Check mysw Problem 131 LO 11 12 13 14 15d On January 1 2017

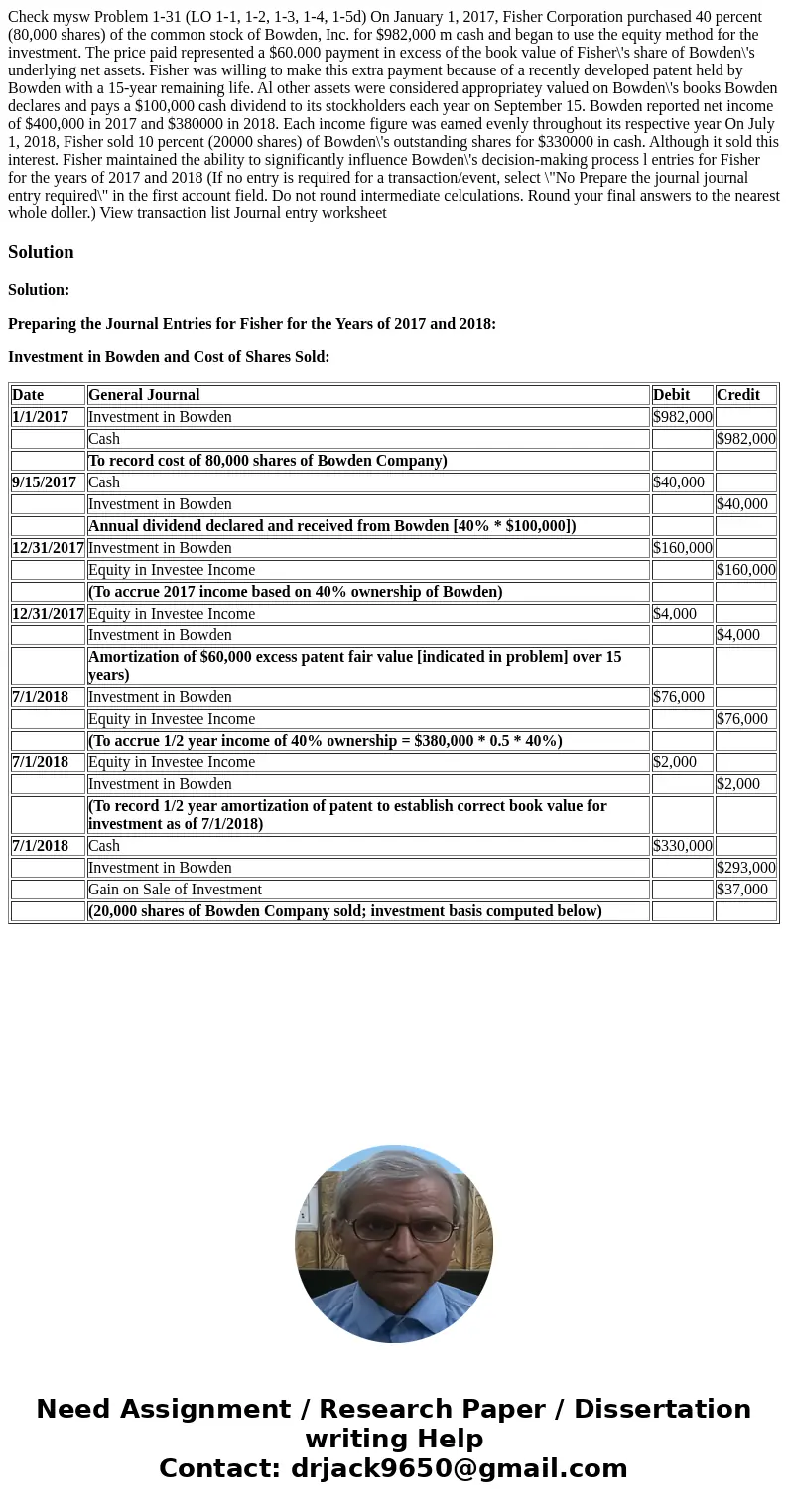

Check mysw Problem 1-31 (LO 1-1, 1-2, 1-3, 1-4, 1-5d) On January 1, 2017, Fisher Corporation purchased 40 percent (80,000 shares) of the common stock of Bowden, Inc. for $982,000 m cash and began to use the equity method for the investment. The price paid represented a $60.000 payment in excess of the book value of Fisher\'s share of Bowden\'s underlying net assets. Fisher was willing to make this extra payment because of a recently developed patent held by Bowden with a 15-year remaining life. Al other assets were considered appropriatey valued on Bowden\'s books Bowden declares and pays a $100,000 cash dividend to its stockholders each year on September 15. Bowden reported net income of $400,000 in 2017 and $380000 in 2018. Each income figure was earned evenly throughout its respective year On July 1, 2018, Fisher sold 10 percent (20000 shares) of Bowden\'s outstanding shares for $330000 in cash. Although it sold this interest. Fisher maintained the ability to significantly influence Bowden\'s decision-making process l entries for Fisher for the years of 2017 and 2018 (If no entry is required for a transaction/event, select \"No Prepare the journal journal entry required\" in the first account field. Do not round intermediate celculations. Round your final answers to the nearest whole doller.) View transaction list Journal entry worksheet

Solution

Solution:

Preparing the Journal Entries for Fisher for the Years of 2017 and 2018:

Investment in Bowden and Cost of Shares Sold:

| Date | General Journal | Debit | Credit |

| 1/1/2017 | Investment in Bowden | $982,000 | |

| Cash | $982,000 | ||

| To record cost of 80,000 shares of Bowden Company) | |||

| 9/15/2017 | Cash | $40,000 | |

| Investment in Bowden | $40,000 | ||

| Annual dividend declared and received from Bowden [40% * $100,000]) | |||

| 12/31/2017 | Investment in Bowden | $160,000 | |

| Equity in Investee Income | $160,000 | ||

| (To accrue 2017 income based on 40% ownership of Bowden) | |||

| 12/31/2017 | Equity in Investee Income | $4,000 | |

| Investment in Bowden | $4,000 | ||

| Amortization of $60,000 excess patent fair value [indicated in problem] over 15 years) | |||

| 7/1/2018 | Investment in Bowden | $76,000 | |

| Equity in Investee Income | $76,000 | ||

| (To accrue 1/2 year income of 40% ownership = $380,000 * 0.5 * 40%) | |||

| 7/1/2018 | Equity in Investee Income | $2,000 | |

| Investment in Bowden | $2,000 | ||

| (To record 1/2 year amortization of patent to establish correct book value for investment as of 7/1/2018) | |||

| 7/1/2018 | Cash | $330,000 | |

| Investment in Bowden | $293,000 | ||

| Gain on Sale of Investment | $37,000 | ||

| (20,000 shares of Bowden Company sold; investment basis computed below) |

Homework Sourse

Homework Sourse