A project has an expected risky cash flow of 500 in year 4 T

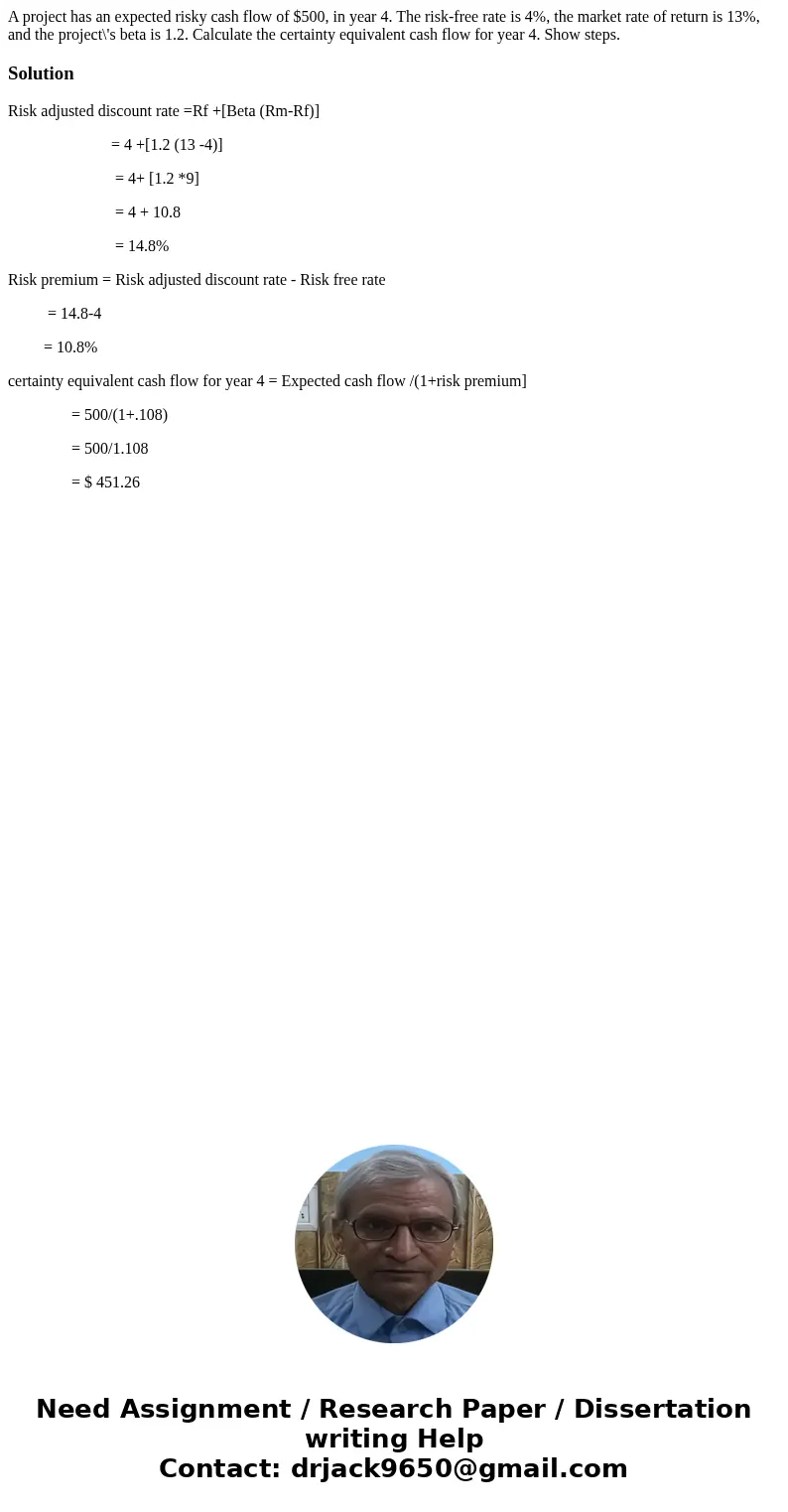

A project has an expected risky cash flow of $500, in year 4. The risk-free rate is 4%, the market rate of return is 13%, and the project\'s beta is 1.2. Calculate the certainty equivalent cash flow for year 4. Show steps.

Solution

Risk adjusted discount rate =Rf +[Beta (Rm-Rf)]

= 4 +[1.2 (13 -4)]

= 4+ [1.2 *9]

= 4 + 10.8

= 14.8%

Risk premium = Risk adjusted discount rate - Risk free rate

= 14.8-4

= 10.8%

certainty equivalent cash flow for year 4 = Expected cash flow /(1+risk premium]

= 500/(1+.108)

= 500/1.108

= $ 451.26

Homework Sourse

Homework Sourse