Janes Inc is considering the purchase of a machine that woul

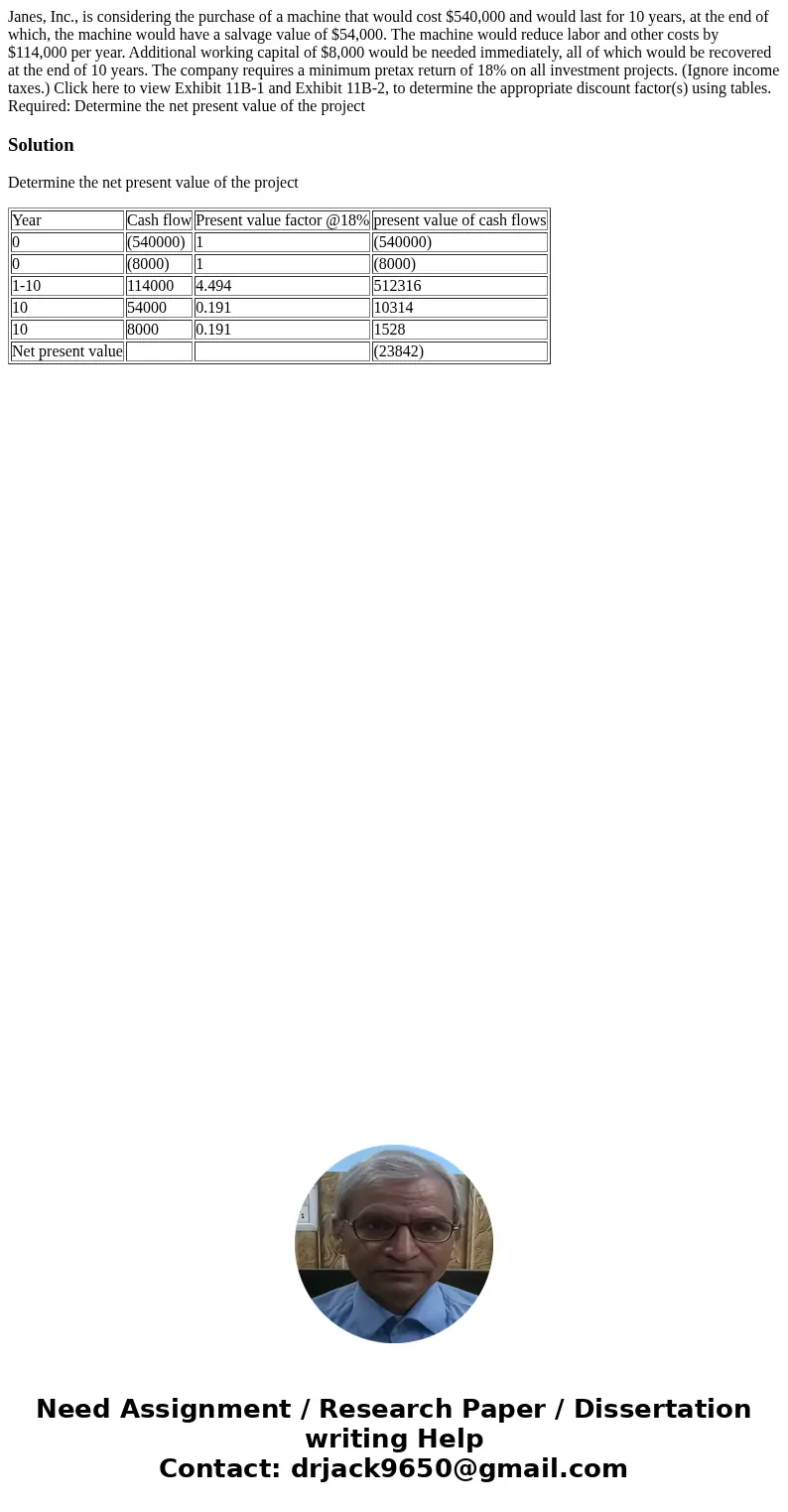

Janes, Inc., is considering the purchase of a machine that would cost $540,000 and would last for 10 years, at the end of which, the machine would have a salvage value of $54,000. The machine would reduce labor and other costs by $114,000 per year. Additional working capital of $8,000 would be needed immediately, all of which would be recovered at the end of 10 years. The company requires a minimum pretax return of 18% on all investment projects. (Ignore income taxes.) Click here to view Exhibit 11B-1 and Exhibit 11B-2, to determine the appropriate discount factor(s) using tables. Required: Determine the net present value of the project

Solution

Determine the net present value of the project

| Year | Cash flow | Present value factor @18% | present value of cash flows |

| 0 | (540000) | 1 | (540000) |

| 0 | (8000) | 1 | (8000) |

| 1-10 | 114000 | 4.494 | 512316 |

| 10 | 54000 | 0.191 | 10314 |

| 10 | 8000 | 0.191 | 1528 |

| Net present value | (23842) |

Homework Sourse

Homework Sourse