, received $20,000 in social security benefits in 2016. He also earned $12,000 in wages and $6,000 in interest income, $4,000 of which was tax-exempt. What percentage of Kevin\'s benefits will most likely be considered taxable income? O None Up to 50%

Solution

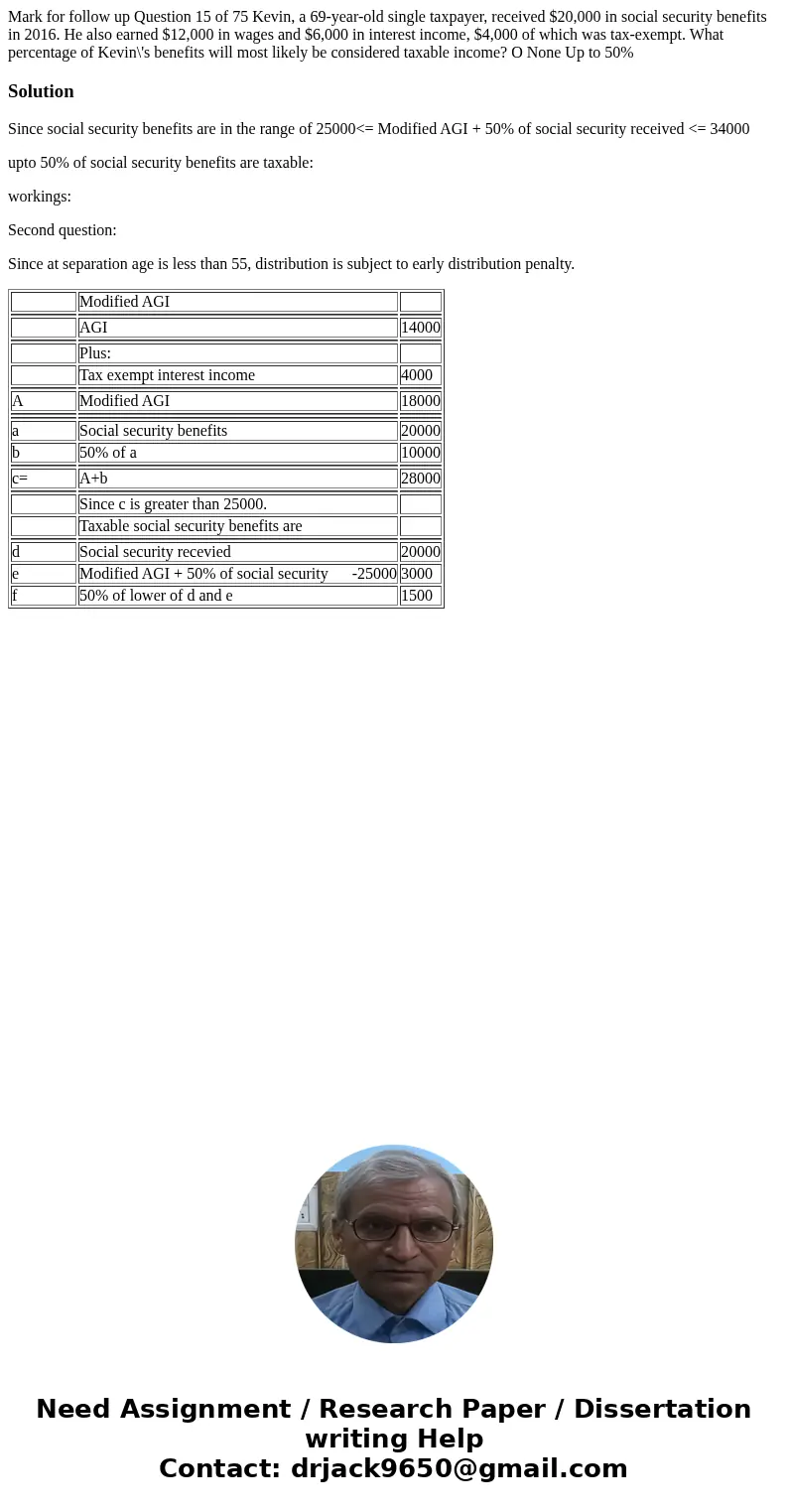

Since social security benefits are in the range of 25000<= Modified AGI + 50% of social security received <= 34000

upto 50% of social security benefits are taxable:

workings:

Second question:

Since at separation age is less than 55, distribution is subject to early distribution penalty.

| Modified AGI | ||

| AGI | 14000 | |

| Plus: | ||

| Tax exempt interest income | 4000 | |

| A | Modified AGI | 18000 |

| a | Social security benefits | 20000 |

| b | 50% of a | 10000 |

| c= | A+b | 28000 |

| Since c is greater than 25000. | ||

| Taxable social security benefits are | ||

| d | Social security recevied | 20000 |

| e | Modified AGI + 50% of social security -25000 | 3000 |

| f | 50% of lower of d and e | 1500 |

Homework Sourse

Homework Sourse