Two years ago you purchased a 18000 car putting 3500 down an

Two years ago, you purchased a $18,000 car, putting $3,500 down and borrowing the rest. Your loan was a 36-month fixed rate loan at a stated rate of 7.0% per year. You paid a non-refundable application fee of $100 at that time in cash. Interest rates have fallen during the last two years and a new bank now offers to refinance your car by lending you the balance due at a stated rate of 4.5% per year. You will use the proceeds of this loan to pay off the old loan. Suppose the new loan over the residual loan life requires a $200 non-refundable application fee. Given all this information, should you refinance? How much do you gain/lose if you do?

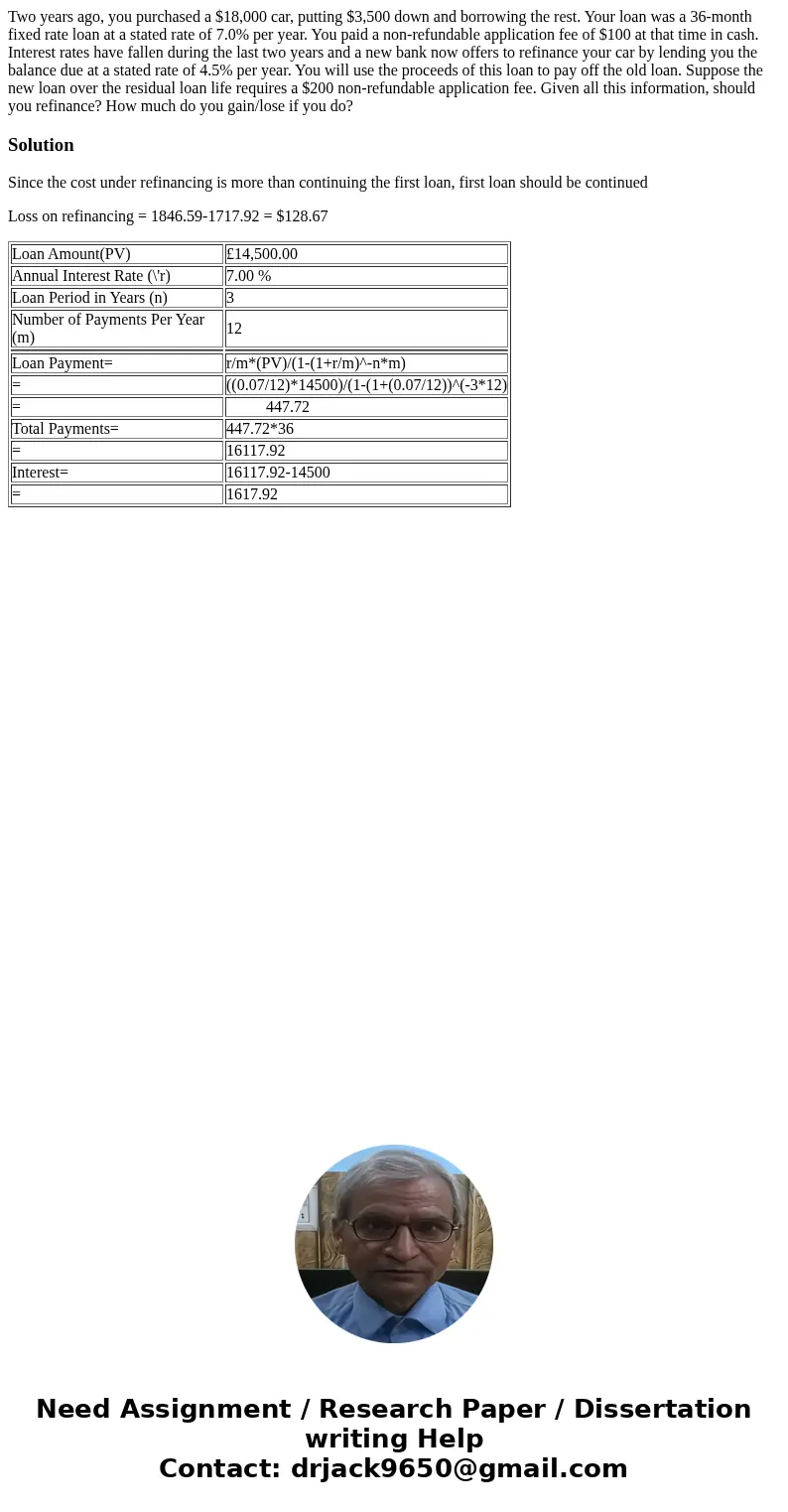

Solution

Since the cost under refinancing is more than continuing the first loan, first loan should be continued

Loss on refinancing = 1846.59-1717.92 = $128.67

| Loan Amount(PV) | £14,500.00 |

| Annual Interest Rate (\'r) | 7.00 % |

| Loan Period in Years (n) | 3 |

| Number of Payments Per Year (m) | 12 |

| Loan Payment= | r/m*(PV)/(1-(1+r/m)^-n*m) |

| = | ((0.07/12)*14500)/(1-(1+(0.07/12))^(-3*12) |

| = | 447.72 |

| Total Payments= | 447.72*36 |

| = | 16117.92 |

| Interest= | 16117.92-14500 |

| = | 1617.92 |

Homework Sourse

Homework Sourse